Answered step by step

Verified Expert Solution

Question

1 Approved Answer

O 1. What is characteristic of a general partnership? 2. Meaning of limited liability company 3. Santana Jones contributes equipment that had originally cost $125,000

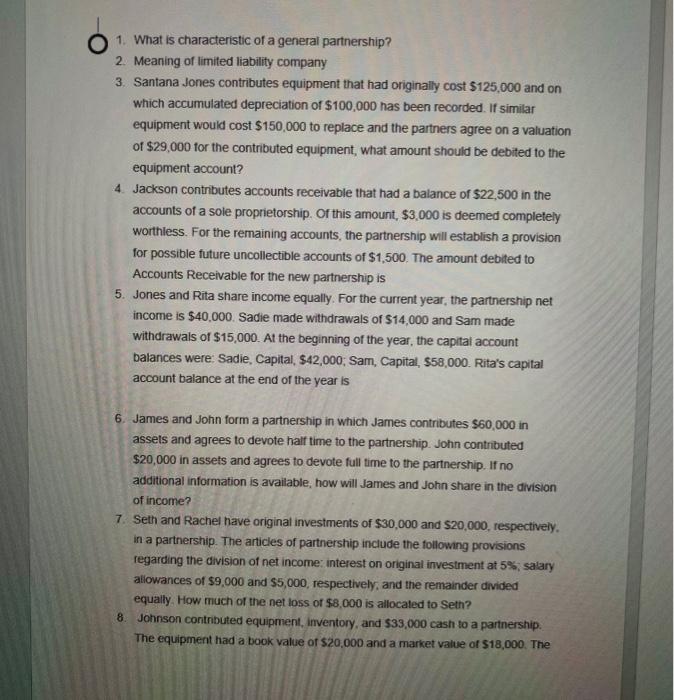

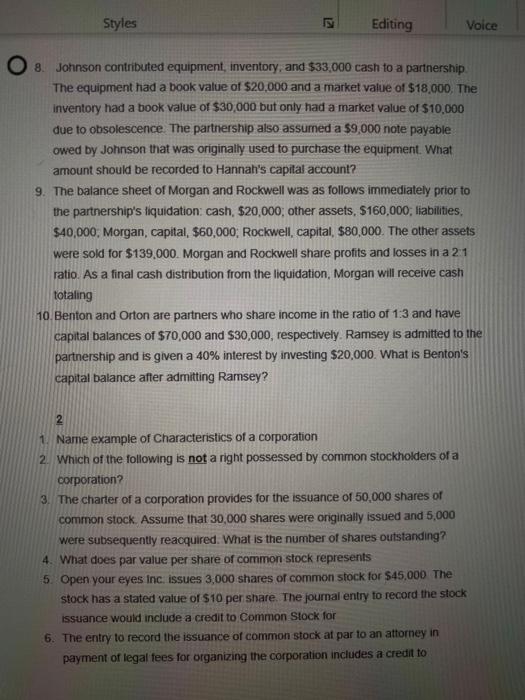

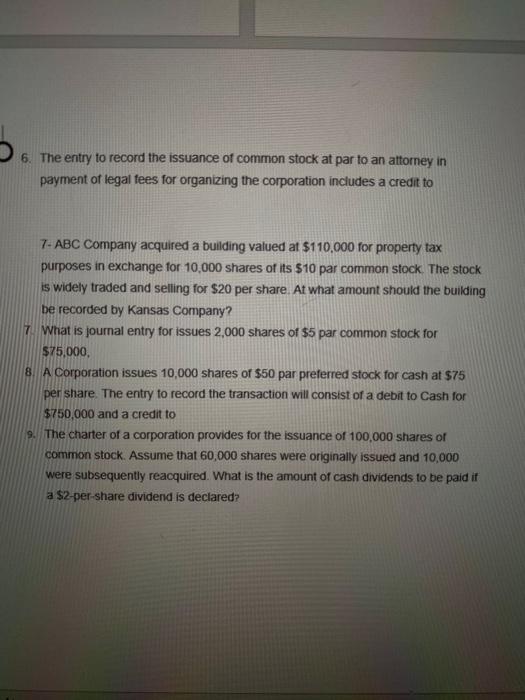

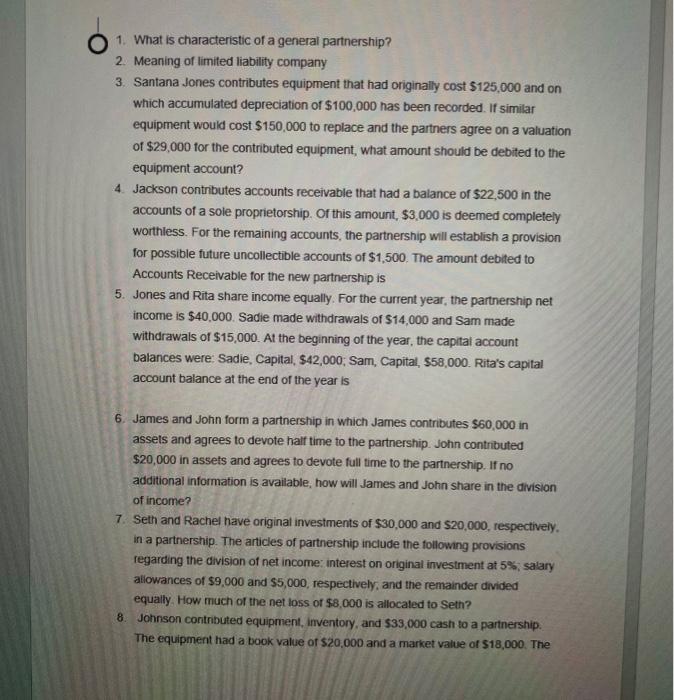

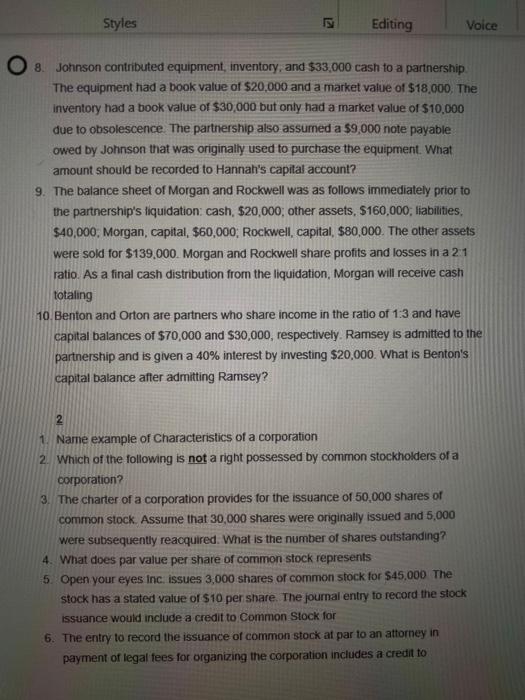

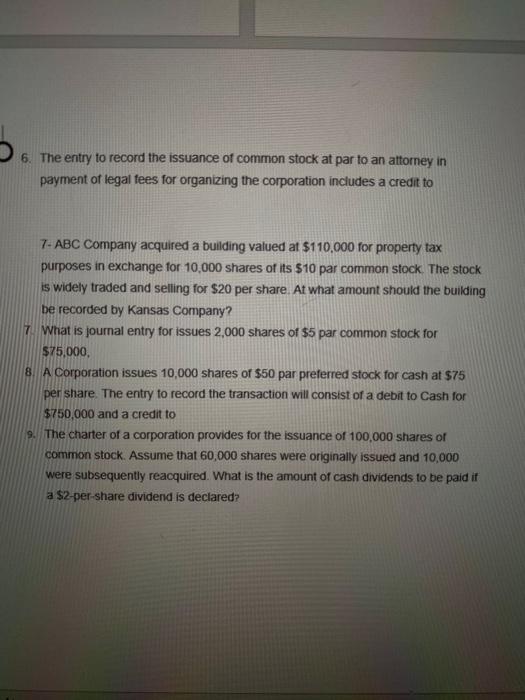

O 1. What is characteristic of a general partnership? 2. Meaning of limited liability company 3. Santana Jones contributes equipment that had originally cost $125,000 and on which accumulated depreciation of $100,000 has been recorded. If similar equipment would cost $150,000 to replace and the partners agree on a valuation of $29,000 for the contributed equipment, what amount should be debited to the equipment account? 4. Jackson contributes accounts receivable that had a balance of $22,500 in the accounts of a sole proprietorship of this amount, $3,000 is deemed completely worthless. For the remaining accounts, the partnership will establish a provision for possible future uncollectible accounts of $1,500. The amount debited to Accounts Receivable for the new partnership is 5. Jones and Rita share income equally. For the current year, the partnership net income is $40.000. Sadie made withdrawals of $14,000 and Sam made withdrawals of $15,000. At the beginning of the year, the capital account balances were: Sadie, Capital, $42,000: Sam, Capital, $58,000. Rita's capital account balance at the end of the year is 6. James and John form a partnership in which James