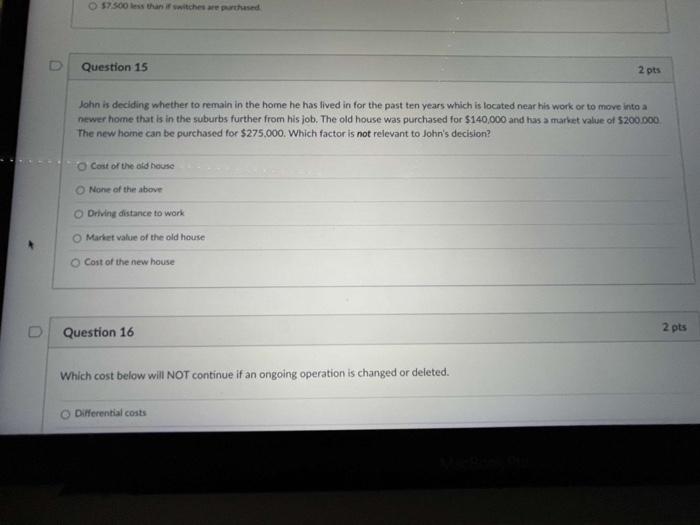

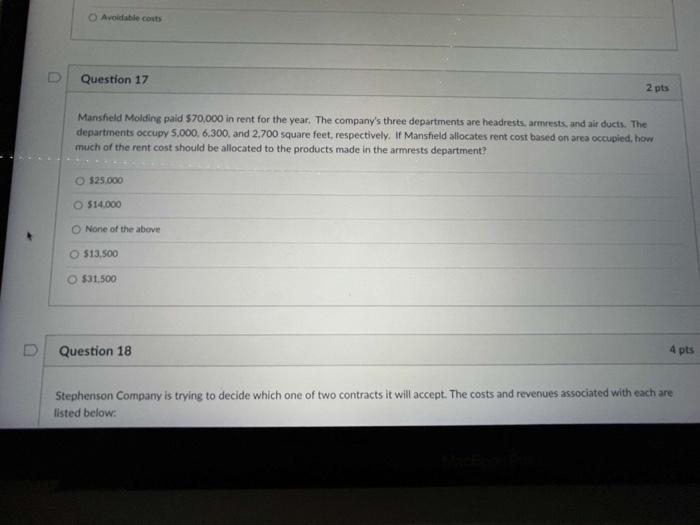

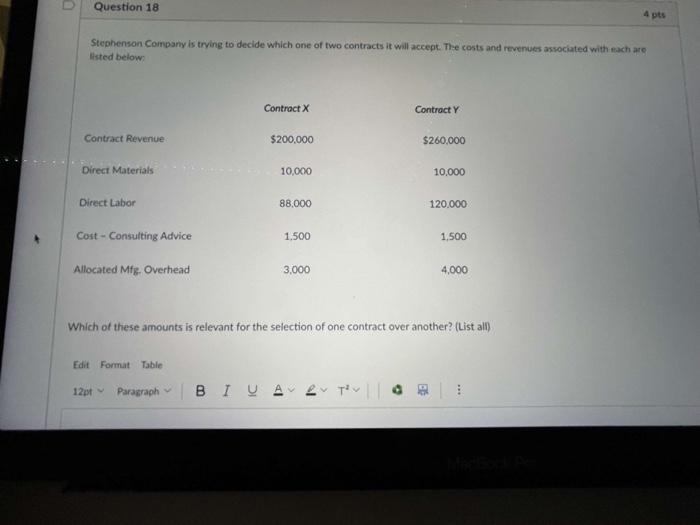

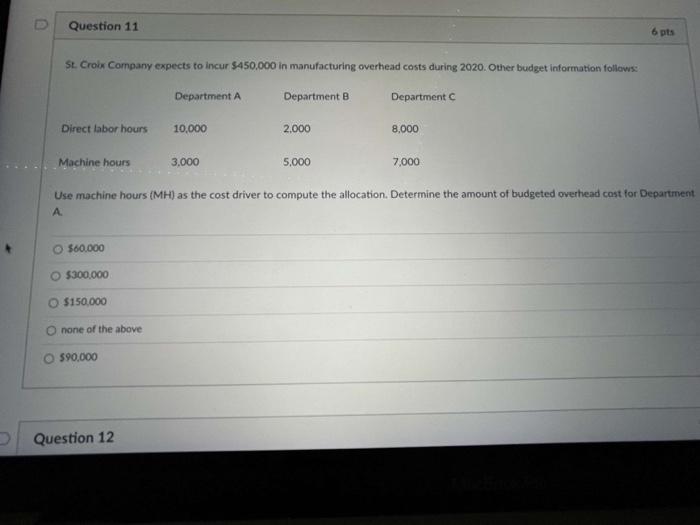

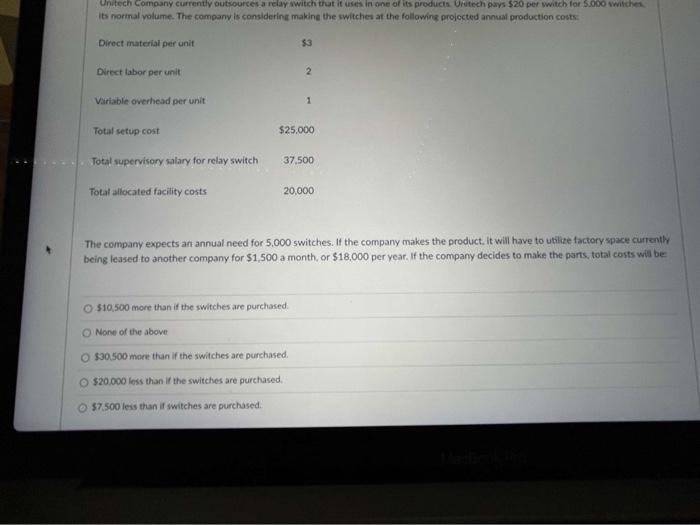

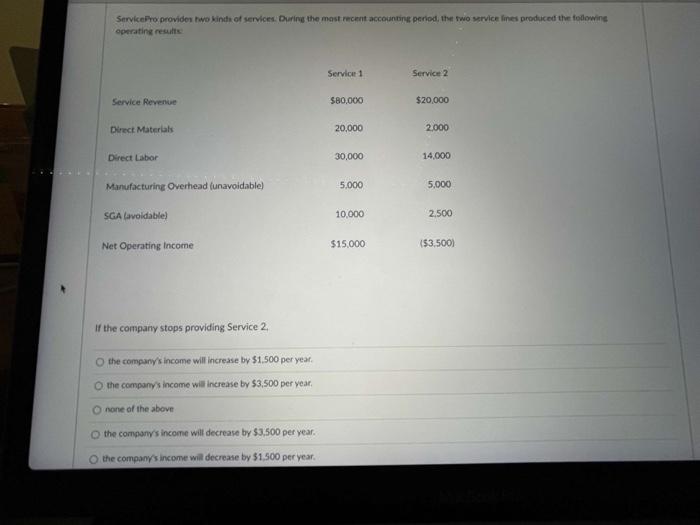

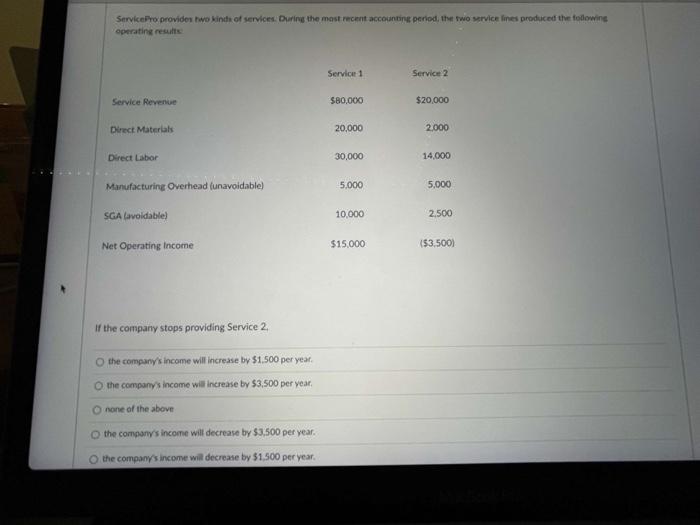

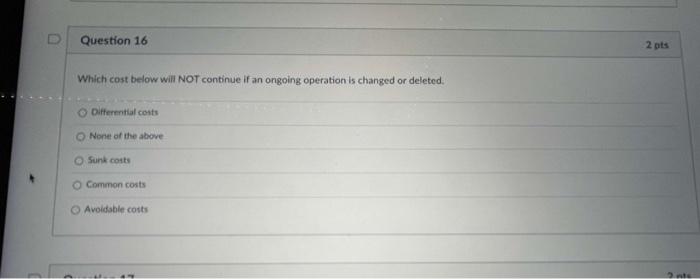

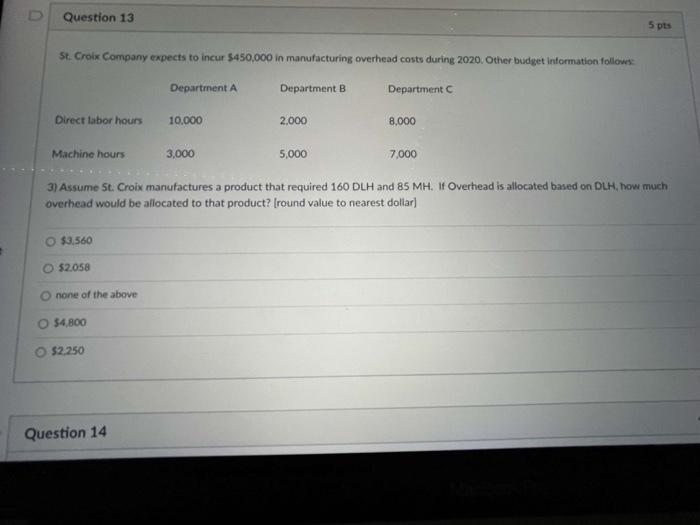

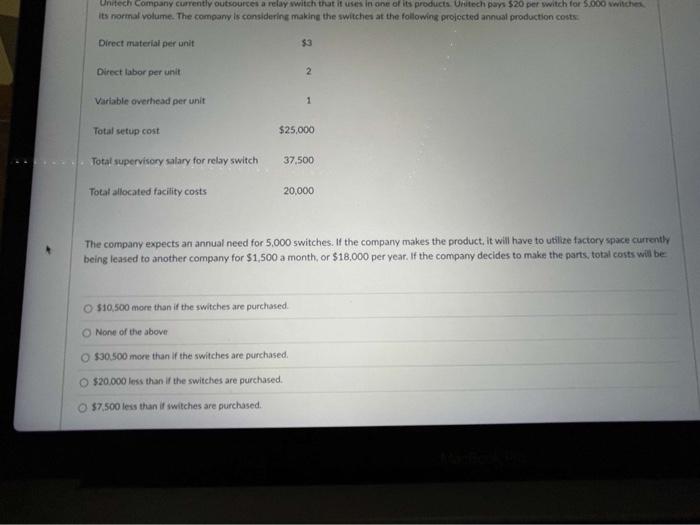

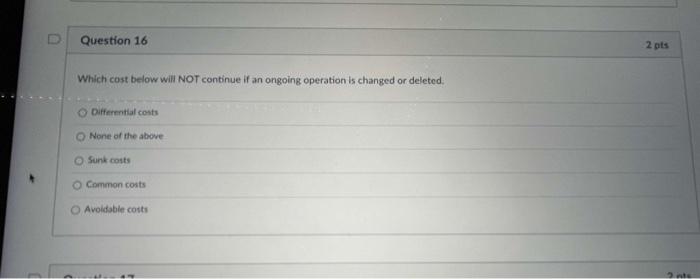

O $7.500 less than switches are purchased Question 15 2 pts John is deciding whether to remain in the home he has lived in for the past ten years which is located near his work or to move into a newer home that is in the suburbs further from his job. The old house was purchased for $140,000 and has a market value of $200.000 The new home can be purchased for $275.000. Which factor is not relevant to John's decision? Cost of the old house None of the above Driving distance to work Market value of the old house Cost of the new house D Question 16 2 pts Which cost below will NOT continue if an ongoing operation is changed or deleted. Differential costs Avoidable con Question 17 2 pts Manshield Molding paid $70,000 in rent for the year. The company's three departments are headrests, armrests, and air ducts. The departments occupy 5.000. 6.300, and 2.700 square feet, respectively. If Mansfield allocates rent cost based on area occupied, how much of the rent cost should be allocated to the products made in the armrests department? 