Answered step by step

Verified Expert Solution

Question

1 Approved Answer

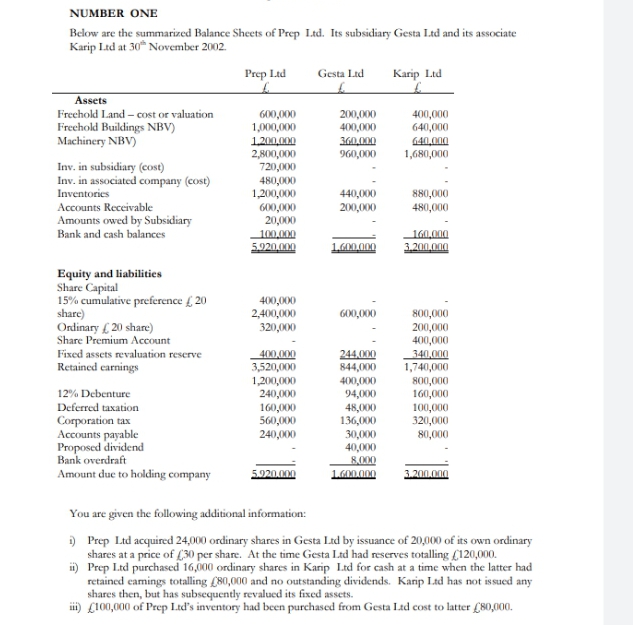

NUMBER ONE Below are the summarized Balance Sheets of Prep Ltd. Its subsidiary Gesta Ltd and its associate Karip Ltd at 30th November 2002.

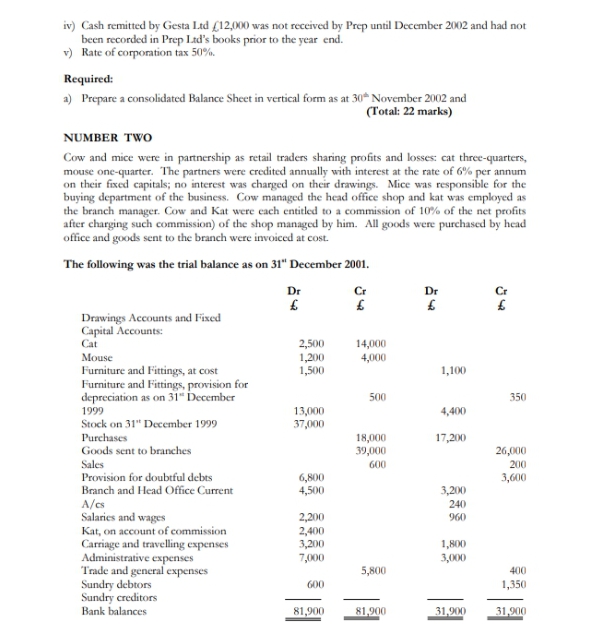

NUMBER ONE Below are the summarized Balance Sheets of Prep Ltd. Its subsidiary Gesta Ltd and its associate Karip Ltd at 30th November 2002. Prep Ltd Gesta Ltd Karip Ltd Assets Freehold Land-cost or valuation 600,000 200,000 400,000 Freehold Buildings NBV) 1,000,000 400,000 640,000 Machinery NBV) 1,200,000 360,000 640,000 2,800,000 960,000 1,680,000 Inv. in subsidiary (cost) 720,000 Inv. in associated company (cost) 480,000 Inventories 1,200,000 440,000 880,000 Accounts Receivable 600,000 200,000 480,000 Amounts owed by Subsidiary 20,000 Bank and cash balances 100,000 160,000 5.920.000 1,600,000 3,200,000 Equity and liabilities Share Capital 15% cumulative preference 20 400,000 share) 2,400,000 600,000 800,000 Ordinary 20 share) 320,000 200,000 Share Premium Account 400,000 Fixed assets revaluation reserve 400,000 244,000 340,000 Retained earnings 3,520,000 844,000 1,740,000 1,200,000 400,000 800,000 12% Debenture Deferred taxation Corporation tax 240,000 94,000 160,000 160,000 48,000 100,000 560,000 136,000 320,000 Accounts payable Proposed dividend Bank overdraft Amount due to holding company 240,000 30,000 80,000 40,000 8,000 5.920.000 1.600.000 3.200.000 You are given the following additional information: i) Prep Ltd acquired 24,000 ordinary shares in Gesta Ltd by issuance of 20,000 of its own ordinary shares at a price of 30 per share. At the time Gesta Ltd had reserves totalling (120,000. ii) Prep Ltd purchased 16,000 ordinary shares in Karip Ltd for cash at a time when the latter had retained eamings totalling 80,000 and no outstanding dividends. Karip Ltd has not issued any shares then, but has subsequently revalued its fixed assets. iii) 100,000 of Prep Ltd's inventory had been purchased from Gesta Ltd cost to latter 80,000. iv) Cash remitted by Gesta Ltd 12,000 was not received by Prep until December 2002 and had not been recorded in Prep Ltd's books prior to the year end. v) Rate of corporation tax 50%. Required: a) Prepare a consolidated Balance Sheet in vertical form as at 30 November 2002 and NUMBER TWO (Total: 22 marks) Cow and mice were in partnership as retail traders sharing profits and losses: cat three-quarters, mouse one-quarter. The partners were credited annually with interest at the rate of 6% per annum on their fixed capitals; no interest was charged on their drawings. Mice was responsible for the buying department of the business. Cow managed the head office shop and kat was employed as the branch manager. Cow and Kat were each entitled to a commission of 10% of the net profits after charging such commission) of the shop managed by him. All goods were purchased by head office and goods sent to the branch were invoiced at cost. The following was the trial balance as on 31" December 2001. Dr Cr Dr Drawings Accounts and Fixed Capital Accounts: Cat 2,500 14,000 Mouse 1,200 4,000 Furniture and Fittings, at cost 1,500 1,100 Furniture and Fittings, provision for depreciation as on 31" December 500 50 350 1999 13,000 4,400 Stock on 31" December 1999 37,000 Purchases 18,000 17,200 Goods sent to branches 39,000 26,000 Sales 600 200 Provision for doubtful debts 6,800 3,600 Branch and Head Office Current 4,500 3,200 A/cs 240 Salaries and wages 2,200 960 Kat, on account of commission 2,400 Carriage and travelling expenses 3,200 1,800 Administrative expenses 7,000 3,000 Trade and general expenses 5,800 400 Sundry debtors 600 1,350 Sundry creditors Bank balances 81,900 81,900 31,900 31,900 You are given the following additional information:- 1) Stocks on 31" December 2001 amounted to: head office (14,440, branch 6,570. 2) Administrative expenses are to be apportioned between head office and the branch in proportion to sales. 3) Depreciation is to be provided on furniture and fittings at 10% of cost. 4) The provision for doubtful debts is to be increased by 50 in respect of head office debtors and decreased by 20 in the case of those of the branch. 5) On 31" December 2001 cash amounting to 2,400, in transit from the branch to head office, had been recorded in the branch books but not in those of head office, and on that date goods invoiced at 800, in transit from head office to the branch, had been recorded in the head office books but not in the branch books. You are required to: a) Prepare Trading and Profit and Loss Accounts and the Appropriation Account for the year ended 31" December, 2001 showing the net profit of the head office and branch respectively. b) Prepare the Balance Sheet as on that date, and c) Show the closing entries in the Branch Current Account giving the make-up of the closing

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started