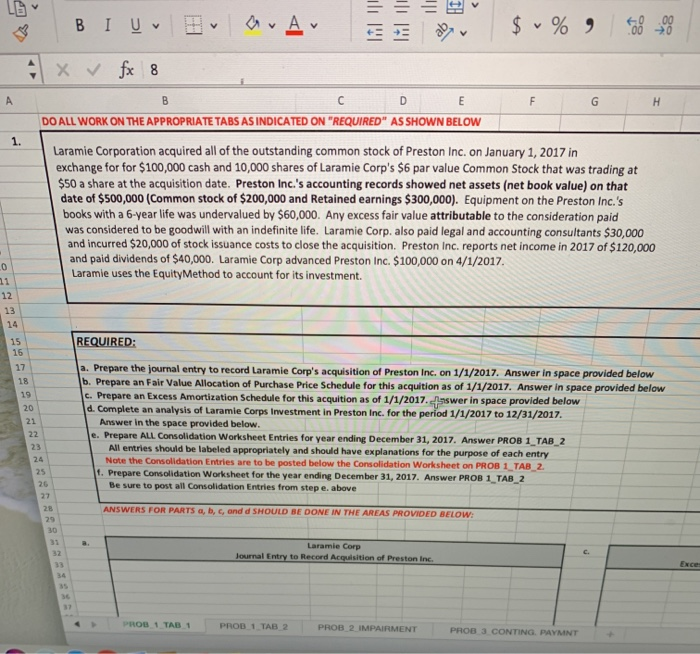

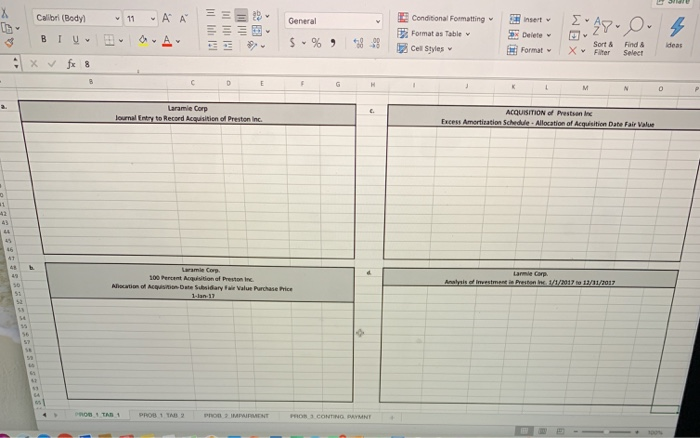

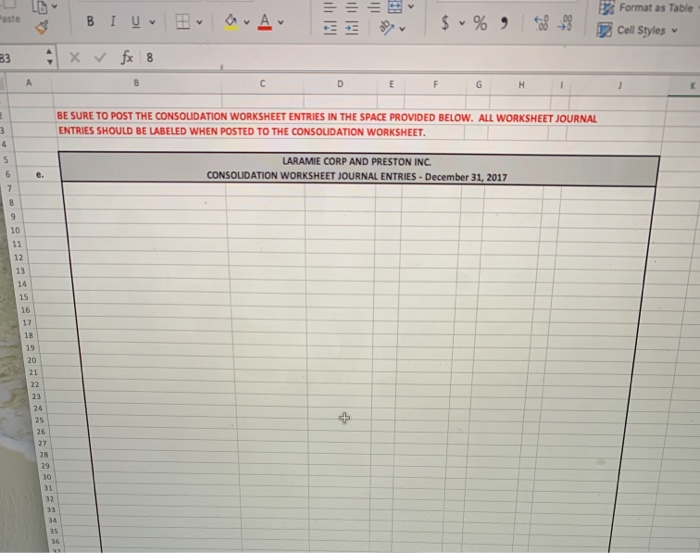

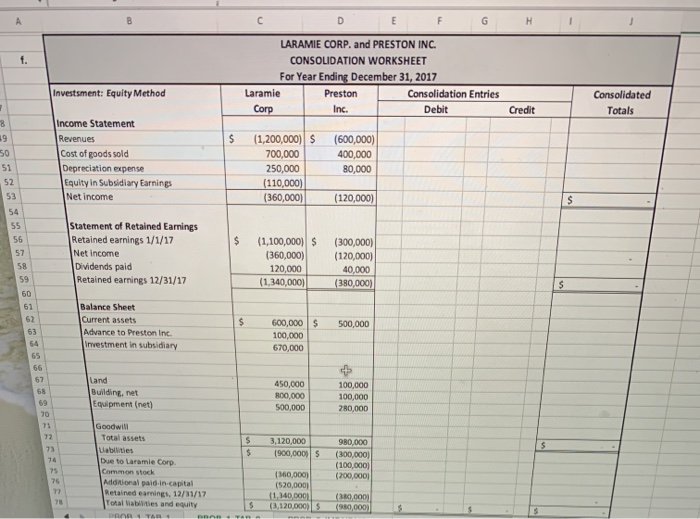

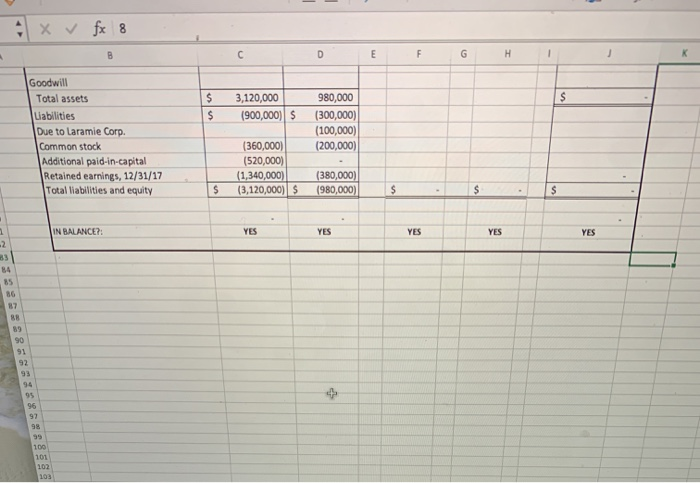

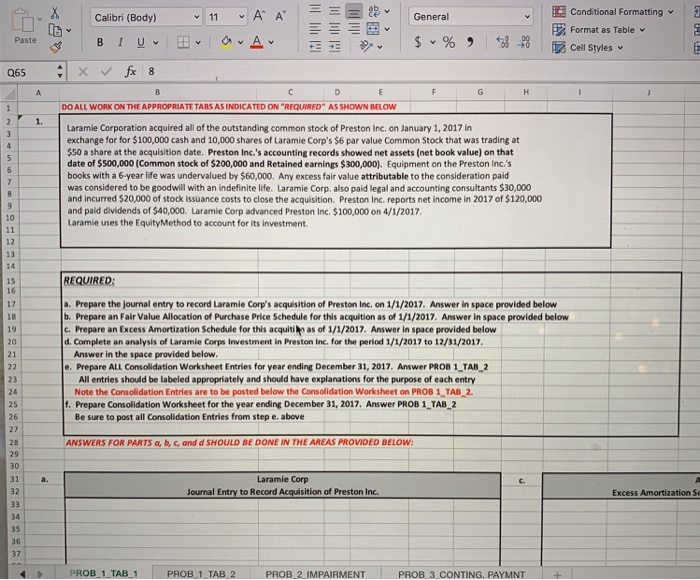

O BI U OA by $ % 9 8 1 x V fx 8 G H DE DO ALL WORK ON THE APPROPRIATE TABS AS INDICATED ON "REQUIRED" AS SHOWN BELOW Laramie Corporation acquired all of the outstanding common stock of Preston Inc. on January 1, 2017 in exchange for for $100,000 cash and 10,000 shares of Laramie Corp's $6 par value Common Stock that was trading at $50 a share at the acquisition date. Preston Inc.'s accounting records showed net assets (net book value) on that date of $500,000 (Common stock of $200,000 and Retained earnings $300,000). Equipment on the Preston Inc.'s books with a 6-year life was undervalued by $60,000. Any excess fair value attributable to the consideration paid was considered to be goodwill with an indefinite life. Laramie Corp. also paid legal and accounting consultants $30,000 and incurred $20,000 of stock issuance costs to close the acquisition. Preston Inc. reports net income in 2017 of $120,000 and paid dividends of $40,000. Laramie Corp advanced Preston Inc. $100,000 on 4/1/2017 Laramie uses the Equity Method to account for its investment. REQUIRED: a. Prepare the journal entry to record Laramie Corp's acquisition of Preston Inc. on 1/1/2017. Answer in space provided below b. Prepare an Fair Value Allocation of Purchase Price Schedule for this acquition as of 1/1/2017. Answer in space provided below c. Prepare an Excess Amortization Schedule for this acquition as of 1/1/2017.swer in space provided below d. Complete an analysis of Laramie Corps Investment in Preston Inc. for the period 1/1/2017 to 12/31/2017 Answer in the space provided below. e. Prepare ALL Consolidation Worksheet Entries for year ending December 31, 2017. Answer PROB 1 TAB 2 All entries should be labeled appropriately and should have explanations for the purpose of each entry Note the Consolidation Entries are to be posted below the Consolidation Worksheet on PROB 1 TAB 2. Prepare Consolidation Worksheet for the year ending December 31, 2017. Answer PROB 1_TAB_2 Be sure to post all consolidation Entries from stepe. above