525.000 514.000 None of the above O $13.500 $31.500 Question 18 4 pts Stephenson Company is trying to decide which one of two contracts it will accept. The costs and revenues associated with each are listed below: Question 18 4 pts Stephenson Company is trying to decide which one of two contracts it will accept. The costs and revenues associated with each are isted below Contract x Contract Contract Revenue $200,000 $260,000 Direct Materials 10,000 10.000 Direct Labor 88.000 120.000 Cost - Consulting Advice 1.500 1.500 Allocated Mfg. Overhead 3,000 4,000 Which of these amounts is relevant for the selection of one contract over another? (List all Edit Format Table 12pt Paragraph BI A 2 Tv . 40 Question 11 6 pts St Croix Company expects to incur $450,000 in manufacturing overhead costs during 2020. Other budget information follows: Department A Department B Department Direct labor hours 10,000 2.000 8.000 Machine hours 3,000 5,000 7,000 Use machine hours (MH) as the cost driver to compute the allocation. Determine the amount of budgeted overhead cost for Department A O $60.000 O $300,000 O $150.000 none of the above 590,000 Question 12 Unitech company currently outsources a relay switch that it uses in one of its products. Urtech pays $20 per wwitch for 5.000 switches its normal volume. The company is considerine making the switches at the following projected annual production costs Direct material per unit $3 2 Direct labor per unit Variable overhead per unit 1 Total setup cost $25.000 37,500 Total supervisory salary for relay switch Totat allocated facility costs 20,000 The company expects an annual need for 5.000 switches. If the company makes the product. It will have to utilize factory space currently being leased to another company for $1,500 a month, or $18,000 per year. If the company decides to make the parts, total costs will be $10.500 more than if the switches are purchased None of the above