Question

Nutek, Inc., holds a patent for the Full Service handi-plate, which the company described as a patented plastic buffet plate that allows the user to

Nutek, Inc., holds a patent for the Full Service handi-plate, which the company described as a patented plastic buffet plate that allows the user to hold both a plate and cup in one hand and that has a multitude of uses including social gatherings such as backyard barbecues, buffets, picnics, and parties of any kind. (No, were not making this up.) Nutek also purchased a patent for $1,000,000 for a specialty line of patented switch plate covers and outlet plate covers specifically designed to light up automatically when the power fails. Assume the switch plate patent was purchased January 1, 2009, and it is being amortized over a period of 10 years. Assume Nutek does not use an accumulated amortization account but instead charges amortization directly against the intangible asset account. After many months of unsuccessful attempts to manufacture the switch plate covers, Nutek determined the patent was significantly impaired and its book value on January 1, 2010, was written off. Describe the financial statement effects of accounting for the asset impairment and give the journal entry to record the impairment

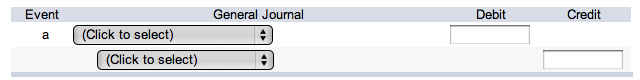

Nutek, Inc., holds a patent for the Full Service½ handi-plate, which the company described as ½a patented plastic buffet plate that allows the user to hold both a plate and cup in one hand½ and that ½has a multitude of uses including social gatherings such as backyard barbecues, buffets, picnics, and parties of any kind.½ (No, we½re not making this up.) Nutek also purchased a patent for $1,000,000 for ½a specialty line of patented switch plate covers and outlet plate covers specifically designed to light up automatically when the power fails.½ Assume the switch plate patent was purchased January 1, 2009, and it is being amortized over a period of 10 years. Assume Nutek does not use an accumulated amortization account but instead charges amortization directly against the intangible asset account. After many months of unsuccessful attempts to manufacture the switch plate covers, Nutek determined the patent was significantly impaired and its book value on January 1, 2010, was written off. Describe the financial statement effects of accounting for the asset impairment and give the journal entry to record the impairment Nutek, Inc., holds a patent for the Full Service½ handi-plate, which the company described as ½a patented plastic buffet plate that allows the user to hold both a plate and cup in one hand½ and that ½has a multitude of uses including social gatherings such as backyard barbecues, buffets, picnics, and parties of any kind.½ (No, we½re not making this up.) Nutek also purchased a patent for $1,000,000 for ½a specialty line of patented switch plate covers and outlet plate covers specifically designed to light up automatically when the power fails.½ Assume the switch plate patent was purchased January 1, 2009, and it is being amortized over a period of 10 years. Assume Nutek does not use an accumulated amortization account but instead charges amortization directly against the intangible asset account. After many months of unsuccessful attempts to manufacture the switch plate covers, Nutek determined the patent was significantly impaired and its book value on January 1, 2010, was written off. Describe the financial statement effects of accounting for the asset impairment and give the journal entry to record the impairment

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started