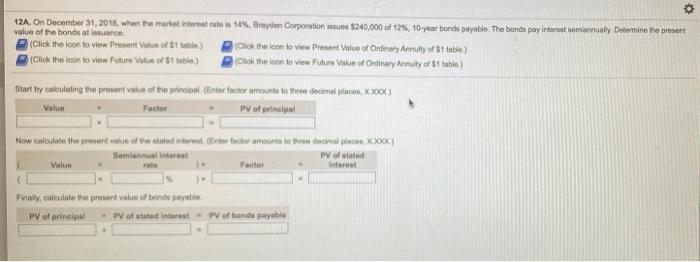

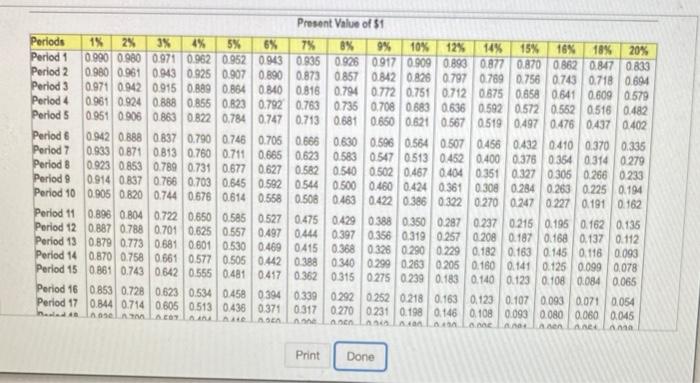

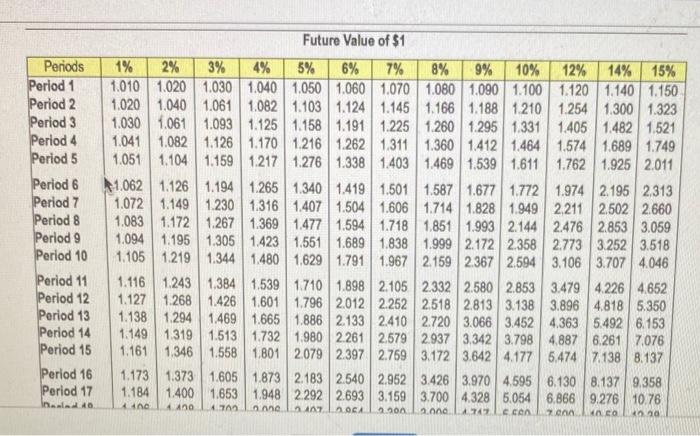

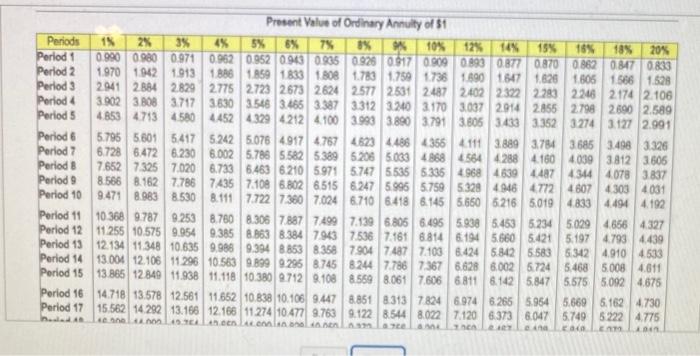

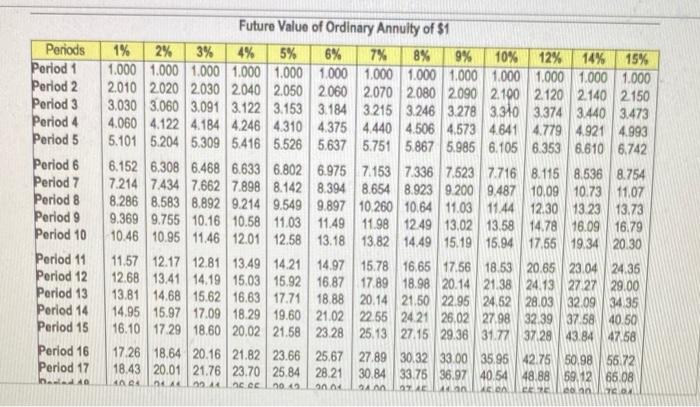

o 12A. On December 31, 2018, when the market intrat 14%. Brydon Corporation $240,000 of 2%, 10 year bonds payable. The bonds pay informarvaly Determine the present value of the bonds at isano (Click the loon to view Present of the Click the loan to view Present Value of Ordinary Arnulty of 5) (Click the icon to view Puture of tabi) Click the lot to view Pure Value of Ordinary Annuty of thin Start by cakeleting the present value of the principal, inter factor mounts to three decimal places, xxx) Value Factor py of principal Now calculate the procent value of the stated interest (nor factor amount to demons XXX) py of the Value Factor interest Finaly, calculate the present value of bonde payable PV of principal PV of stated interest - PV of brands payable Present Value of $1 Periods 15 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 16% 18% 20% Period 1 0.990 0.980 0,971 0.962 0.9520943 0.835 0.926 0917 0.909 0.893 0877 0.870 0.862 0.847 0.833 Period 2 0.980 0961 0.943 0925 0.9070 890 0.873 0857 0.842 0.8280797 0.769 0.756 0.743 0.7180.694 Period 3 0.971 0.942 0.915 0.889 0.8840 840 0.816 0.794 0772 0.751 0.712 0.875 0.658 0.641 0.609 0.579 Period 4 0961 0.924 0.888 0.855 0.823 0.792 0.763 0735 0.708 0.683 0.636 0.592 0.572 0.552 0.516 0.482 Period 5 0.951 0.906 08630 822 0.784 0.747 0.7130681 0.660 0.621 0567 0.519 0.497 0.476 0437 0402 Period 0.942 0.888 0.837 0.790 0.746 0.705 0.666 0.630 0.596 0.564 0.5070.456 0.432 0.410 0.370 0.335 Period 7 0.933 0.871 0813 0.750 0.7110.665 0.623 0.583 0.547 0.513 0.452 0.400 0.375 035403140279 Period 8 0.923 0853 0.789 0.731 0.677 0.627 0.5820.540 0.502 0.467 0.404 0351 0.327 0.305 0.266 0233 Period 0.914 0.837 0.766 0.7030.545 0.592 0544 0.500 0.460 0.424 0.361 0.308 0.284 0.263 0.225 0.194 Period 10 0.905 0.820 0.744 0.676 0.614 0.558 0.508 0.463 0.422 0.386 0322 0.270 0247 0 227 0191 0.162 Period 11 0.896 0.804 0722 0.650 0.585 0.527 0.475 0.429 0.388 0.350 0.297 0237 0215 0.195 0.162 0.135 Period 12 0.887 0.788 0.701 0.625 0.557 0.497 0.444 0.397 0.356 0.319 0257 0.208 0.1870.168 0.137 0.112 Period 13 0.879 0.773 0.681 0.601 0.530 0.4690415 0.368 0325 0.290 0229 0.182 0.163 0.145 0.116 0.093 Period 14 0.870 0.758 0 661 0.577 0.505 0.442 0.388 0340 0.299 0.263 0205 0.160 0.141 0.125 0.099 0.078 Period 15 0861 0.743 06420555 0.481 0.417 0.362 0.315 0275 0.239 0.183 0.140 0.123 