Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nz gst law thank you. Dixon Ltd is non-GST registered and has come to you with an accounting problem. Dixon's invoices reveal that the company

nz gst law thank you.

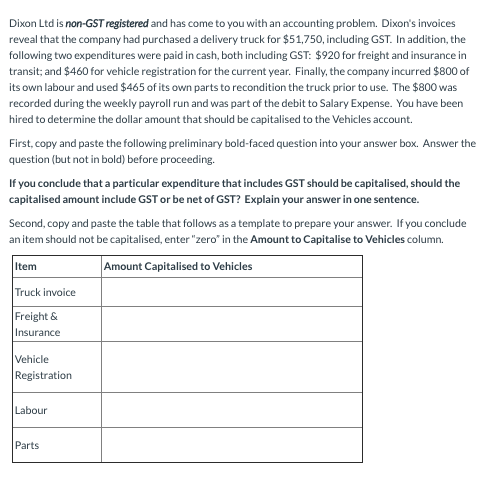

Dixon Ltd is non-GST registered and has come to you with an accounting problem. Dixon's invoices reveal that the company had purchased a delivery truck for $51,750, including GST. In addition, the following two expenditures were paid in cash, both including GST: $920 for freight and insurance in transit; and $460 for vehicle registration for the current year. Finally, the company incurred $800 of its own labour and used $465 of its own parts to recondition the truck prior to use. The $800 was recorded during the weekly payroll run and was part of the debit to Salary Expense. You have been hired to determine the dollar amount that should be capitalised to the Vehicles account. First, copy and paste the following preliminary bold-faced question into your answer box. Answer the question (but not in bold) before proceeding. If you conclude that a particular expenditure that includes GST should be capitalised, should the capitalised amount include GST or be net of GST? Explain your answer in one sentence. Second, copy and paste the table that follows as a template to prepare your answer. If you conclude an item should not be capitalised, enter "zero" in the Amount to Capitalise to Vehicles column. Item Amount Capitalised to Vehicles Truck invoice Freight & Insurance Vehicle Registration Labour Parts Dixon Ltd is non-GST registered and has come to you with an accounting problem. Dixon's invoices reveal that the company had purchased a delivery truck for $51,750, including GST. In addition, the following two expenditures were paid in cash, both including GST: $920 for freight and insurance in transit; and $460 for vehicle registration for the current year. Finally, the company incurred $800 of its own labour and used $465 of its own parts to recondition the truck prior to use. The $800 was recorded during the weekly payroll run and was part of the debit to Salary Expense. You have been hired to determine the dollar amount that should be capitalised to the Vehicles account. First, copy and paste the following preliminary bold-faced question into your answer box. Answer the question (but not in bold) before proceeding. If you conclude that a particular expenditure that includes GST should be capitalised, should the capitalised amount include GST or be net of GST? Explain your answer in one sentence. Second, copy and paste the table that follows as a template to prepare your answer. If you conclude an item should not be capitalised, enter "zero" in the Amount to Capitalise to Vehicles column. Item Amount Capitalised to Vehicles Truck invoice Freight & Insurance Vehicle Registration Labour PartsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started