Answered step by step

Verified Expert Solution

Question

1 Approved Answer

NWP Assessment Player Ul Appli x + viley.com/was/ui/v2/assessment-player/index.html?launchid=a291d1e5-253d-43f4-96ef-56965c782a27#/question/ ps M Gmail Home Part Question 1 of 7 / 10 Your parents are considering investing in

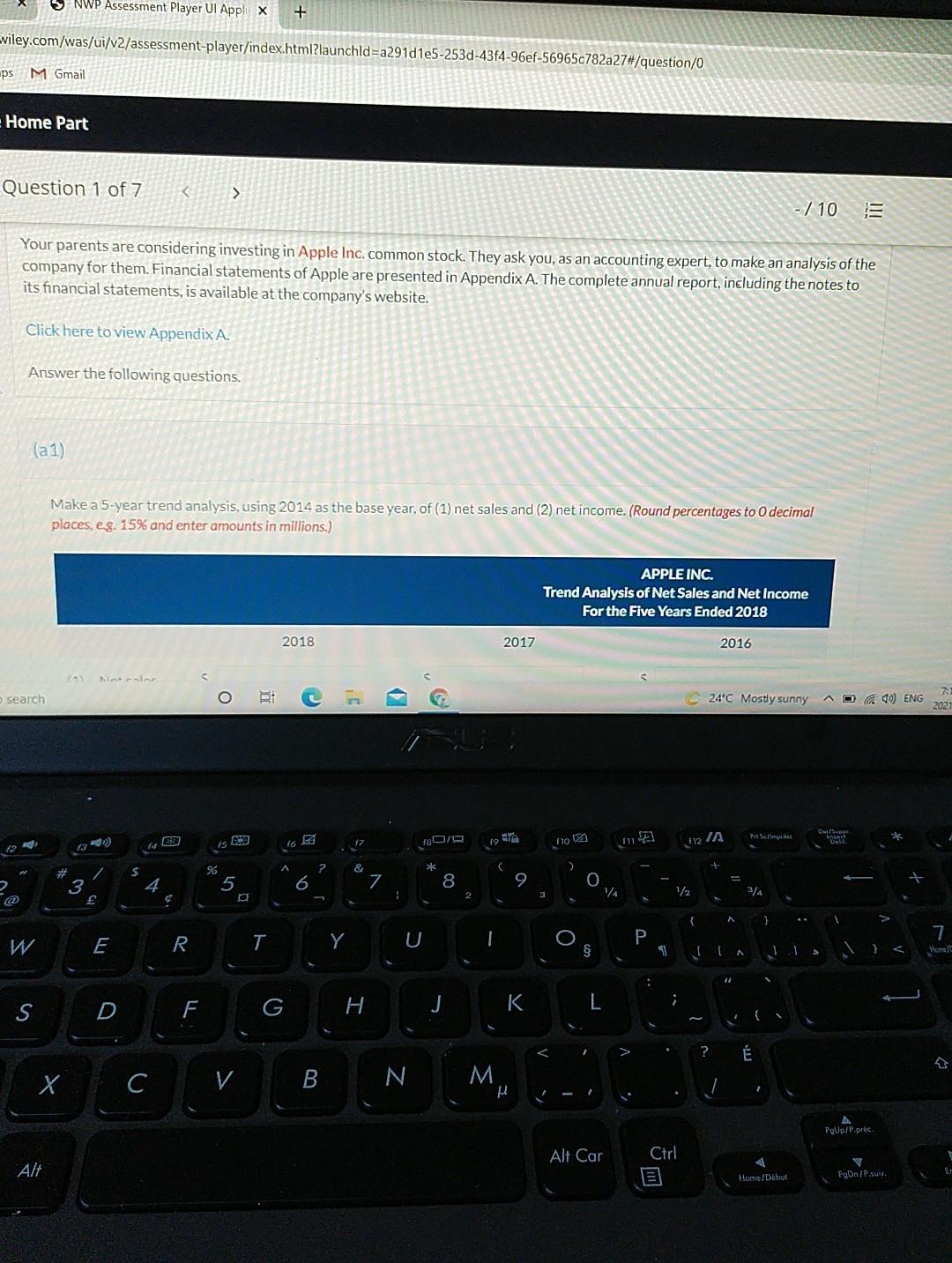

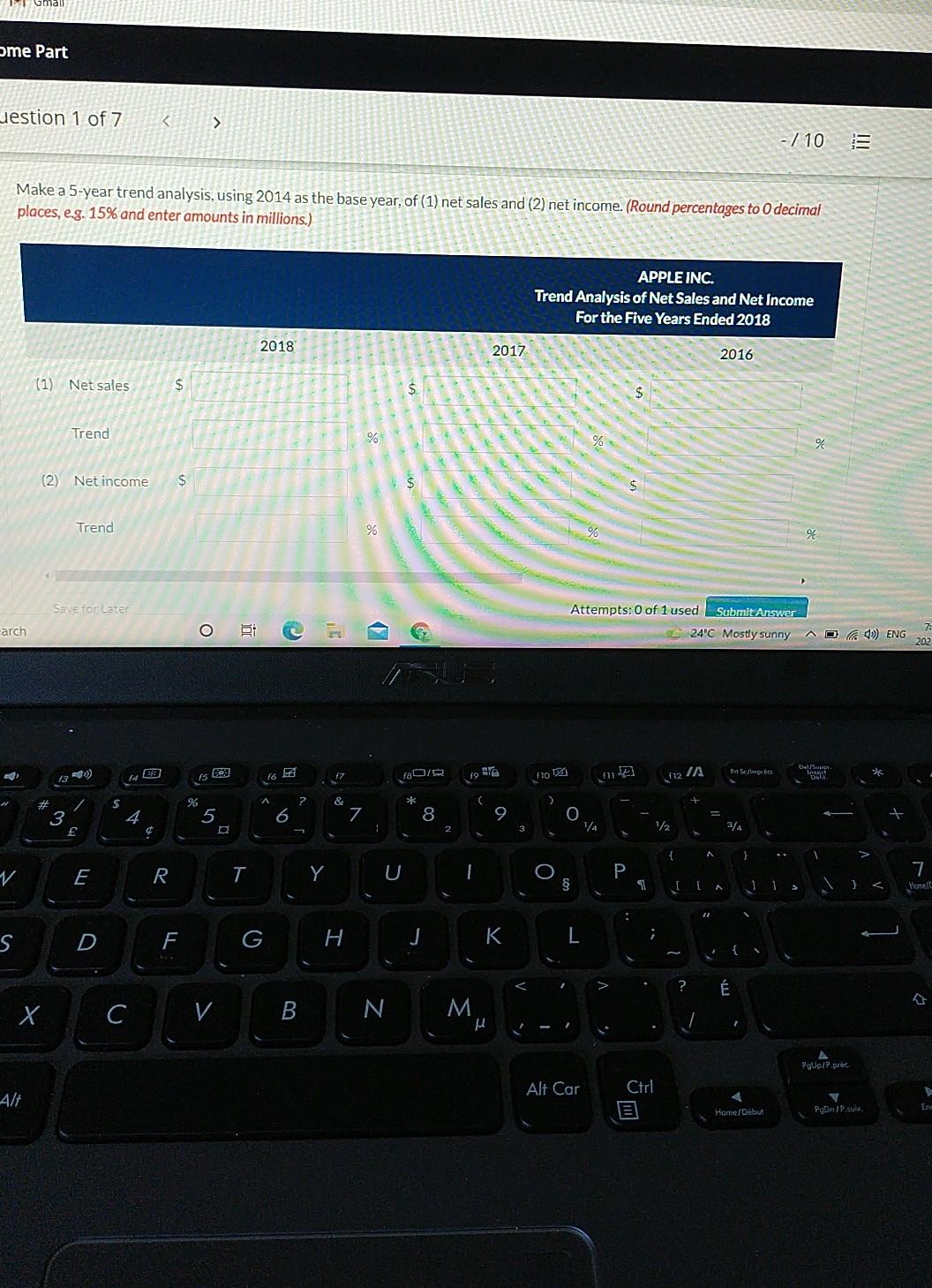

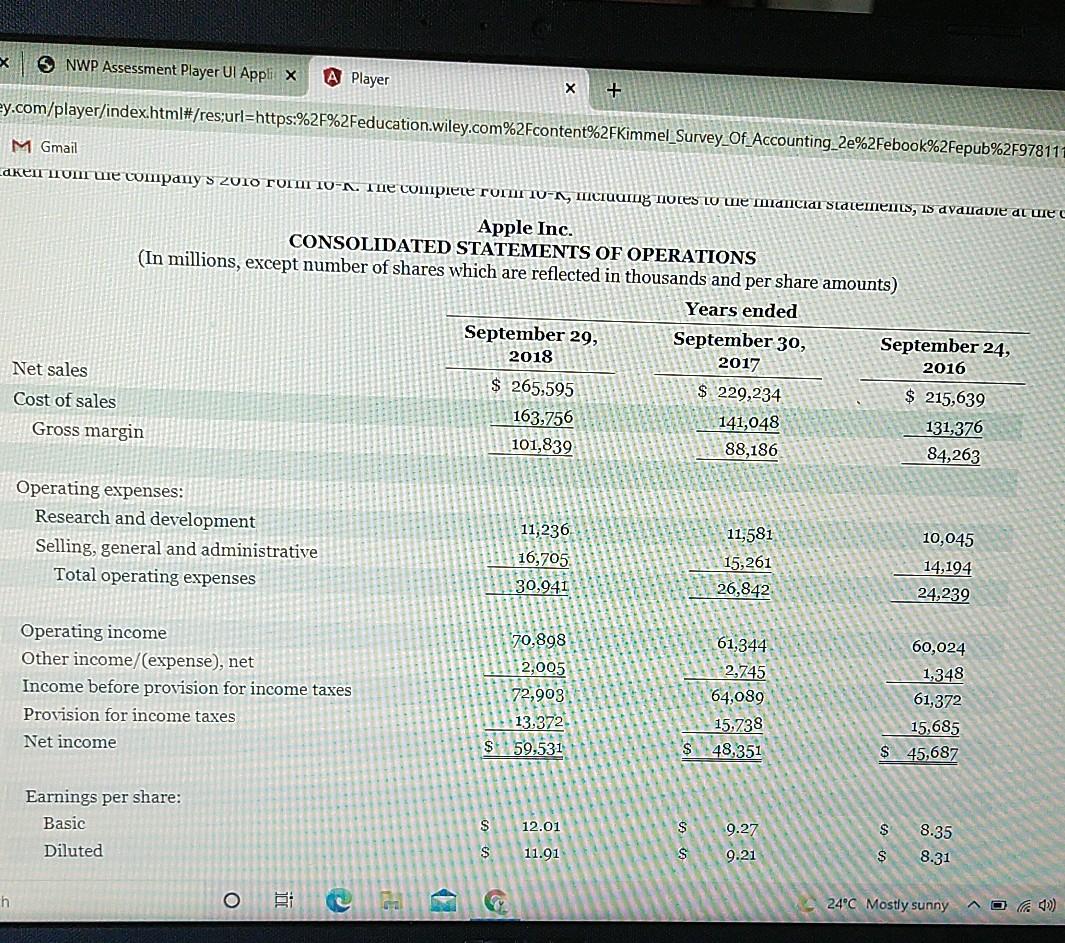

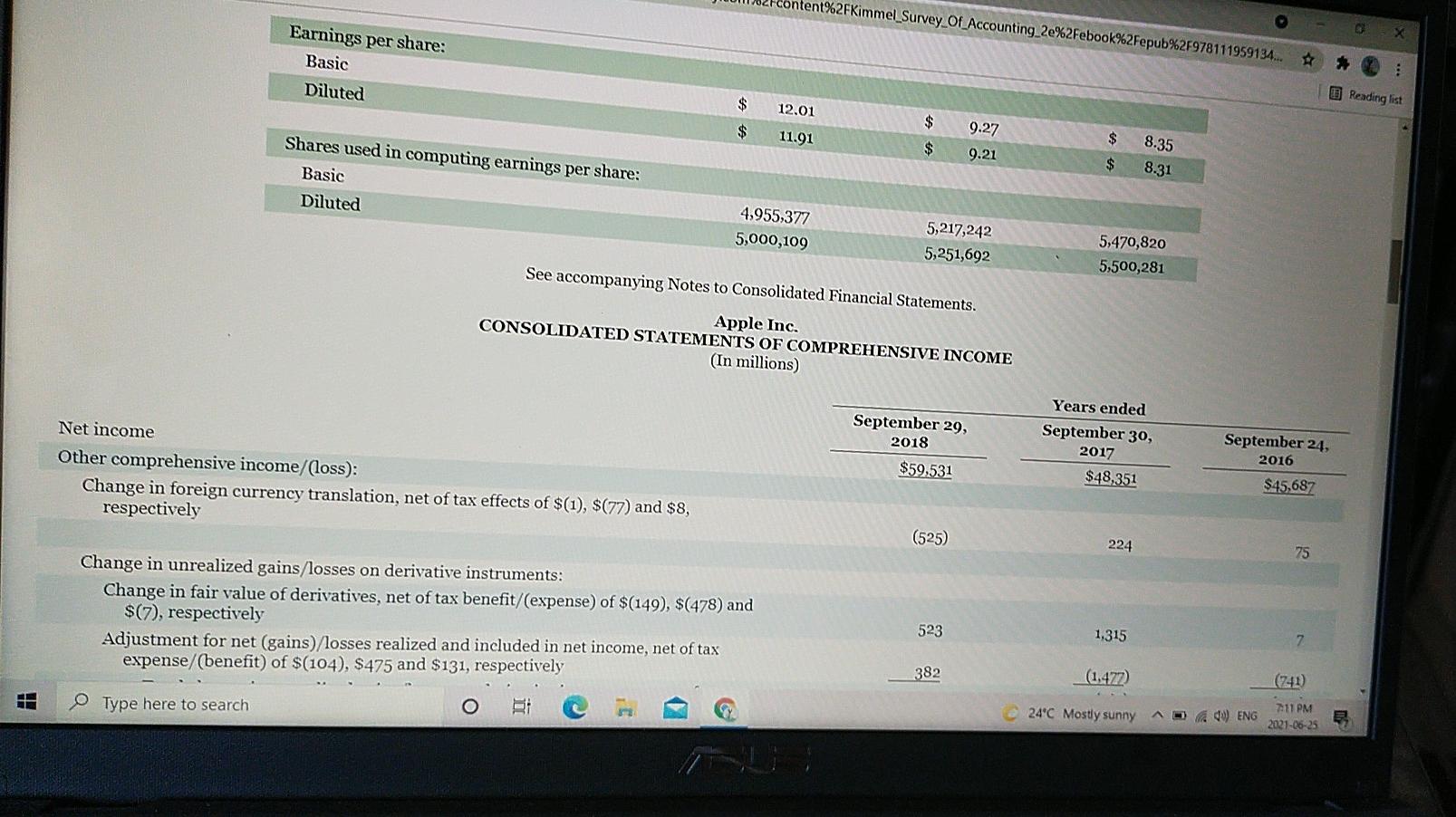

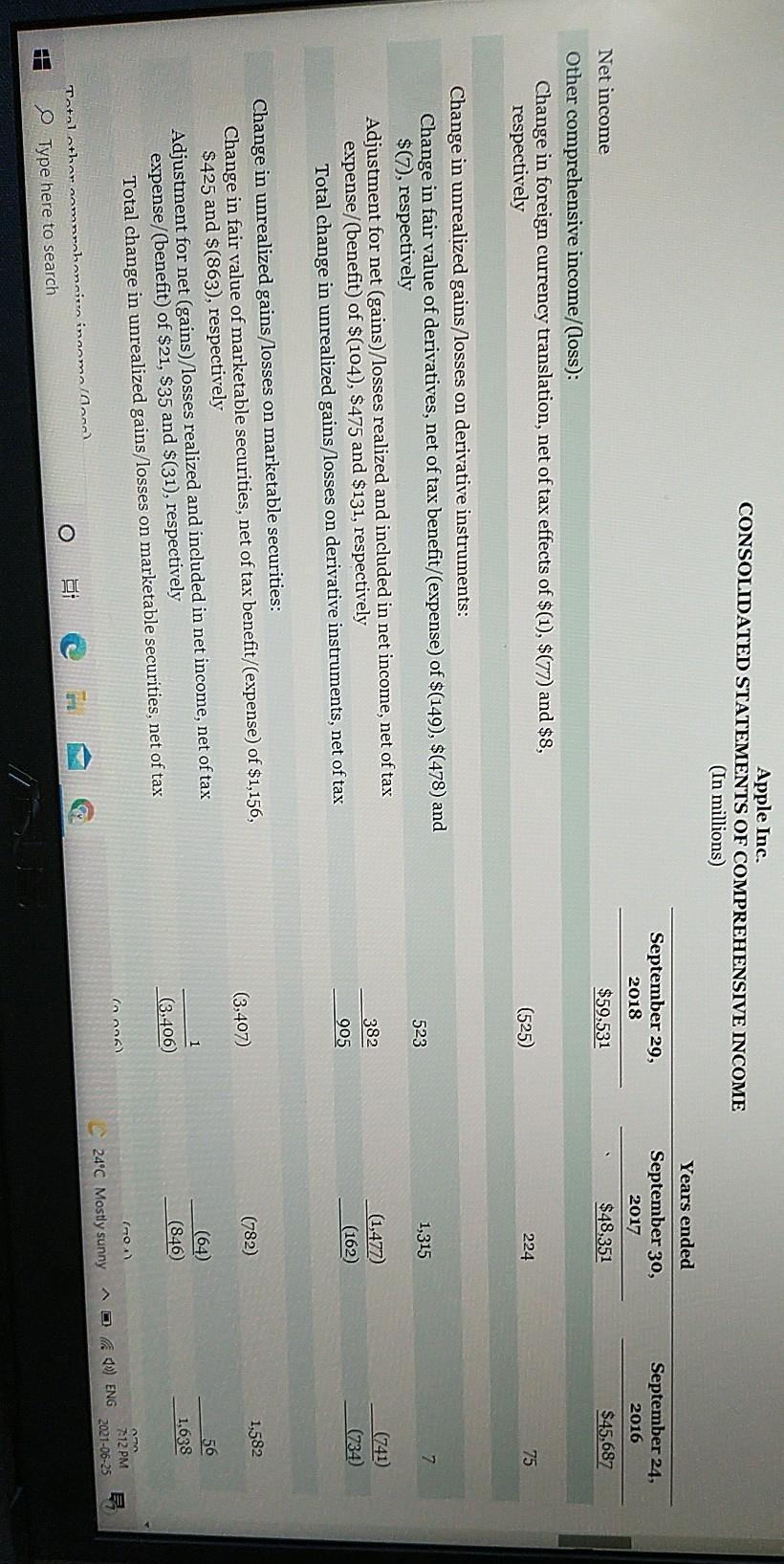

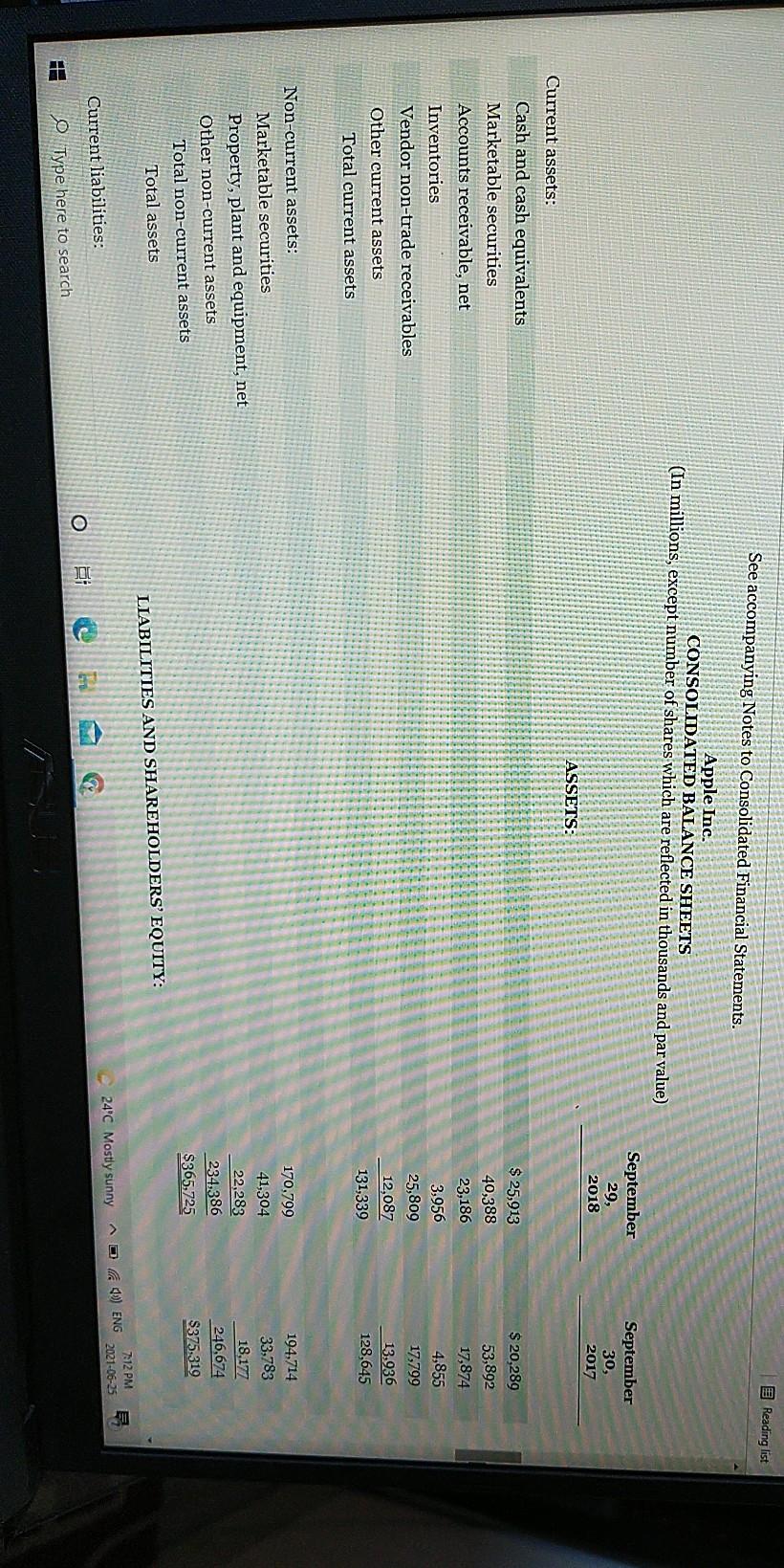

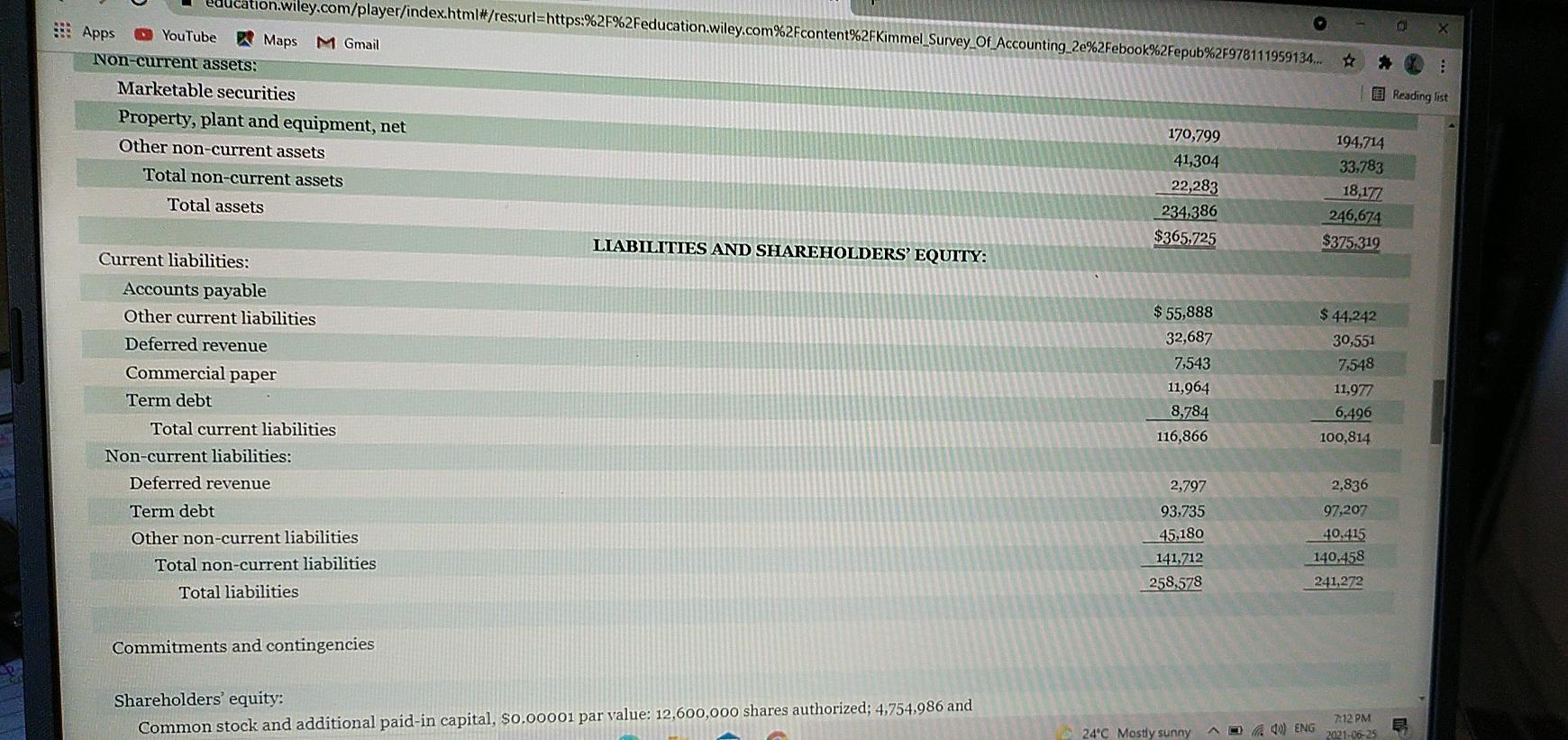

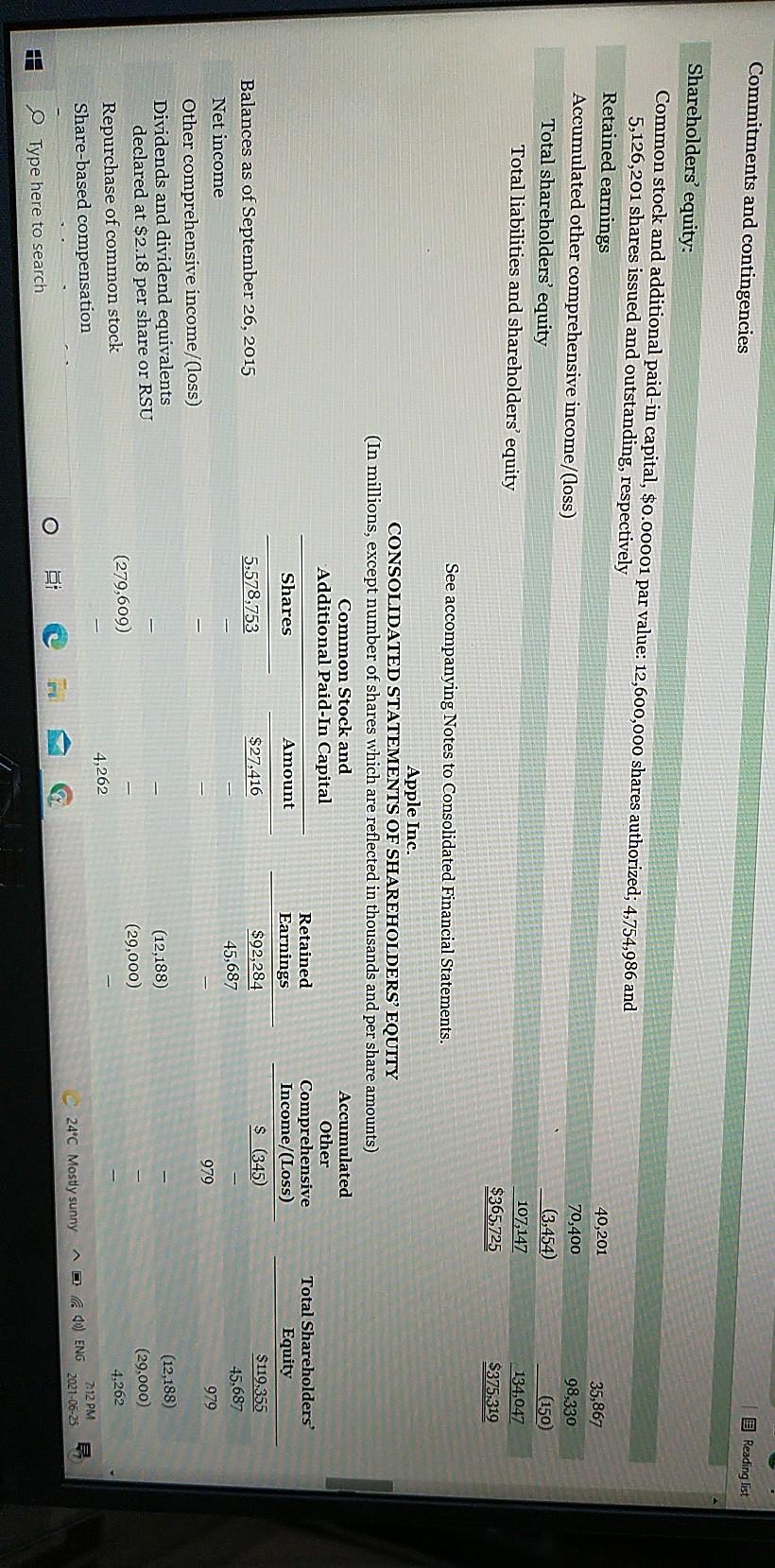

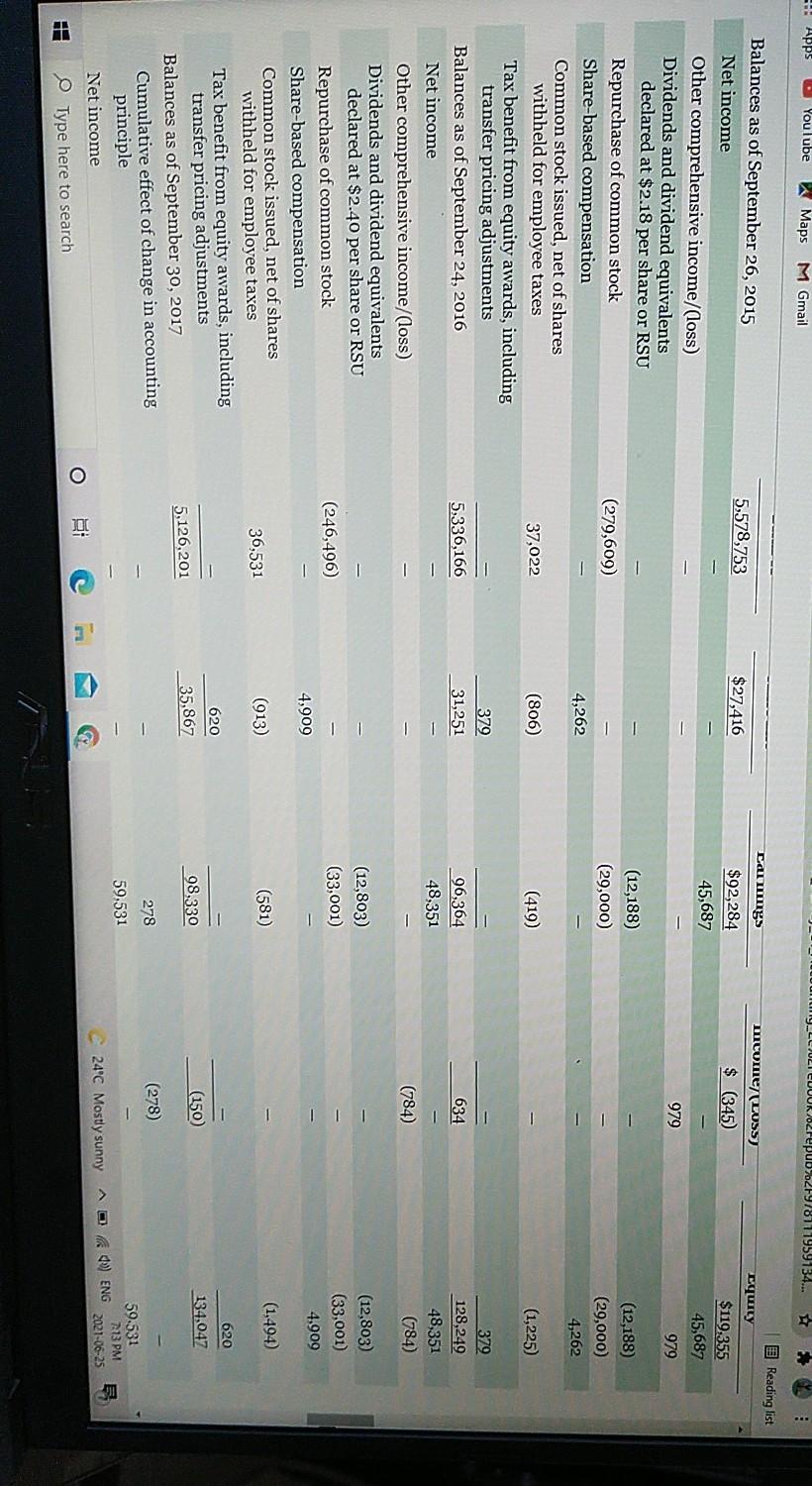

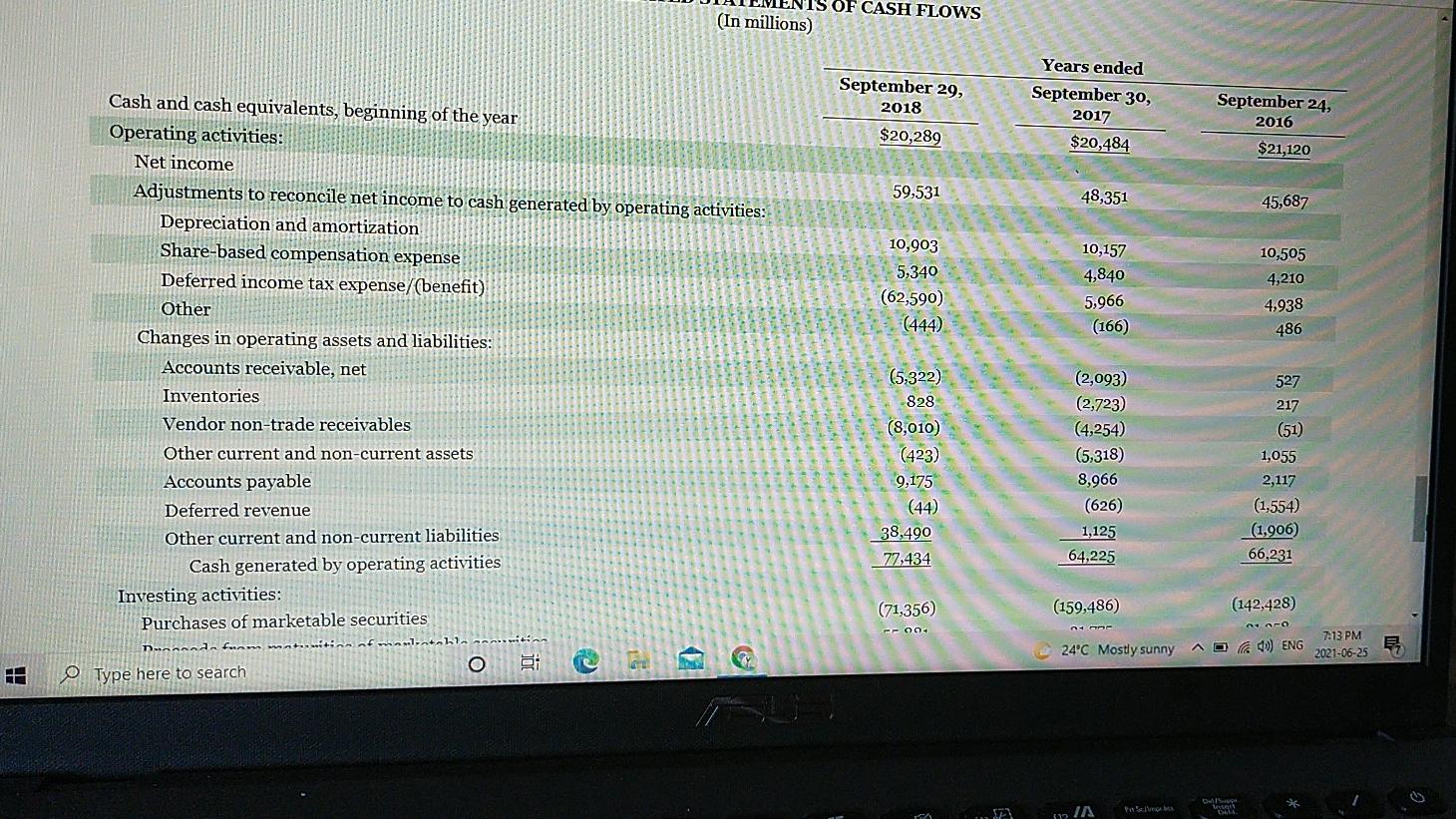

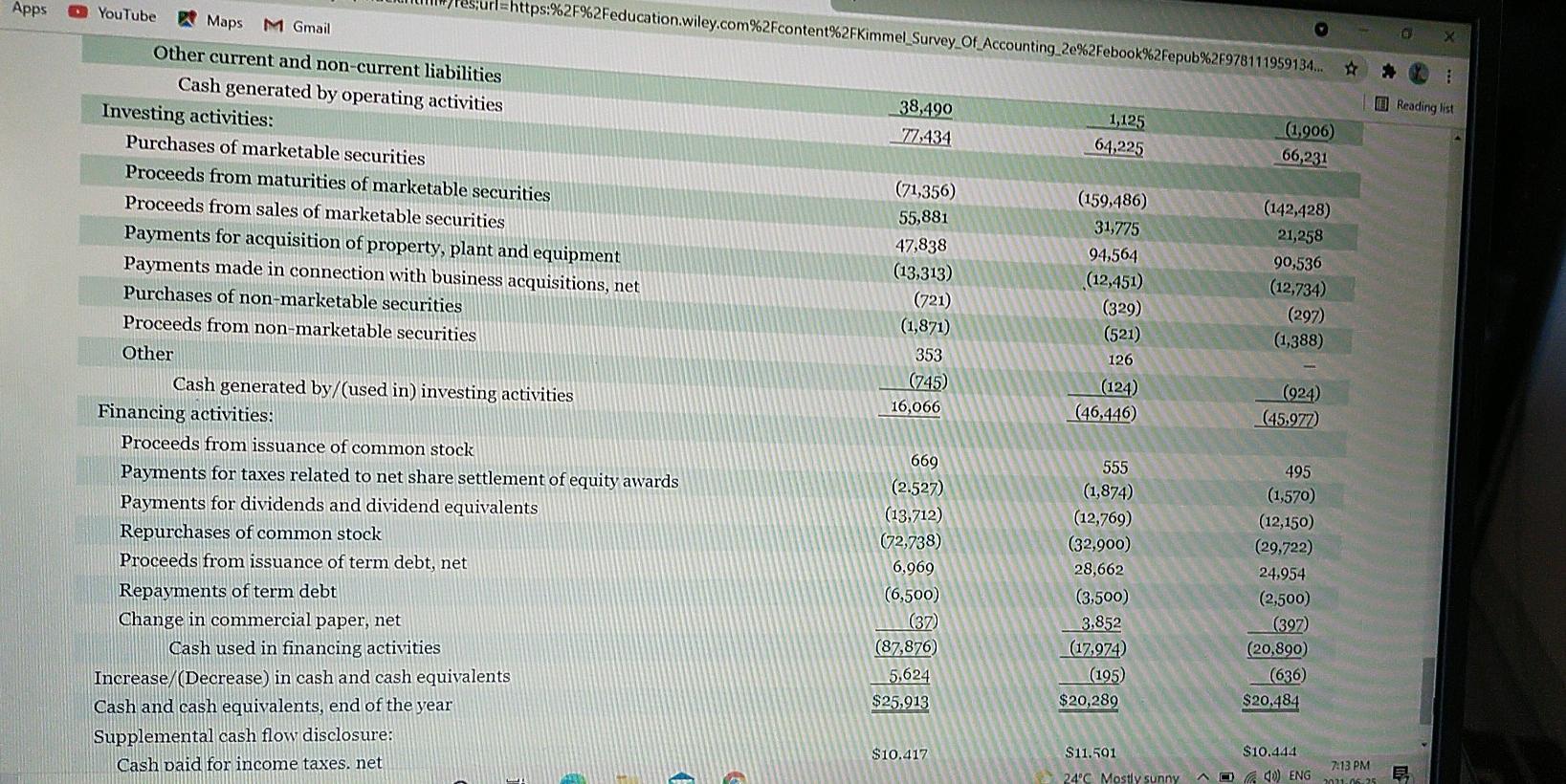

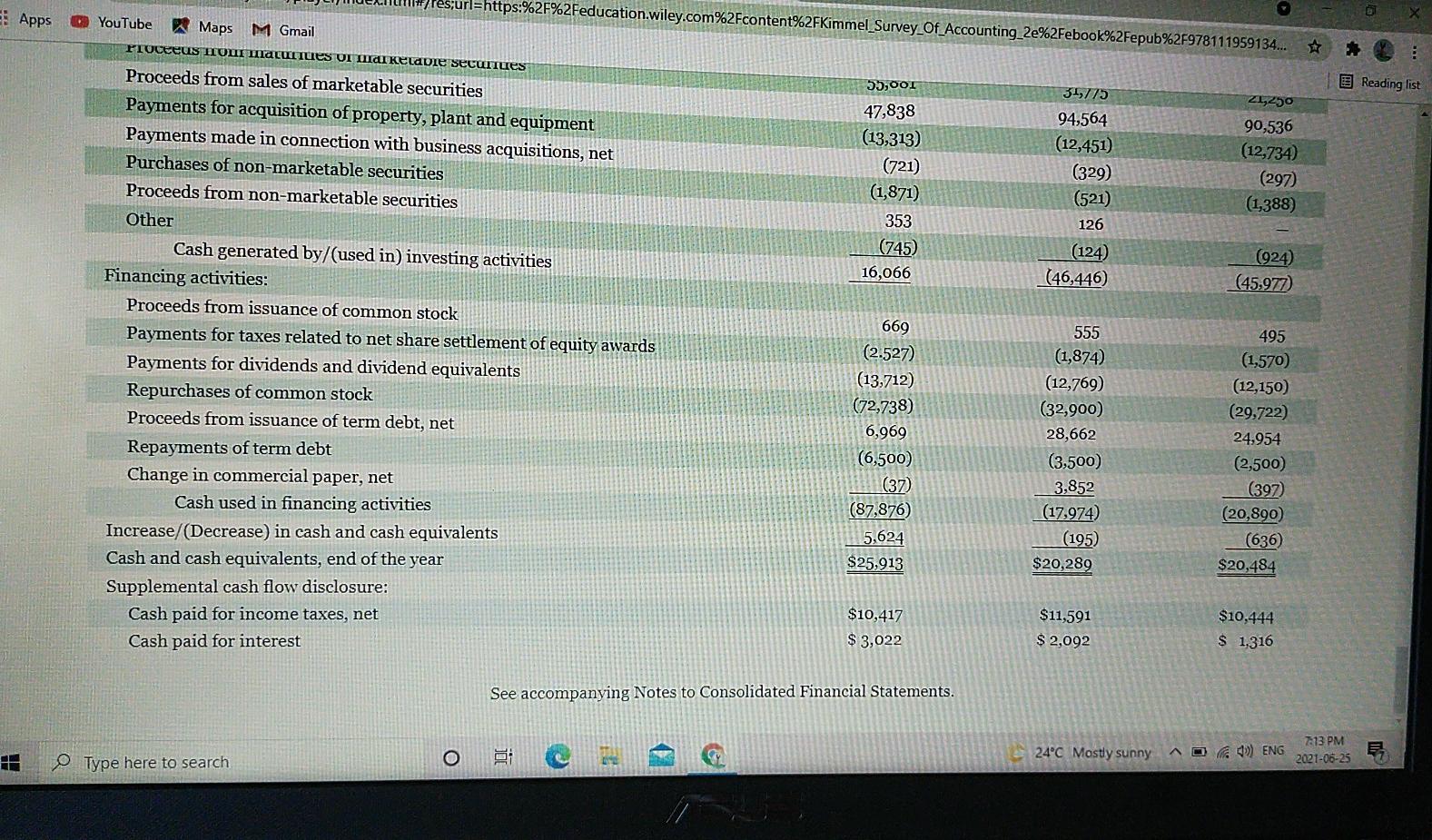

