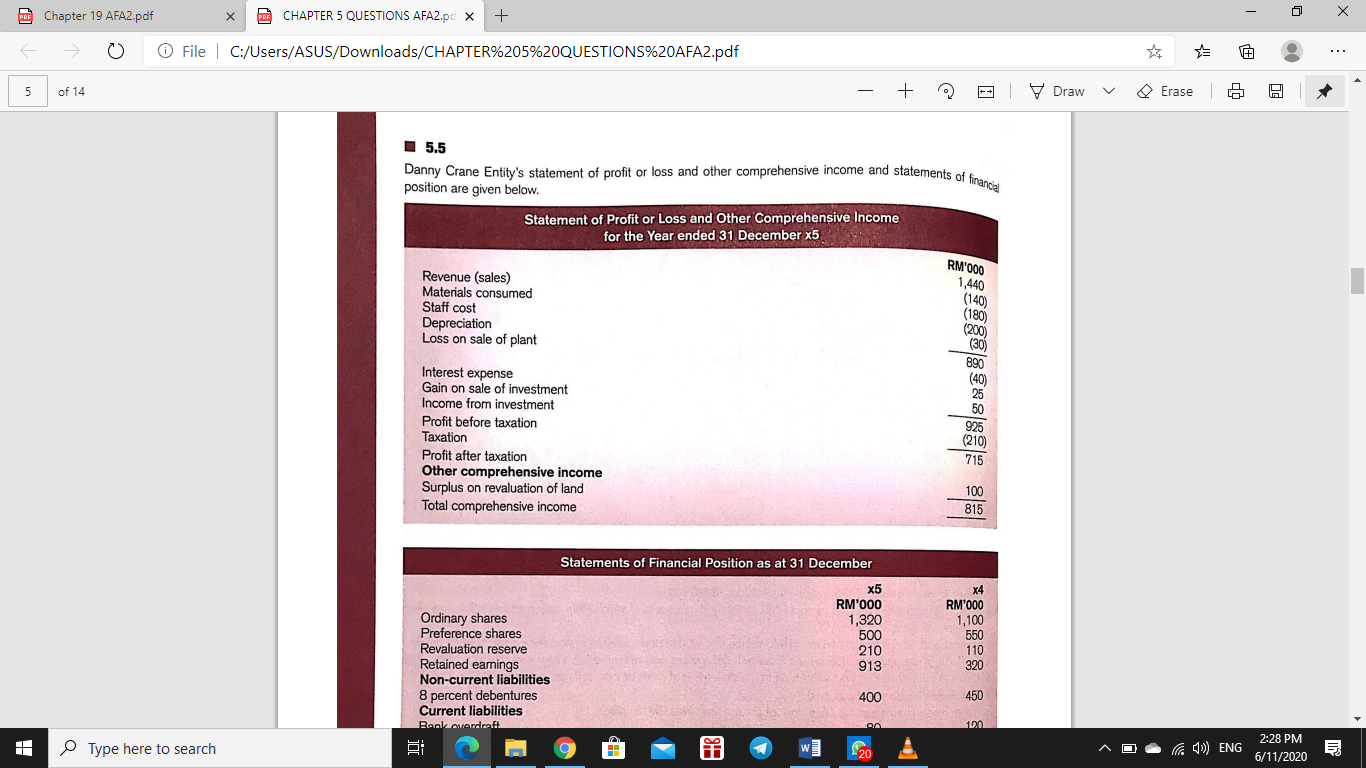

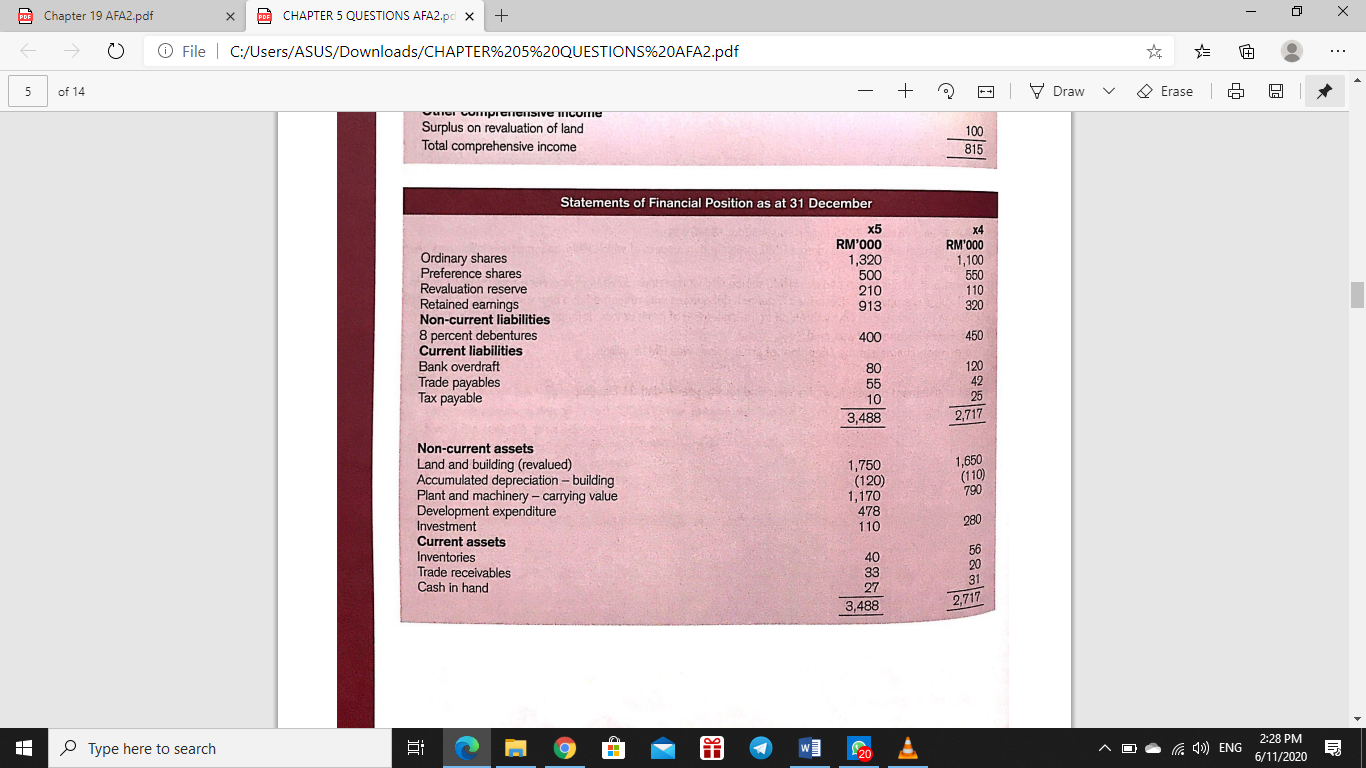

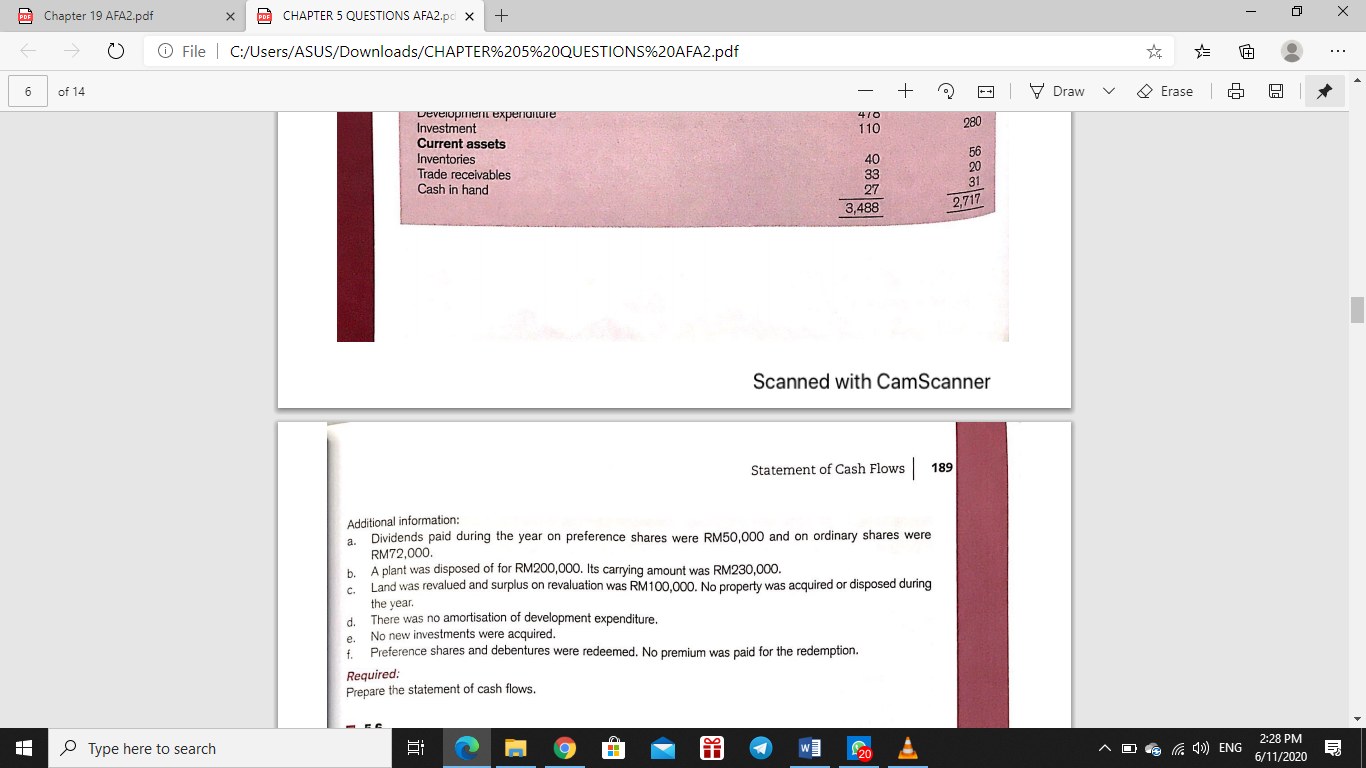

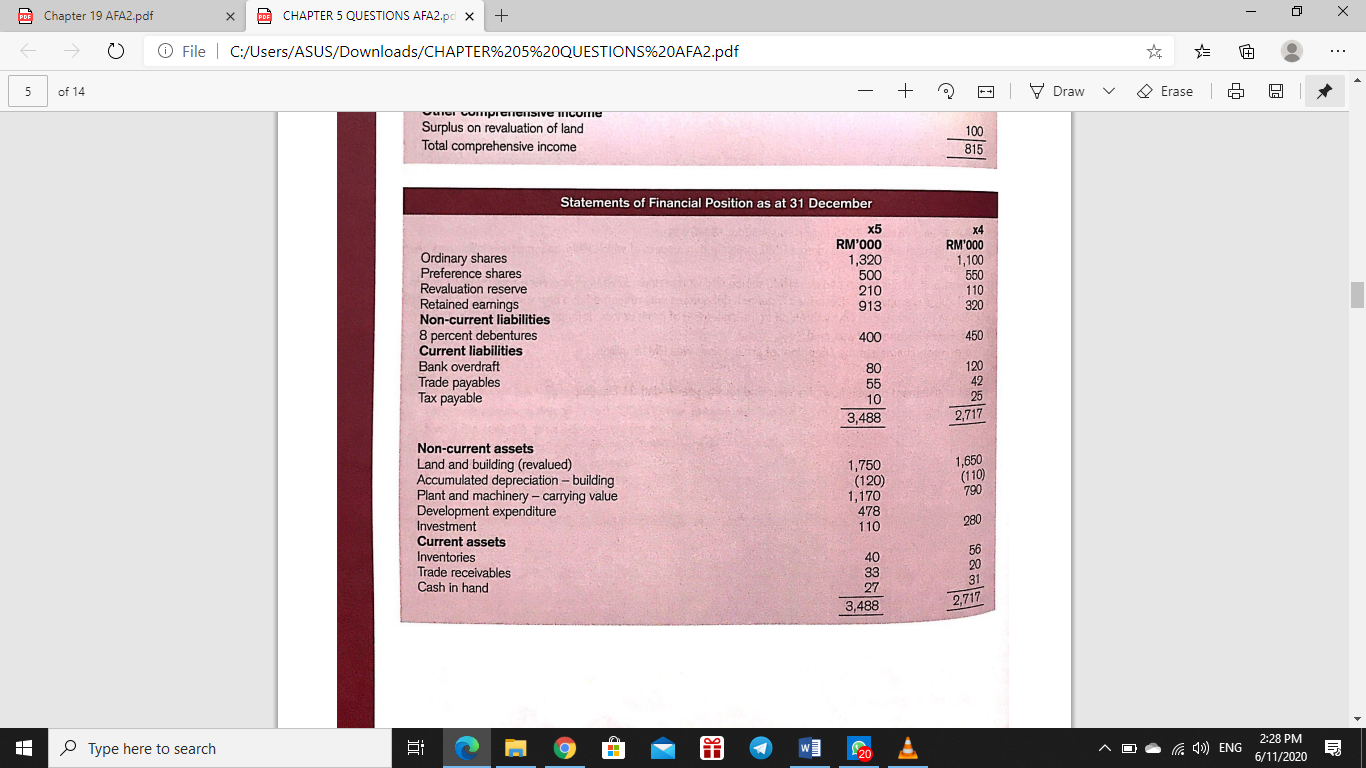

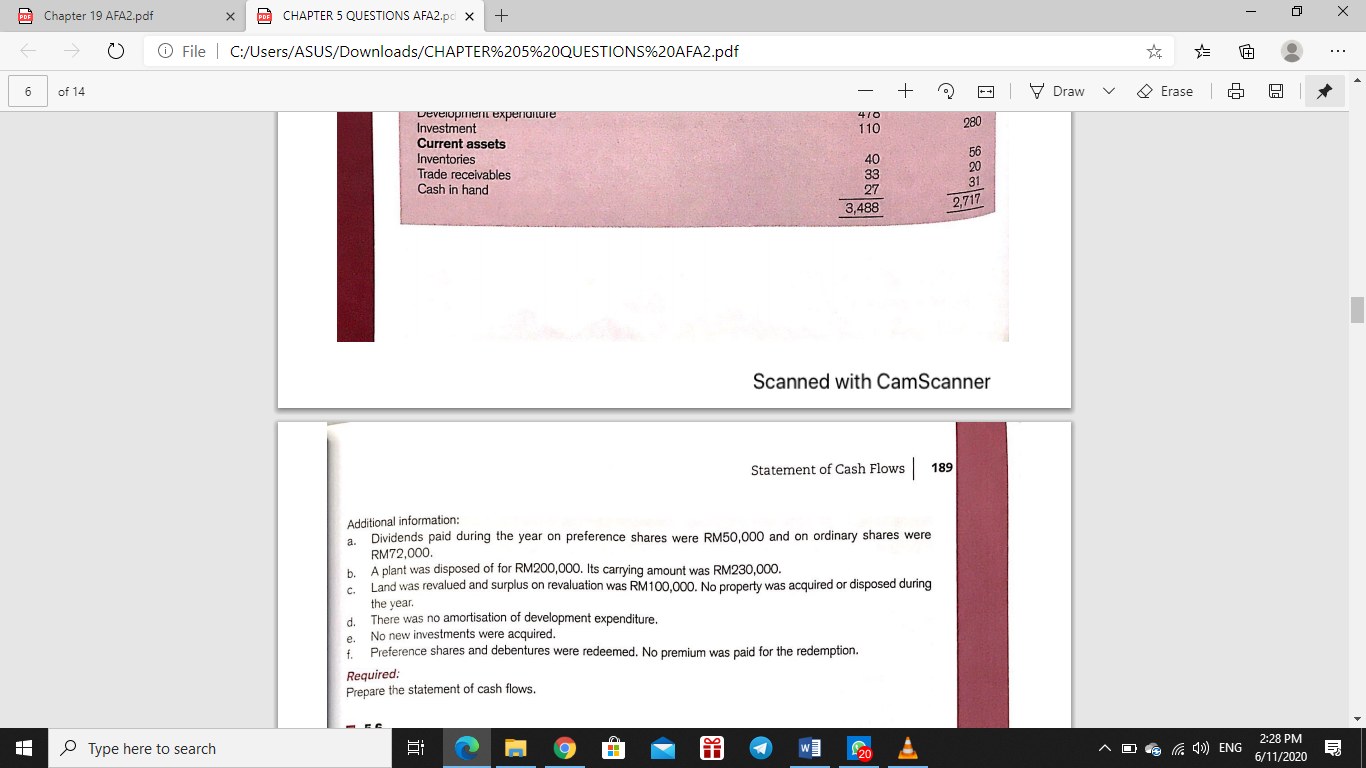

o Danny Crane Entity's statement of profit or loss and other comprehensive income and statements of firencial PDF Chapter 19 AFA2.pdf PDE CHAPTER 5 QUESTIONS AFA2.pc X + File C:/Users/ASUS/Downloads/CHAPTER%205%20QUESTIONS%20AFA2.pdf 5 of 14 5.5 Draw Erase A position are given