ANSWERS FOR PARTS a, b, c, and d SHOULD BE DONE IN THE AREAS PROVIDED BELOW: Laramie Corp Journal Entry to Record Acquisition of Preston Inc. PROB 1 TAB 1 PROB 1 TAB 2 PROS 2 IMPAIRMENT PROS 3 CONTING, PAYMNT 11 A I. 47. Calibri (Body BIU A A MI General $-% Conditional Formatting Formatas Table Cell Styles *38-98 Format Sort A Filter das X Find Select ACQUISITION of Preston in Journey Laramie Corp to Record Acquisition of Pres 100 Percent Acquisition of Prestine Alocation of Ac u te Subsidiary Value Purchase Price Format as Table 1991 5 $ -% -9 raste 8 BI - Bravar 33 x fx 8 BE SURE TO POST THE CONSOLIDATION WORKSHEET ENTRIES IN THE SPACE PROVIDED BELOW. ALL WORKSHEET JOURNAL ENTRIES SHOULD BE LABELED WHEN POSTED TO THE CONSOLIDATION WORKSHEET. LARAMIE CORP AND PRESTON INC. CONSOLIDATION WORKSHEET JOURNAL ENTRIES - December 31, 2017 LARAMIE CORP. and PRESTON INC. CONSOLIDATION WORKSHEET For Year Ending December 31, 2017 Laramie Preston Consolidation Entries Corp Inc. Debit Investment: Equity Method Consolidated Totals Credit $ Income Statement Revenues Cost of goods sold Depreciation expense Equity in Subsidiary Earnings Net income (1,200,000) $ 700,000 250,000 (110,000) (360,000) (600,000) 400,000 80,000 (120,000) Statement of Retained Earnings Retained earnings 1/1/17 Net income Dividends paid Retained earnings 12/31/17 (1,100,000) $ (360,000) 120,000 (1,340,000) (300,000) (120,000) 40,000 (380,000) Balance Sheet Current assets Advance to Preston Inc. Investment in subsidiary $ 500,000 600,000 100,000 670,000 Land Building, net Equipment (net) 450,000 800,000 500,000 100,000 100,000 280,000 3.120,000 1900,000) Goodwill Total assets abilities Due to Laramie Corp Common stock Additional paid in capital Retained earnings, 12/31/17 Total abilities and equity 980,000 (300,000) (100,000) (200,000 (360,000 (520,000 (1,140,000 (3,120,000 $ $ (0,000) 90,000 1 4x v fx 8 DE G H 3,120,000 (900,000) S Goodwill Total assets Liabilities Due to Laramie Corp. Common stock Additional paid-in-capital Retained earnings, 12/31/17 Total liabilities and equity 980,000 (300,000) (100,000) (200,000) (360,000) (520,000) (1,340,000) (3,120,000) S (380,000) (980,000) $ $ . IN BALANCE?: YES YES 100 101 102 103 11 A General Calibri (Body) BI U V x 8 A A Conditional