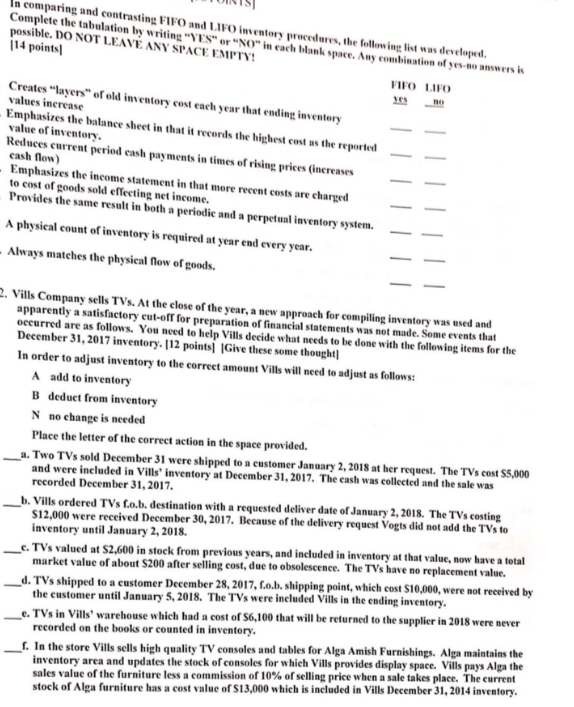

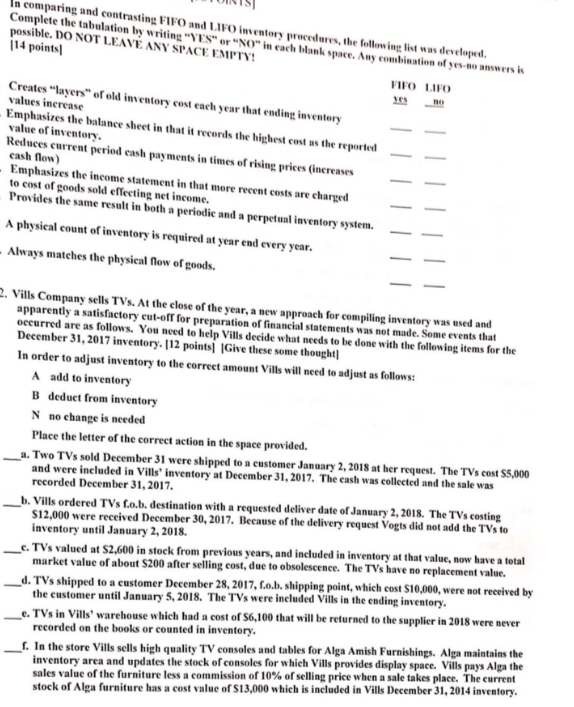

O and LIFO inventory procedures, the following list was developed Complete the tabulation by witng"YESr"NO"in cach ankspace. Any combination of yes-no answers is possible. DO NOT LEAVE ANY SPACE EMPTY 114 points FIFO LIFO Creates "layers" of old inventory cost each year that ending inventery values inerease Emphasizes the balance sheet in that it records the highest cost as the reported value of invento Reduces current period cash payments in times of rising prices (increases_ cash flow Emphasizes the income statement in that more recent costs are charged to cost of goods sold effeeting net income. Provides the same result in both a periodic and a perpetual inventory system. ry A physical count of inventory is required at year end every year. Always matches the physical flow of goods. Vills Company sells TVs.At the elose of the year, a new approach for compiling inventory was apparently a satisfactory cut-off for preparation of financial statements was not oecurred are as follows. You need to help Vills decide what needs to be done with the following items for the December 31,2017 inventory. 112 points] |Give these some thought) not made. Some events that In order to adjust inventory to the correet amount Vills will need to adjust as follows A add to inventory B deduct from inventory N no change is needed Place the letter of the correct action in the space provided. a. Two TVs sold December 31 were shipped to a customer January 2,2018 at her request. The TVs cost $5,000 and were ineluded in Vills' inventory at December 31,2017. The cash was collected and the sale was recorded December 31, 2017 b. Vills ordered TVs fo.b. destination with a requested deliver date of January 2,2018. The TVs costing S12,000 were received December 30, 2017. Because of the delivery request Vogts did not add the TVs to inventory until January 2, 2018. years, and included in inventory at that value, now have a total . TVs valued at S2.600 in stock from previous s have no replacement value. market value of about $200 after selling cost, due to obsolescence. The TV d. TVs shipped to a customer December 28, 2017, fo. shipping point, which cost $10,00, were not received by e. TVs in Vills warehouse which had a cost of S6,100 that will be returned to the supplier in 2018 were never f.In the store Vills sells high quality TV consoles and tables for Alga Amish Furnishings. Alga maintains the the customer until January 5,2018. The TVs were included Vills in the ending inventory. recorded on the books or counted in inventory inventory area and updates the stock of consoles for which Vills provides display space. Vills pays Alga th sales value of the furniture less a commission of 10% of selling price when a sale takes place. The current stock of Alga furniture has a cost value of S13,000 which is included in Vills December 31,2014 inventory