O $30.500 more than if the switches are purchased $20.000 less than if the switches are purchased $7.500 less than it witches are purchased. Service to provides two kinds of services. During the most recent accounting period, the two service lines produiced the todowing operating results Service 1 Service 2 Service Revenue $80,000 $20,000 Direct Materials 20.000 2000 Direct Labor 30,000 14,000 Manufacturing Overhead (unavoidable) 5.000 5.000 SGA Lavoidable 10,000 2.500 Net Operating Income $15.000 ($3.500) If the company stops providing Service 2. the company's income will increase by $1.500 per year, the company income will increase by $3,500 per year, none of the above the company's income will decrease by $3,500 per year. the company's income will decrease by $1.500 per year. Service to provides two kinds of services. During the most recent accounting period, the two service lines produiced the todowing operating results Service 1 Service 2 Service Revenue $80,000 $20,000 Direct Materials 20.000 2000 Direct Labor 30,000 14,000 Manufacturing Overhead (unavoidable) 5.000 5.000 SGA Lavoidable 10,000 2.500 Net Operating Income $15.000 ($3.500) If the company stops providing Service 2. the company's income will increase by $1.500 per year, the company income will increase by $3,500 per year, none of the above the company's income will decrease by $3,500 per year. the company's income will decrease by $1.500 per year. Question 16 2 pts Which cost below will NOT continue if an ongoing operation is changed or deleted. Differential costs None of the above Sunk costs Common costs Avoidable costs D Question 10 6 pts Based on your analyses above, what specific recommendations do you have for Pearl