contributes $60,000 in assets and agrees to devote half time to the partnership. John contributed $20,000 in assets and agrees to devote full time to the partnership. If no additional information is available, how will James and John share in the division of income? 7. Seth and Rachel have original investments of $30,000 and $20,000, respectively. in a partnership. The articles of partnership include the following provisions regarding the division of net income interest on original investment at 5%, salary allowances of $9,000 and $5,000, respectively, and the remainder divided equally. How much of the net loss of $8,000 is allocated to Seth? 8. Johnson contributed equipment, inventory, and $33,000 cash to a partnership The equipment had a book value of $20,000 and a market value of $18,000. The Styles a Editing Voice O & Johnson contributed equipment, inventory, and $33,000 cash to a partnership The equipment had a book value of $20,000 and a market value of $18,000. The Inventory had a book value of $30,000 but only had a market value of $10,000 due to obsolescence The partnership also assumed a $9,000 note payable owed by Johnson that was originally used to purchase the equipment. What amount should be recorded to Hannah's capital account? 9. The balance sheet of Morgan and Rockwell was as follows immediately prior to the partnership's liquidation: cash, $20,000; other assets, $160,000; liabilities, $40,000, Morgan, capital, $60,000: Rockwell, capital, $80,000. The other were sold for $139,000. Morgan and Rockwell share profits and losses in a 2.1 ratio. As a final cash distribution from the liquidation, Morgan will receive cash totaling 10. Benton and Orton are partners who share income in the ratio of 1:3 and have capital balances of $70,000 and $30,000, respectively. Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000. What is Benton's capital balance after admitting Ramsey? ets 2 1. Name example of Characteristics of a corporation 2. Which of the following is not a right possessed by common stockholders of a corporation? 3. The charter of a corporation provides for the issuance of 50,000 shares of common stock. Assume that 30,000 shares were orginally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding? 4. What does par value per share of common stock represents 5. Open your eyes Inc. issues 3,000 shares of common stock for $45,000 The stock has a stated value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for 6. The entry to record the issuance of common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to 6. The entry to record the issuance of common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to 7- ABC Company acquired a building valued at $110,000 for property tax purposes in exchange for 10,000 shares of its $10 par common stock. The stock is widely traded and selling for $20 per share. At what amount should the building be recorded by Kansas Company? 7. What is journal entry for issues 2,000 shares of $5 par common stock for $75,000 8. A Corporation issues 10,000 shares of $50 par preferred stock for cash at $75 per share. The entry to record the transaction will consist of a debit to Cash for $750,000 and a credit to 9. The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the amount of cash dividends to be paid it a $2-per-share dividend is declared

