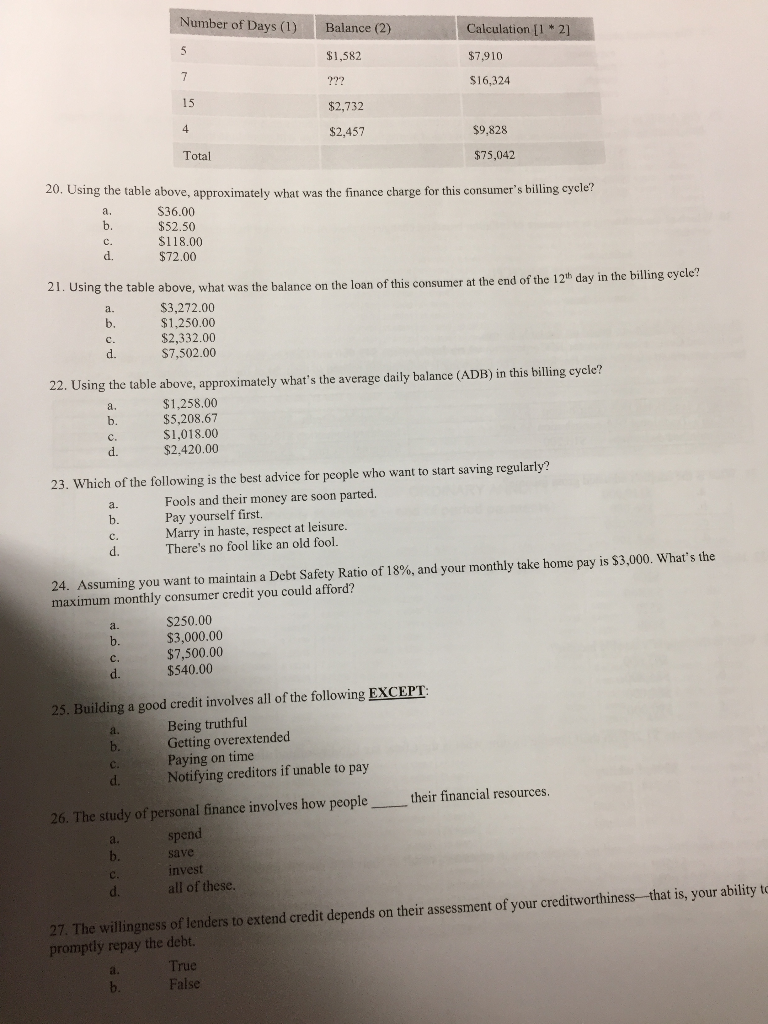

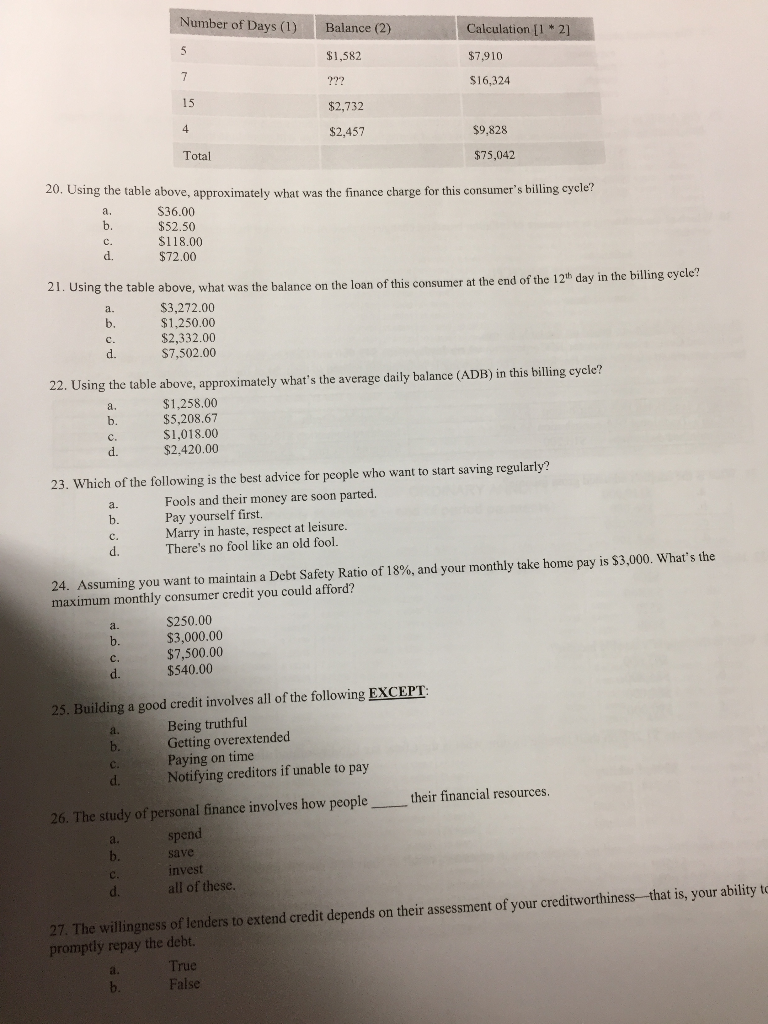

Number of Days (1) Balance (2) Calculation [1 * 2] $1,582 $7,910 ??? $16,324 $2,732 $2,457 $9.828 Total $75,042 20. Using the table above, approximately what was the finance charge for this consumer's billing cycle! $36.00 $52.50 $118.00 $72.00 21. Using the table above, what was the balance on the loan of this consumer at the end of the 12" day in the billing cycle $3,272.00 $1,250.00 $2,332.00 $7,502.00 22. Using the table above, approximately what's the average daily balance (ADB) in this billing cycle? $1.258.00 $5,208.67 $1,018.00 $2.420.00 23. Which of the following is the best advice for people who want to start saving regularly? Fools and their money are soon parted. Pay yourself first Marry in haste, respect at leisure. There's no fool like an old fool. 24. Assuming you want to maintain a Debt Safety Ratio of 18%, and your monthly take home pay is $3,000. What's the maximum monthly consumer credit you could afford? $250.00 $3,000.00 $7,500.00 $540.00 25. Building a good credit involves all of the following EXCEPT: Being truthful Getting overextended Paying on time Notifying creditors if unable to pay their financial resources, 26. The study of personal finance involves how people spend save invest all of these. 