NWP Assessment Player Ul Appli x + viley.com/was/ui/v2/assessment-player/index.html?launchid=a291d1e5-253d-43f4-96ef-56965c782a27#/question/ ps M Gmail Home Part Question 1 of 7 / 10 Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix A. Answer the following questions. (a1) Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (Round percentages to O decimal places, eg. 15% and enter amounts in millions.) APPLE INC. Trend Analysis of Net Sales and Net Income For the Five Years Ended 2018 2018 2017 2016 Nintonloo search O iT c - GE 24C Mostly sunny 10) ENG 202 Smu. 17 19 Er 18O/N Fo 1221A 9 A ? & sic C ) 5 6 $ 4 7 00 9 0 3 12 1 3/4 o 2 @ { A } .. E R T Y U O II s Home F G S D K J L ; ? X C N M H - Poup!P.prec Alt Car Alt Ctrl E E Home/Debut PgDel Piwi. ome Part Jestion 1 of 7 - / 10 Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (Round percentages to 0 decimal places, e.g. 15% and enter amounts in millions.) APPLE INC. Trend Analysis of Net Sales and Net Income For the Five Years Ended 2018 2018 2017 2016 (1) Net sales $ $ Trend % (2) Net income $ $ Trend % Save for Later Attempts: 0 of 1 used Submit Answer 24C Mostly sunny- arch O dENG 202 Dell E3 15 16 17 180/ Pn S Angebot f10 12 in F12 14 & 2 ** C $ ) 3 4 96 5 6 7 8 a 0 1 2 1/4 3 3/4 V2 { } E V R T Y U C 7 tomalt cos [N F G S H J K L { 7:13 PM 2011.05 E E! Apps * B Reading list es;url=https:%2F%2Feducation.wiley.com%2Fcontent%2FKimmel Survey_Of_Accounting_2e%2Febook%2Fepub%2F978111959134... C YouTube Maps M Gmail * PIOCEEUS H10I MALIITILIES DI TIIMI Kelapie secuitues Proceeds from sales of marketable securities 55,001 31,775 255450 Payments for acquisition of property, plant and equipment 47,838 94,564 90,536 Payments made in connection with business acquisitions, net (13,313) (12,451) (12,734) Purchases of non-marketable securities (721) (329) (297) Proceeds