Question

Nurjahan Printing Press has 3 printing machines. Because of some unidentifiable reasons, the company follows different depreciation method for each of the machines. The information

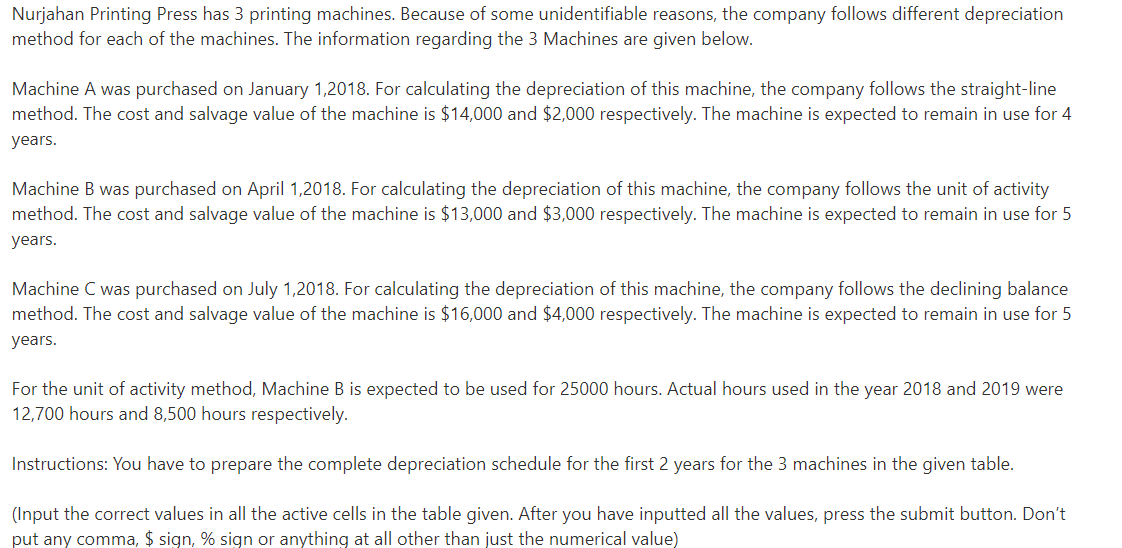

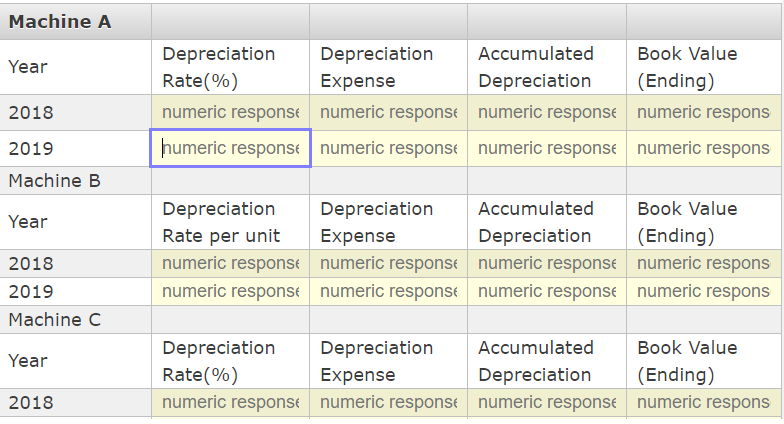

Nurjahan Printing Press has 3 printing machines. Because of some unidentifiable reasons, the company follows different depreciation method for each of the machines. The information regarding the 3 Machines are given below. Machine A was purchased on January 1,2018. For calculating the depreciation of this machine, the company follows the straight-line method. The cost and salvage value of the machine is $14,000 and $2,000 respectively. The machine is expected to remain in use for 4 years. Machine B was purchased on April 1,2018. For calculating the depreciation of this machine, the company follows the unit of activity method. The cost and salvage value of the machine is $13,000 and $3,000 respectively. The machine is expected to remain in use for 5 years. Machine C was purchased on July 1,2018. For calculating the depreciation of this machine, the company follows the declining balance method. The cost and salvage value of the machine is $16,000 and $4,000 respectively. The machine is expected to remain in use for 5 years. For the unit of activity method, Machine B is expected to be used for 25000 hours. Actual hours used in the year 2018 and 2019 were 12,700 hours and 8,500 hours respectively. Instructions: You have to prepare the complete depreciation schedule for the first 2 years for the 3 machines in the given table. (Input the correct values in all the active cells in the table given. After you have inputted all the values, press the submit button. Dont put any comma, $ sign, % sign or anything at all other than just the numerical value)

