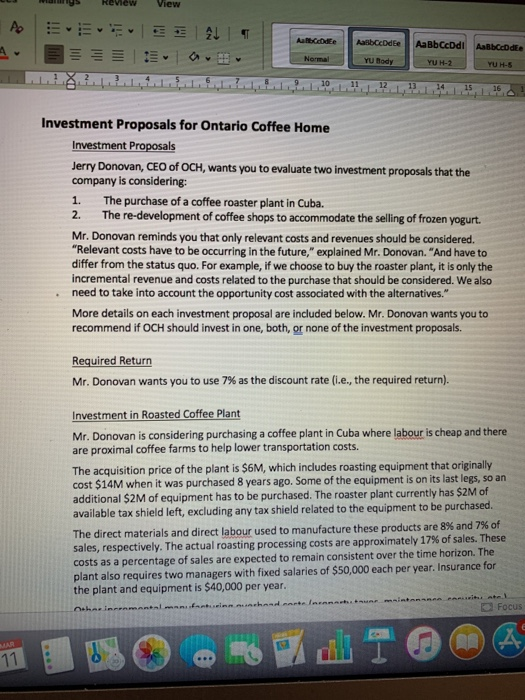

nys Review View AO ALI ACJE AasbacDdEe AaBb CcDdl AaBbccdee YU H-2 YU H-5 YU Body Investment Proposals for Ontario Coffee Home Investment Proposals Jerry Donovan, CEO of OCH, wants you to evaluate two investment proposals that the company is considering: 1. The purchase of a coffee roaster plant in Cuba. 2. The re-development of coffee shops to accommodate the selling of frozen yogurt. Mr. Donovan reminds you that only relevant costs and revenues should be considered. "Relevant costs have to be occurring in the future," explained Mr. Donovan. "And have to differ from the status quo. For example, if we choose to buy the roaster plant, it is only the incremental revenue and costs related to the purchase that should be considered. We also need to take into account the opportunity cost associated with the alternatives." More details on each investment proposal are included below. Mr. Donovan wants you to recommend if OCH should invest in one, both, or none of the investment proposals. Required Return Mr. Donovan wants you to use 7% as the discount rate (le, the required return). Investment in Roasted Coffee Plant Mr. Donovan is considering purchasing a coffee plant in Cuba where labour is cheap and there are proximal coffee farms to help lower transportation costs. The acquisition price of the plant is $6M, which includes roasting equipment that originally cost $14M when it was purchased 8 years ago. Some of the equipment is on its last legs, so an additional $2M of equipment has to be purchased. The roaster plant currently has $2M of available tax shield left, excluding any tax shield related to the equipment to be purchased The direct materials and direct labour used to manufacture these products are 8% and 7% of sales, respectively. The actual roasting processing costs are approximately 17% of sales. These costs as a percentage of sales are expected to remain consistent over the time horizon. The plant also requires two managers with fixed salaries of $50,000 each per year. Insurance for the plant and equipment is $40,000 per year. karin FOCUS nys Review View AO ALI ACJE AasbacDdEe AaBb CcDdl AaBbccdee YU H-2 YU H-5 YU Body Investment Proposals for Ontario Coffee Home Investment Proposals Jerry Donovan, CEO of OCH, wants you to evaluate two investment proposals that the company is considering: 1. The purchase of a coffee roaster plant in Cuba. 2. The re-development of coffee shops to accommodate the selling of frozen yogurt. Mr. Donovan reminds you that only relevant costs and revenues should be considered. "Relevant costs have to be occurring in the future," explained Mr. Donovan. "And have to differ from the status quo. For example, if we choose to buy the roaster plant, it is only the incremental revenue and costs related to the purchase that should be considered. We also need to take into account the opportunity cost associated with the alternatives." More details on each investment proposal are included below. Mr. Donovan wants you to recommend if OCH should invest in one, both, or none of the investment proposals. Required Return Mr. Donovan wants you to use 7% as the discount rate (le, the required return). Investment in Roasted Coffee Plant Mr. Donovan is considering purchasing a coffee plant in Cuba where labour is cheap and there are proximal coffee farms to help lower transportation costs. The acquisition price of the plant is $6M, which includes roasting equipment that originally cost $14M when it was purchased 8 years ago. Some of the equipment is on its last legs, so an additional $2M of equipment has to be purchased. The roaster plant currently has $2M of available tax shield left, excluding any tax shield related to the equipment to be purchased The direct materials and direct labour used to manufacture these products are 8% and 7% of sales, respectively. The actual roasting processing costs are approximately 17% of sales. These costs as a percentage of sales are expected to remain consistent over the time horizon. The plant also requires two managers with fixed salaries of $50,000 each per year. Insurance for the plant and equipment is $40,000 per year. karin FOCUS