0.108 0.084 0.065 Period 16 0.853 0.7280.623 0.534 0.458 0394 03390292 0252 0218 0.163 0.123 0.107 0.093 0.071 0.054 Period 17 0.844 0.714 0605 0513 0.438 0.371 0.317 0270 0 2310.198 0.146 0.108 0.093 0.080 0.060 0.045 heel Ali DER . ALABLE A LA aned AAA Print Done Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Future Value of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.010 1.020 1.030 1.040 1.050 1.060 1.070 1.080 1.090 1.100 1.120 1.140 1.150 1.020 1.040 1.061 1.082 1.103 1.1241.145 1.166 1.188 1.210 1.254 1.300 1.323 1.030 1.061 1.093 1.125 1.158 1.191 1.225 1.260 1.295 1.331 1.405 1.482 1,521 1.041 1.082 1.126 1.170 1.216 1.262 1.311 1.360 1.412 1.464 1.574 1.689 1.749 1.051 1.104 1.159 1.217 1.276 1.338 1403 1.469 1.539 1.611 1.762 1.925 2.011 1.062 1.126 1.194 1.265 1.340 1.419 1.501 1.587 1.677 1772 1.974 2.195 2,313 1.072 1.149 1.2301.316 1.407 1.504 1.606 1714 1.828 1.949 2.211 2.502 2.660 1.083 1.172 1.267 1.369 1,477 1.594 1.718 1.851 1.993 2.144 2.476 2.853 3.059 1.094 1.195 1.305 1423 1.551 1.689 1.838 1.999 2.172 2358 2.773 3.252 3.518 1.105 1.219 1.344 1.480 1.629 1.791 1.967 2.159 2.367 2.594 3.106 3.707 4.046 1.116 1.243 1.384 1.539 1710 1.898 2.105 2332 2.580 2.853 3.479 4.226 4652 1.127 1.268 1.426 1.601 1796 2012 2.252 2518 2.813 3.138 3.896 4818 5.350 1.138 1.294 1.469 1.665 1.886 2.133 2410 2720 3.066 3.452 4.363 5.492 6.153 1.149 1.319 1.513 1.732 1.980 2261 2.579 2.937 3.342 3.798 4.8876.261 7.076 1.1611.346 1.558 1,801 2079 2.397 2.769 3.1723.642 4.177 5.4747.138 8.137 1.173 1.373 1.605 1.873 2.183 2.540 2.952 3.426 3.970 4.595 6.130 8.137 9.358 1.184 1.400 1.653 1.948 2292 2.693 3.159 3.700 4.328 5.0546,866 9.276 10.76 2.000 COA Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 44 4.70 AT OCA 2000 4.747 20 COCO 090 8% Present Value of Ordinary Annuity of 1 Periods 15 2% 3% 4% 5% 7% 0% 10% 12% 14 15% 15% 18% 20% Period 1 0.990 0.980 0.971 0.962 0.952 0943 0.035 0.926 0917 0909 0893 0.877 0.870 0.862 087 0.833 Period 2 1970 1942 1913 1886 1859 1833 1808 1.780 1.759 1736 1690 1647 1.620 1805 1 566 1528 Period 3 2941 2884 2829 2775 2723 2673 2624 2577 2531 2487 2.402 2322 2283 2246 2174 2106 Period 4 3.902 3.808 3.717 3.630 3.546 3.465 3.387 3.312 324031703037 29142855 2799 2690 2.589 Period 5 4.853 4 713 4580 4.452 43294212 4.100 3.9933.890 37913.805 3.433 3352 3274 3127 2.991 Period 6 5.795 5.601 5417 5.2425.076 49174767 46234486435641113.889 3784 3.685 3.498 3.326 Period 7 6.728 6.4726.230 6.002 5.786 5582 5389 5206 503349685844288 218040393812 3 606 Period 8 7.6527325 7.020 6.733 5.463 6.210 5.97157475535 5.335 4.968 4639 4487 4344 4.078 3837 Period 9 8.566 8. 