Nurjahan Printing Press has 3 printing machines. Because of some unidentifiable reasons, the company follows different depreciation method for each of the machines. The information regarding the 3 Machines are given below. Machine A was purchased on January 1,2018. For calculating the depreciation of this machine, the company follows the straight-line method. The cost and salvage value of the machine is $14,000 and $2,000 respectively. The machine is expected to remain in use for 4 years. Machine B was purchased on April 1,2018. For calculating the depreciation of this machine, the company follows the unit of activity method. The cost and salvage value of the machine is $13,000 and $3,000 respectively. The machine is expected to remain in use for 5 years. Machine C was purchased on July 1,2018. For calculating the depreciation of this machine, the company follows the declining balance method. The cost and salvage value of the machine is $16,000 and $4,000 respectively. The machine is expected to remain in use for 5 years. For the unit of activity method, Machine B is expected to be used for 25000 hours. Actual hours used in the year 2018 and 2019 were 12,700 hours and 8,500 hours respectively. Instructions: You have to prepare the complete depreciation schedule for the first 2 years for the 3 machines in the given table. (Input the correct values in all the active cells in the table given. After you have inputted all the values, press the submit button. Dont put any comma, $ sign, % sign or anything at all other than just the numerical value) Nurjahan Printing Press has 3 printing machines. Because of some unidentifiable reasons, the company follows different depreciation method for each of the machines. The information regarding the 3 Machines are given below. Machine A was purchased on January 1,2018. For calculating the depreciation of this machine, the company follows the straight-line method. The cost and salvage value of the machine is $14,000 and $2,000 respectively. The machine is expected to remain in use for 4 years. Machine B was purchased on April 1,2018. For calculating the depreciation of this machine, the company follows the unit of activity method. The cost and salvage value of the machine is $13,000 and $3,000 respectively. The machine is expected to remain in use for 5 years. Machine C was purchased on July 1,2018. For calculating the depreciation of this machine, the company follows the declining balance method. The cost and salvage value of the machine is $16,000 and $4,000 respectively. The machine is expected to remain in use for 5 years. For the unit of activity method, Machine B is expected to be used for 25000 hours. Actual hours used in the year 2018 and 2019 were 12,700 hours and 8,500 hours respectively. Instructions: You have to prepare the complete depreciation schedule for the first 2 years for the 3 machines in the given table. (Input the correct values in all the active cells in the table given. After you have inputted all the values, press the submit button. Dont put any comma, $ sign, % sign or anything at all other than just the numerical value)

Nurjahan Printing Press has 3 printing machines. Because of some unidentifiable reasons, the company follows different depreciation method for each of the machines. The information regarding the 3 Machines are given below. Machine A was purchased on January 1,2018. For calculating the depreciation of this machine, the company follows the straight-line method. The cost and salvage value of the machine is $14,000 and $2,000 respectively. The machine is expected to remain in use for 4 years. Machine B was purchased on April 1,2018. For calculating the depreciation of this machine, the company follows the unit of activity method. The cost and salvage value of the machine is $13,000 and $3,000 respectively. The machine is expected to remain in use for 5 years. Machine C was purchased on July 1,2018. For calculating the depreciation of this machine, the company follows the declining balance method. The cost and salvage value of the machine is $16,000 and $4,000 respectively. The machine is expected to remain in use for 5 years. For the unit of activity method, Machine B is expected to be used for 25000 hours. Actual hours used in the year 2018 and 2019 were 12,700 hours and 8,500 hours respectively. Instructions: You have to prepare the complete depreciation schedule for the first 2 years for the 3 machines in the given table. (Input the correct values in all the active cells in the table given. After you have inputted all the values, press the submit button. Dont put any comma, $ sign, % sign or anything at all other than just the numerical value)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started