Hartley to improve the efficiency of Basalt's operations? Edit Format Table 12pt Paragraph BIU A 2T a 3 O words P Question 13 5 pts St. Croix Company expects to incur $450,000 in manufacturing overhead costs during 2020. Other budget information follow Department A Department B Department Direct labor hours 10.000 2.000 8,000 Machine hours 3,000 5,000 7,000 3) Assume St. Croix manufactures a product that required 160 DLH and 85 MH. 1 Overhead is allocated based on DLH how much overhead would be allocated to that product? (round value to nearest dollar) $3.560 52058 none of the above O 34.800 $2.250 Question 14 Unitech company currently outsources a relay switch that it uses in one of its products. Unitech pays $20 per wwitch for 5.000 wwitches its normal volume. The company is considerine making the switches at the following projected annual production costs Direct material per unit $3 2 Direct labor per unit Variable overhead per unit 1 Total setup cost $25,000 37,500 Total supervisory salary for relay switch Total allocated facility costs 20,000 The company expects an annual need for 5,000 switches. If the company makes the product, it will have to utilize factory space currently being leased to another company for $1.500 a month, or $18,000 per year. If the company decides to make the parts, total costs will be $10.500 more than if the switches are purchased None of the above $30.500 more than the switches are purchased, $20.000 less than if the switches are purchased. $7.500 less than it switches are purchased. Question 16 2 pts Which cost below will NOT continue if an ongoing operation is changed or deleted. Differential costs None of the above Sunk costs Common costs Avoidable costs