Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NUMBER THREE Taitus has had a bankruptcy petition filed against him in the High Court. A receiving order was made on 31 October 1995.

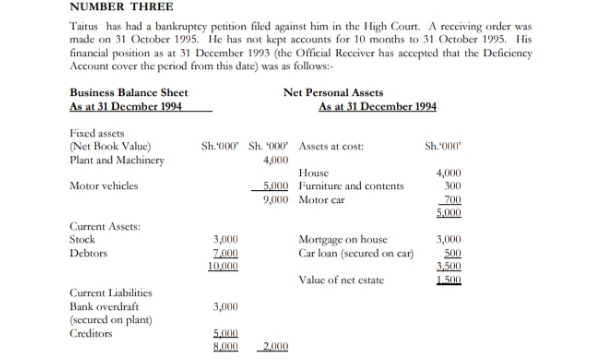

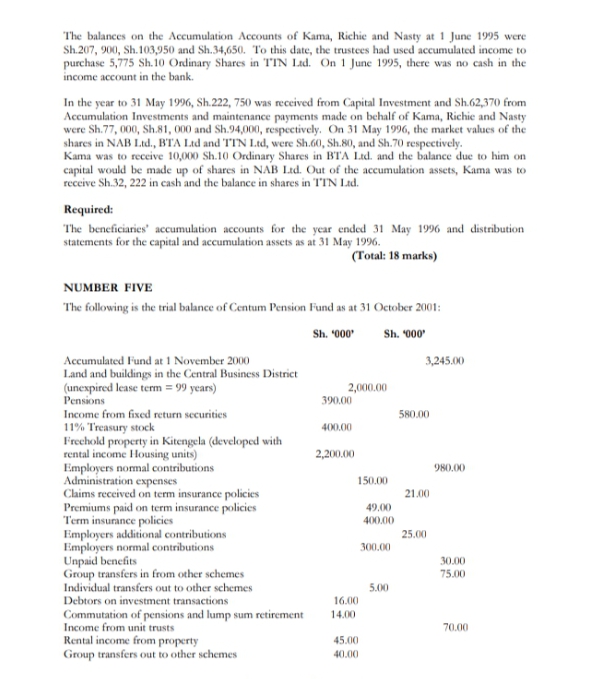

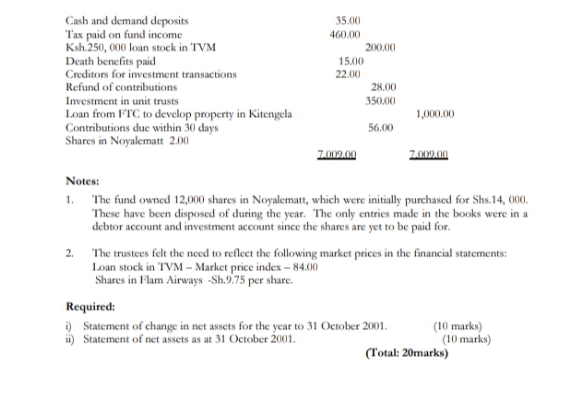

NUMBER THREE Taitus has had a bankruptcy petition filed against him in the High Court. A receiving order was made on 31 October 1995. He has not kept accounts for 10 months to 31 October 1995. His financial position as at 31 December 1993 (the Official Receiver has accepted that the Deficiency Account cover the period from this date) was as follows:- Business Balance Sheet Net Personal Assets As at 31 Decmber 1994 As at 31 December 1994 Fixed assets (Net Book Value) Sh.'000 Sh. '000' Assets at cost: Sh.'000' Plant and Machinery 4,000 House 4,000 Motor vehicles 5,000 Furniture and contents 300 9,000 Motor car 700 5,000 Current Assets: Stock 3,000 Mortgage on house 3,000 Debtors 7,000 Car loan (secured on car) 500 10,000 3,500 Value of net estate 1.500 Current Liabilities Bank overdraft 3,000 (secured on plant) Creditors 5,000 8.000 2.000 Capital Finance lease on vehicles You establish the following facts. 11.000 7,500 3.500 11.000 Between 1 January 1995 and 31 October 1995, he had made 10 monthly payments of Sh.60,000 each in respect of his mortgage: mortgage interests for the period was Sh.500, 000. He had made 3 quarterly repayments on his car loan Sh.75, 000 each and on the finance lease on his vehicles of Sh.850, 000 each; interest for the 10 months on the car loan and finance lease were Sh.100,000 and Sh.600,000 respectively. These payments were made out of his business bank account for the 10- month period to 31 October 1995; sales (both for cash and on credit) totalled Sh.30 million. He collected and banked directly Sh.28 million from debtors and sales; he used Sh.1 million collections for drawings. All creditors at 3 December 1994 were in respect of trade purchases. In the 10 months he had paid Sh 22 million to trade creditors and Sh.5million in respect of expenses. He had neither purchased nor sold any fixed assets, either for his business or his personal use. He had obtained a short-term loan from his uncle on 29 October 1995 for Sh.5 million which he had banked in his business bank account on the same day. Overdraft interest for the period had been charged in the amount of Sh.750, 000. On 31 October 1995, stock at cost was Sh.2 million. Liabilities of Sh.6 million for purchases and Sh.1 million for expenses (including Sh.300,000 to his 25 employees for months of September and October - all earn in excess of Sh.3, 000 per month, and Sh.260, 000 PAYE deductions not yet paid across to the Income Tax Department) need to be accounted for: The realisable value of assets are: Plant Sh.1.8 million, Motor vehicles Sh.2.5 million, Stock Sh.1.6 million, Debtors Sh.5.5 million, House Sh.4.2 million, Furniture and contents Sh.0.1 million, Motor Car Sh.0.4 million. He had drawn Sh.500, 000 from his business bank account in respect of personal expenses. Required: Statement of Affairs and a Deficiency Account in accordance with the format contained in the Bankruptcy Act. Show all your workings. (Total: 20 marks) NUMBER FOUR Kama, Richie and Nasty had been orphaned when both their parents died in a bus accident in April 1992. Their uncle, Mr. Kipeo, a stockbroker on the Nairobi Stock Exchange, organised a harambee for them in June 1992 and raised Sh.1, 980,000. He invested this amount as follows: 9,600 Sh.10 Ordinary Shares