O 1. What is characteristic of a general partnership? 2. Meaning of limited liability company 3. Santana Jones contributes equipment that had originally cost $125,000 and on which accumulated depreciation of $100,000 has been recorded. If similar equipment would cost $150,000 to replace and the partners agree on a valuation of $29,000 for the contributed equipment, what amount should be debited to the equipment account? 4. Jackson contributes accounts receivable that had a balance of $22,500 in the accounts of a sole proprietorship of this amount, $3,000 is deemed completely worthless. For the remaining accounts, the partnership will establish a provision for possible future uncollectible accounts of $1,500. The amount debited to Accounts Receivable for the new partnership is 5. Jones and Rita share income equally. For the current year, the partnership net income is $40.000. Sadie made withdrawals of $14,000 and Sam made withdrawals of $15,000. At the beginning of the year, the capital account balances were: Sadie, Capital, $42,000: Sam, Capital, $58,000. Rita's capital account balance at the end of the year is 6. James and John form a partnership in which James contributes $60,000 in assets and agrees to devote half time to the partnership. John contributed $20,000 in assets and agrees to devote full time to the partnership. If no additional information is available, how will James and John share in the division of income? 7. Seth and Rachel have original investments of $30,000 and $20,000, respectively. in a partnership. The articles of partnership include the following provisions regarding the division of net income interest on original investment at 5%, salary allowances of $9,000 and $5,000, respectively, and the remainder divided equally. How much of the net loss of $8,000 is allocated to Seth? 8. Johnson contributed equipment, inventory, and $33,000 cash to a partnership The equipment had a book value of $20,000 and a market value of $18,000. The Styles a Editing Voice O & Johnson contributed equipment, inventory, and $33,000 cash to a partnership The equipment had a book value of $20,000 and a market value of $18,000. The Inventory had a book value of $30,000 but only had a market value of $10,000 due to obsolescence The partnership also assumed a $9,000 note payable owed by Johnson that was originally used to purchase the equipment. What amount should be recorded to Hannah's capital account? 9. The balance sheet of Morgan and Rockwell was as follows immediately prior to the partnership's liquidation: cash, $20,000; other assets, $160,000; liabilities, $40,000, Morgan, capital, $60,000: Rockwell, capital, $80,000. The other were sold for $139,000. Morgan and Rockwell share profits and losses in a 2.1 ratio. As a final cash distribution from the liquidation, Morgan will receive cash totaling 10. Benton and Orton are partners who share income in the ratio of 1:3 and have capital balances of $70,000 and $30,000, respectively. Ramsey is admitted to the partnership and is given a 40% interest by investing $20,000. What is Benton's capital balance after admitting Ramsey? ets 2 1. Name example of Characteristics of a corporation 2. Which of the following is not a right possessed by common stockholders of a corporation? 3. The charter of a corporation provides for the issuance of 50,000 shares of common stock. Assume that 30,000 shares were orginally issued and 5,000 were subsequently reacquired. What is the number of shares outstanding? 4. What does par value per share of common stock represents 5. Open your eyes Inc. issues 3,000 shares of common stock for $45,000 The stock has a stated value of $10 per share. The journal entry to record the stock issuance would include a credit to Common Stock for 6. The entry to record the issuance of common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to 6. The entry to record the issuance of common stock at par to an attorney in payment of legal fees for organizing the corporation includes a credit to 7- ABC Company acquired a building valued at $110,000 for property tax purposes in exchange for 10,000 shares of its $10 par common stock. The stock is widely traded and selling for $20 per share. At what amount should the building be recorded by Kansas Company? 7. What is journal entry for issues 2,000 shares of $5 par common stock for $75,000 8. A Corporation issues 10,000 shares of $50 par preferred stock for cash at $75 per share. The entry to record the transaction will consist of a debit to Cash for $750,000 and a credit to 9. The charter of a corporation provides for the issuance of 100,000 shares of common stock. Assume that 60,000 shares were originally issued and 10,000 were subsequently reacquired. What is the amount of cash dividends to be paid it a $2-per-share dividend is declared

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started