162 7.7867435 7.108 6.802 6.51562475.995 5759 53294946 4772 4807 4303 4031 Period 10 9.4718.983 8.530 8.111 7.722 7.380 7.024 6.710 6.418 8.145 5.6505216 5.019 4833 4.494 4. 192 Period 11 10.368 9.787 9253 8.780 8.305 78877499 7.139 6806 6.495 5.938 5.453 5234 5.029 46564327 Period 12 11 255 10.57 9.954 9.385 89638.384 7943 7536 71618814 6.194 5.660 5.421 5.197 4.793 4.439 Period 13 12.134 11.348 10.635 9.988 9.3948853 8.358 7.904 7487 7.1038.424 5.342 5.583 5.342 4.910 4533 Period 14 13.004 12.106 11 296 10.583 9.8999295 8.745 82447.786 7367 6.628 8.002 5.724 5.468 5.008 4.611 Period 15 13.865 12.849 11.938 11.118 10.3809712 108 8.559 8.061 7.606 6811 6.142 5.847 5.575 5.092 4.675 Period 16 14.718 13.578 12.561 11.652 10.838 10.106 9.447 8.851 8.3137824 6.9746265 5954 5.669 6.162 4.730 Period 17 15.582 14 292 13.166 12.168 11.274 10.4771 9.763 9.122 8.544 8.0227.1206.373 6.047 5749 5222 4775 The best ante Then ada ET ha Periods Period 1 Period 2 Period 3 Period 4 Period 5 Period 6 Period 7 Period 8 Period 9 Period 10 Period 11 Period 12 Period 13 Period 14 Period 15 Period 16 Period 17 Future Value of Ordinary Annuity of $1 1% 2% 3% 4% 5% 6% 7% 8% 9% 10% 12% 14% 15% 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 1.000 2.010 2020 2030 2040 2050 2060 2.070 2080 2090 2.100 2.120 2.140 2 150 3.030 3.060 3.091 3.122 3.153 3.1843.215 3.246 3.278 3.310 3.374 3.440 3.473 4.060 4.122 4.184 4.246 4.310 4.375 4.440 4.506 4.573 4.641 4779 4.921 4.993 5.101 5.204 5.309 5.416 5.526 5,637 5.751 5.867 5.986 6.105 6.353 6.610 6.742 6.152 6.308 6.468 6.633 6.802 6.975 7.153 7.336 7.523 7.716 8.115 8.536 8.754 7.214 7434 7662 7.898 8.142 8.394 8.654 8.923 9.200 9.487 10.09 10.73 11.07 8.286 8.583 8.892 9.214 9.549 9.897 10.260 10.64 11.03 11.44 12.30 13.23 13.73 9.369 9.755 10.16 10.58 11.03 11.49 11.98 1249 13.02 13.58 14.78 16.09 16.79 10.46 10.95 11.46 12.01 12.58 13.18 13.82 1449 15.1915.94 17.56 19.34 20.30 11.57 12.17 12.81 13.49 14.21 14.97 15.78 16,65 1756 18.53 20.65 23.04 24.36 12.68 1341 14.19 15.03 15.92 16.87 17.89 18.98 20.14 21.38 24.13 2727 29.00 13.81 14.68 15.62 1663 17.7118.88 20.14 21.50 22.95 24.52 28.03 32.09 34 35 14,95 15.97 17.09 18.29 19.60 21.02 22.55 2421 26.02 27.98 32 3937.58 40.50 16.10 17.29 18.60 20.02 21.58 23.28 25.13 27.15 29.36 31.77 3728 43.84 4758 17.26 18.64 20.16 21.82 23.66 25.67 27.89 30.32 33.00 35.96 42.75 50.98 5572 18.43 20.01 21.76 23.70 25.84 28.21 30.84 33.75 36.97 40,54 48.88 59,12 65.08 0.0 ALDATE 17X Inas 004 44 21 BA YE