in NAB Ltd. 12,600 Sh.10 Ordinary Shares in BTA Ltd. 13,200 Sh.10 Ordinary Shares in TTN Ltd. 1,980,000 Sh. 756,000 792,000 432,000 He established an accumulation and maintenance trust to hold these investments on behalf of the children. The trust had a wide investment clause. He ruled that accounts be made up to 31 May each year. When each child reached the age of 21 the trustees were to transfer to him his share of The balances on the Accumulation Accounts of Kama, Richie and Nasty at 1 June 1995 were Sh.207, 900, Sh.103,950 and Sh.34,650. To this date, the trustees had used accumulated income to purchase 5,775 Sh.10 Ordinary Shares in TIN Ltd. On 1 June 1995, there was no cash in the income account in the bank. In the year to 31 May 1996, Sh.222, 750 was received from Capital Investment and Sh.62,370 from Accumulation Investments and maintenance payments made on behalf of Kama, Richie and Nasty were Sh.77, 000, Sh.81, 000 and Sh.94,000, respectively. On 31 May 1996, the market values of the shares in NAB Ltd., BTA Ltd and TTN Ltd, were Sh.60, Sh.80, and Sh.70 respectively. Kama was to receive 10,000 Sh.10 Ordinary Shares in BTA Ltd. and the balance due to him on capital would be made up of shares in NAB Ltd. Out of the accumulation assets, Kama was to receive Sh.32, 222 in cash and the balance in shares in TTN Ltd. Required: The beneficiaries' accumulation accounts for the year ended 31 May 1996 and distribution statements for the capital and accumulation assets as at 31 May 1996. NUMBER FIVE (Total: 18 marks) The following is the trial balance of Centum Pension Fund as at 31 October 2001: Accumulated Fund at 1 November 2000 Sh. '000' Sh. '000' 3,245.00 Land and buildings in the Central Business District (unexpired lease term = 99 years) 2,000.00 Pensions 390.00 Income from fixed return securities 580.00 11% Treasury stock 400.00 Freehold property in Kitengela (developed with rental income Housing units) 2,200.00 Employers normal contributions 980.00 Administration expenses 150.00 Claims received on term insurance policies 21.00 Premiums paid on term insurance policies Term insurance policies 49.00 400.00 Employers additional contributions Employers normal contributions Unpaid benefits 25.00 300.00 30.00 Group transfers in from other schemes 75.00 Individual transfers out to other schemes 5.00 Debtors on investment transactions 16.00 Commutation of pensions and lump sum retirement 14.00 Income from unit trusts 70.00 Rental income from property 45.00 Group transfers out to other schemes 40.00 Cash and demand deposits 35.00 Tax paid on fund income 460.00 Ksh.250,000 loan stock in 'TVM 200.00 Death benefits paid 15.00 Creditors for investment transactions 22.00 Refund of contributions 28.00 Investment in unit trusts 350.00 Loan from FTC to develop property in Kitengela 1,000.00 Contributions due within 30 days Shares in Noyalematt 2.00 56.00 7.009.00 7.009.00 Notes: 1. The fund owned 12,000 shares in Noyalematt, which were initially purchased for Shs. 14,000. These have been disposed of during the year. The only entries made in the books were in a debtor account and investment account since the shares are yet to be paid for. 2. The trustees felt the need to reflect the following market prices in the financial statements: Loan stock in TVM-Market price index -84.00 Shares in Flam Airways -Sh.9.75 per share. Required: i) Statement of change in net assets for the year to 31 October 2001. ii) Statement of net assets as at 31 October 2001. (10 marks) (10 marks) (Total: 20marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started