27. The willingness of lenders to extend credit depends on their assessment of your creditworthiness-that is, your ability to promptly repay the debt. True False Number of Days (1) Balance (2) Calculation [1 * 2] $1,582 $7,910 ??? $16,324 $2,732 $2,457 $9.828 Total $75,042 20. Using the table above, approximately what was the finance charge for this consumer's billing cycle! $36.00 $52.50 $118.00 $72.00 21. Using the table above, what was the balance on the loan of this consumer at the end of the 12" day in the billing cycle $3,272.00 $1,250.00 $2,332.00 $7,502.00 22. Using the table above, approximately what's the average daily balance (ADB) in this billing cycle? $1.258.00 $5,208.67 $1,018.00 $2.420.00 23. Which of the following is the best advice for people who want to start saving regularly? Fools and their money are soon parted. Pay yourself first Marry in haste, respect at leisure. There's no fool like an old fool. 24. Assuming you want to maintain a Debt Safety Ratio of 18%, and your monthly take home pay is $3,000. What's the maximum monthly consumer credit you could afford? $250.00 $3,000.00 $7,500.00 $540.00 25. Building a good credit involves all of the following EXCEPT: Being truthful Getting overextended Paying on time Notifying creditors if unable to pay their financial resources, 26. The study of personal finance involves how people spend save invest all of these. 27. The willingness of lenders to extend credit depends on their assessment of your creditworthiness-that is, your ability to promptly repay the debt. True False