Formatting Format as Table Cell Styles B $ % Paste 965 88 x DO ALL WORK ON THE APPROPRIATE TABS AS INDICATED ON "REQUIRED" AS SHOWN BELOW Laramie Corporation acquired all of the outstanding common stock of Preston Inc. on January 1, 2017 in exchange for for $100,000 cash and 10,000 shares of Laramie Corp's $6 par value Common Stock that was trading at $50 a share at the acquisition date. Preston Inc.'s accounting records showed net assets (net book value) on that date of $500,000 (Common stock of $200,000 and Retained earnings $300,000). Equipment on the Preston Inc.'s books with a 6-year life was undervalued by $60,000. Any excess fair value attributable to the consideration paid was considered to be goodwill with an indefinite life. Laramie Corp. also paid legal and accounting consultants $30,000 and incurred $20,000 of stock issuance costs to close the acquisition. Preston Inc. reports net income in 2017 of $120,000 and paid dividends of $40,000. Laramie Corp advanced Preston Inc. $100,000 on 4/1/2017 Laramie uses the EquityMethod to account for its investment REQUIRED: a. Prepare the journal entry to record Laramie Corp's acquisition of Preston Inc. on 1/1/2017. Answer in space provided below b. Prepare an Fair Value Allocation of Purchase Price Schedule for this acquition as of 1/1/2017. Answer in space provided below c. Prepare an Excess Amortization Schedule for this acquitias of 1/1/2017. Answer in space provided below d. Complete an analysis of Laramie Corps Investment in Preston Inc. for the period 1/1/2017 to 12/31/2017. Answer in the space provided below. e. Prepare ALL Consolidation Worksheet Entries for year ending December 31, 2017. Answer PROB 1_TAB_2 All entries should be labeled appropriately and should have explanations for the purpose of each entry Note the Consolidation Entries are to be posted below the Consolidation Worksheet on PROB 1_TAB_2. f. Prepare Consolidation Worksheet for the year ending December 31, 2017. Answer PROB 1_TAB_2 Be sure to post all consolidation Entries from step e. above ANSWERS FOR PARTS a, b, c, and d SHOULD BE DONE IN THE AREAS PROVIDED BELOW: Laramie Corp Journal Entry to Record Acquisition of Preston Inc. Excess Amortization S PROB 1 TAB 1 PROB 1 TAB 2 PROB 2 IMPAIRMENT PROB 3 CONTING. PAYMNT