Answered step by step

Verified Expert Solution

Question

1 Approved Answer

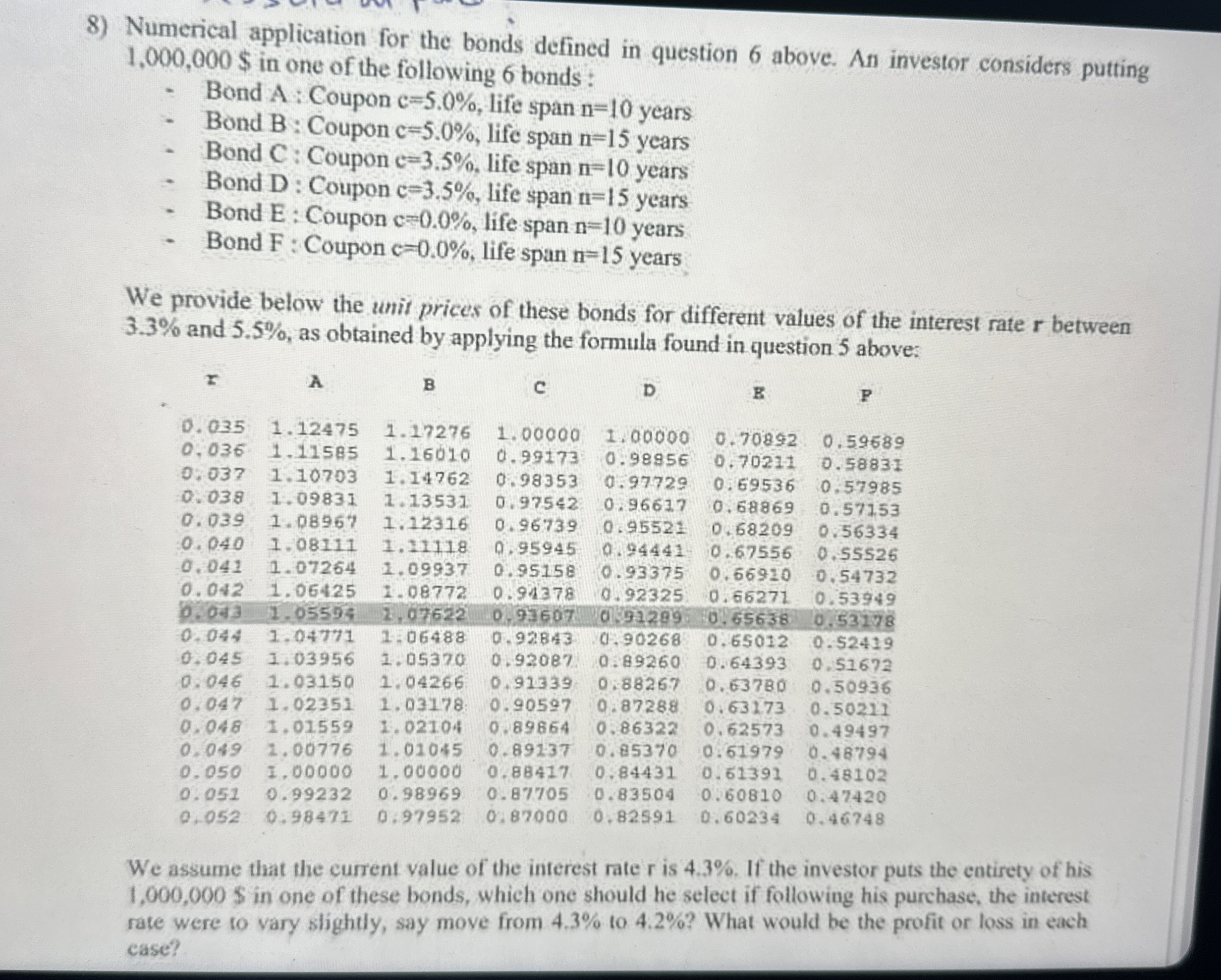

Numerical application for the bonds defined in question 6 above. An investor considers putting 1 , 0 0 0 , 0 0 0 $ in

Numerical application for the bonds defined in question above. An investor considers putting $ in one of the following bonds :

Bond A: Coupon life span years

Bond B : Coupon life span years

Bond : Coupon life span years

Bond D : Coupon life span years

Bond E: Coupon life span years

Bond : Coupon life span years

We provide below the unit prices of these bonds for different values of the interest rate between and as obtained by applying the formula found in question above:

check table in Table in picture

We assume that the current value of the interest rate is If the investor puts the entirety of his $ in one of these bonds, which one should he select if following his purchase, the interest rate were to vary stightly, say move from to What would be the profit or loss in each case? Take the numbers from the figure

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started