Answered step by step

Verified Expert Solution

Question

1 Approved Answer

nzn We have separately explained the treatment of admission of partner and the retirement of a partner. Now, we are going to highlight the combined

nzn

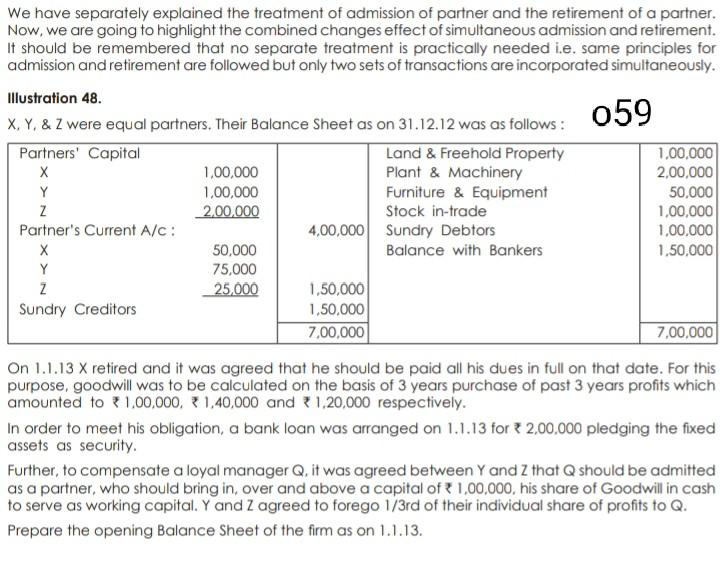

We have separately explained the treatment of admission of partner and the retirement of a partner. Now, we are going to highlight the combined changes effect of simultaneous admission and retirement. It should be remembered that no separate treatment is practically needed i.e. same principles for admission and retirement are followed but only two sets of transactions are incorporated simultaneously. Illustration 48. X, Y. & Z were equal partners. Their Balance Sheet as on 31.12.12 was as follows: 059 Partners' Capital Land & Freehold Property 1,00,000 X 1,00,000 Plant & Machinery 2,00,000 Y 1,00,000 Furniture & Equipment 50,000 Z 2,00.000 Stock in-trade 1,00,000 Partner's Current A/c: 4,00,000 Sundry Debtors 1,00,000 50,000 Balance with Bankers 1.50,000 Y 75,000 Z 25,000 1,50,000 Sundry Creditors 1,50,000 7,00,000 7,00.000 On 1.1.13 X retired and it was agreed that he should be paid all his dues in full on that date. For this purpose, goodwill was to be calculated on the basis of 3 years purchase of past 3 years profits which amounted to 1,00,000, 1,40,000 and 1,20,000 respectively. In order to meet his obligation, a bank loan was arranged on 1.1.13 for + 2,00,000 pledging the fixed assets as security, Further, to compensate a loyal manager Q. it was agreed between Y and Z that should be admitted as a partner, who should bring in, over and above a capital of 1,00,000, his share of Goodwill in cash to serve as working capital. Y and Z agreed to forego 1/3rd of their individual share of profits to Q. Prepare the opening Balance Sheet of the firm as on 1.1.13Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started