from non-marketable securities (1,871) (521) (1,388) Other 353 126 (745) Cash generated by/(used in) investing activities (124) (924) 16,066 (46,446) Financing activities: (45,977) Proceeds from issuance of common stock 555 495 Payments for taxes related to net share settlement of equity awards (2.527) (1,874) (1,570) Payments for dividends and dividend equivalents (13,712) (12,769) (12,150) Repurchases of common stock (72,738) (32,900) (29,722) Proceeds from issuance of term debt, net 6,969 28,662 24,954 Repayments of term debt (6,500) (3,500) (2,500) Change in commercial paper, net (37) 3,852 (397) Cash used in financing activities (87,876) (17,974) (20,890) Increase/(Decrease) in cash and cash equivalents 5,624 (195) (636 Cash and cash equivalents, end of the year $25,913 $20,289 $20,484 Supplemental cash flow disclosure: $10,417 $11,591 $10,444 Cash paid for income taxes, net $ 3,022 $ 2,092 $ 1,316 Cash paid for interest 669 See accompanying Notes to Consolidated Financial Statements. ]] o (9) ENG 11 713 PM 2021-06-25 Type here to search 24C Mostly sunny NWP Assessment Player Ul Appli x + viley.com/was/ui/v2/assessment-player/index.html?launchid=a291d1e5-253d-43f4-96ef-56965c782a27#/question/ ps M Gmail Home Part Question 1 of 7 / 10 Your parents are considering investing in Apple Inc. common stock. They ask you, as an accounting expert, to make an analysis of the company for them. Financial statements of Apple are presented in Appendix A. The complete annual report, including the notes to its financial statements, is available at the company's website. Click here to view Appendix A. Answer the following questions. (a1) Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (Round percentages to O decimal places, eg. 15% and