Question

Victor and Maria, both in their late 30s, have two children: John, age 13 and Joseph, age 15. Victor has had a long sales career

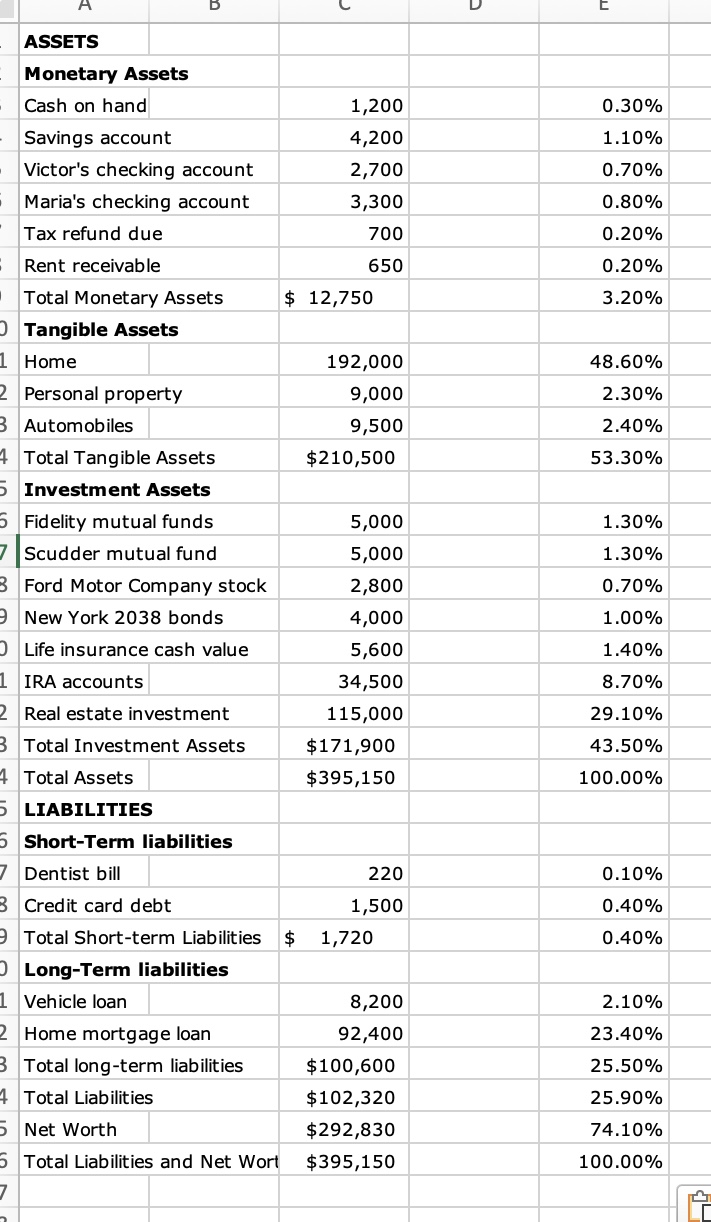

Victor and Maria, both in their late 30s, have two children: John, age 13 and Joseph, age 15. Victor has had a long sales career with a retail appliance store. Maria works part-time as a medical records assistant. The Hernandezs own two vehicles and their home, on which they have a mortgage. They will face many financial challenges over the next 20 years, as their children drive, go to college, and leave home and go out in the world on their own. Victor and Maria also recognize the need to further prepare for their retirement and the challenges of aging. Victor and Maria spent some time making up their first balance sheet, which is shown in the table.

- Assume that their home is now appraised at $200,000 and the value of their automobile has dropped to $8,200. Calculate and characterize the effects of these changes on their net worth. Round your answer to the nearest dollar. Net worth would (Decrease or increase) by $____ because the value of the real estate rose (less than, more than, by the same amount as) the value of the car declined. Calculate the effects of these changes on their asset-to-debt ratio. Round your answers to three decimal places. Old asset-to-debt ratio: ______ New asset-to-debt ratio: ______

2. If Victor and Maria take out a bank loan for $1,500 and pay off their credit card debts totaling $1,500, what effects would these changes have on their net worth? Taking out a bank loan to pay off the credit card liability would -(decrease, increase, not affect) the Hernandezs' net worth.

3. If Victor and Maria sell their New York 2038 bond and put the cash into the savings account, what effects would this have on their net worth and liquidity ratio? Assume their annual expenses are $83,186. Round your answers to three decimal places. Selling the New York bond would -(decrease, increase, not affect) the Hernandezs' net worth. The liquidity ratio would (decrease or increase) from_____ to______ .

\begin{tabular}{|c|c|c|} \hline B & c & E \\ \hline ASSETS & & \\ \hline \multicolumn{3}{|l|}{ Monetary Assets } \\ \hline Cash on hand & 1,200 & 0.30% \\ \hline Savings account & 4,200 & 1.10% \\ \hline Victor's checking account & 2,700 & 0.70% \\ \hline Maria's checking account & 3,300 & 0.80% \\ \hline Tax refund due & 700 & 0.20% \\ \hline Rent receivable & 650 & 0.20% \\ \hline Total Monetary Assets & $12,750 & 3.20% \\ \hline \multicolumn{3}{|l|}{ Tangible Assets } \\ \hline Home & 192,000 & 48.60% \\ \hline Personal property & 9,000 & 2.30% \\ \hline Automobiles & 9,500 & 2.40% \\ \hline Total Tangible Assets & $210,500 & 53.30% \\ \hline \multicolumn{3}{|l|}{ Investment Assets } \\ \hline Fidelity mutual funds & 5,000 & 1.30% \\ \hline Scudder mutual fund & 5,000 & 1.30% \\ \hline Ford Motor Company stock & 2,800 & 0.70% \\ \hline New York 2038 bonds & 4,000 & 1.00% \\ \hline Life insurance cash value & 5,600 & 1.40% \\ \hline IRA accounts & 34,500 & 8.70% \\ \hline Real estate investment & 115,000 & 29.10% \\ \hline Total Investment Assets & $171,900 & 43.50% \\ \hline Total Assets & $395,150 & 100.00% \\ \hline \multicolumn{3}{|l|}{ LIABILITIES } \\ \hline \multicolumn{3}{|l|}{ Short-Term liabilities } \\ \hline Dentist bill & 220 & 0.10% \\ \hline Credit card debt & 1,500 & 0.40% \\ \hline Total Short-term Liabilities & $1,720 & 0.40% \\ \hline \multicolumn{3}{|l|}{ Long-Term liabilities } \\ \hline Vehicle loan & 8,200 & 2.10% \\ \hline Home mortgage loan & 92,400 & 23.40% \\ \hline Total long-term liabilities & $100,600 & 25.50% \\ \hline Total Liabilities & $102,320 & 25.90% \\ \hline Net Worth & $292,830 & 74.10% \\ \hline Total Liabilities and Net Wort & t $395,150 & 100.00% \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started