enter amounts in millions.) APPLE INC. Trend Analysis of Net Sales and Net Income For the Five Years Ended 2018 2018 2017 2016 Nintonloo search O iT c - GE 24C Mostly sunny 10) ENG 202 Smu. 17 19 Er 18O/N Fo 1221A 9 A ? & sic C ) 5 6 $ 4 7 00 9 0 3 12 1 3/4 o 2 @ { A } .. E R T Y U O II s Home F G S D K J L ; ? X C N M H - Poup!P.prec Alt Car Alt Ctrl E E Home/Debut PgDel Piwi. ome Part Jestion 1 of 7 - / 10 Make a 5-year trend analysis, using 2014 as the base year, of (1) net sales and (2) net income. (Round percentages to 0 decimal places, e.g. 15% and enter amounts in millions.) APPLE INC. Trend Analysis of Net Sales and Net Income For the Five Years Ended 2018 2018 2017 2016 (1) Net sales $ $ Trend % (2) Net income $ $ Trend % Save for Later Attempts: 0 of 1 used Submit Answer 24C Mostly sunny- arch O dENG 202 Dell E3 15 16 17 180/ Pn S Angebot f10 12 in F12 14 & 2 ** C $ ) 3 4 96 5 6 7 8 a 0 1 2 1/4 3 3/4 V2 { } E V R T Y U C 7 tomalt cos [N F G S H J K L { 7:13 PM 2011.05 E E! Apps * B Reading list es;url=https:%2F%2Feducation.wiley.com%2Fcontent%2FKimmel Survey_Of_Accounting_2e%2Febook%2Fepub%2F978111959134... C YouTube Maps M Gmail * PIOCEEUS H10I MALIITILIES DI TIIMI Kelapie secuitues Proceeds from sales of marketable securities 55,001 31,775 255450 Payments for acquisition of property, plant and equipment 47,838 94,564 90,536 Payments made in connection with business acquisitions, net (13,313) (12,451) (12,734) Purchases of non-marketable securities (721) (329) (297) Proceeds from non-marketable securities (1,871) (521) (1,388) Other 353 126 (745) Cash generated by/(used in) investing activities (124) (924) 16,066 (46,446) Financing activities: (45,977) Proceeds from issuance of common stock 555 495 Payments for taxes related to net share settlement of equity awards (2.527) (1,874) (1,570) Payments for dividends and dividend equivalents (13,712) (12,769) (12,150) Repurchases of common stock (72,738) (32,900) (29,722) Proceeds from issuance of term debt, net 6,969 28,662 24,954 Repayments of term debt (6,500) (3,500) (2,500) Change in commercial paper, net (37) 3,852 (397) Cash used in financing activities (87,876) (17,974) (20,890) Increase/(Decrease) in cash and cash equivalents 5,624 (195) (636 Cash and cash equivalents, end of the year $25,913 $20,289 $20,484 Supplemental cash flow disclosure: $10,417 $11,591 $10,444 Cash paid for income taxes, net $ 3,022 $ 2,092 $ 1,316 Cash paid for interest 669 See accompanying Notes to Consolidated Financial Statements. ]] o (9) ENG 11 713 PM 2021-06-25 Type here to search 24C Mostly sunny

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started