below. Statement of Profit or Loss and Other Comprehensive Income for the Year ended 31 December x5 RM'000 Revenue (sales) Materials consumed Staff cost Depreciation Loss on sale of plant 1,440 (140) (180) (200 (301 890 50 Interest expense Gain on sale of investment Income from investment Profit before taxation Taxation Profit after taxation Other comprehensive income Surplus on revaluation of land Total comprehensive income (210) 715 100 815 Statements of Financial Position as at 31 December Ordinary shares Preference shares Revaluation reserve Retained earnings Non-current liabilities 8 percent debentures Current liabilities Bankoverdoft x5 RM'000 1,320 500 210 913 x4 RM'000 1,100 550 110 320 400 450 oo Type here to search 20 a )) ENG 2:28 PM 6/11/2020 PDF Chapter 19 AFA2.pdf PDE CHAPTER 5 QUESTIONS AFA2.pc X + o File C:/Users/ASUS/Downloads/CHAPTER%205%20QUESTIONS%20AFA2.pdf 5 of 14 Draw Erase A Wer vom ICICISIVE come Surplus on revaluation of land Total comprehensive income 100 815 Statements of Financial Position as at 31 December X5 RM'000 1,320 500 210 913 x4 RM'000 1,100 550 110 320 Ordinary shares Preference shares Revaluation reserve Retained earnings Non-current liabilities 8 percent debentures Current liabilities Bank overdraft Trade payables Tax payable 400 450 80 55 120 42 25 3,488 2,717 Non-current assets Land and building (revalued) Accumulated depreciation -- building Plant and machinery - carrying value Development expenditure Investment Current assets Inventories Trade receivables Cash in hand 1,750 (120) 1,170 478 110 1,650 (110) 790 280 40 33 27 3,488 56 20 31 2,717 Type here to search 20 a )) ENG 2:28 PM 6/11/2020 DE Chapter 19 AFA2.pdf DE CHAPTER 5 QUESTIONS AFA2.pc X + File C:/Users/ASUS/Downloads/CHAPTER%205%20QUESTIONS%20AFA2.pdf + 6 of 14 Draw Erase A 470 110 280 Development expenditure Investment Current assets Inventories Trade receivables Cash in hand 56 20 40 33 27 3,488 31 2,717 Scanned with CamScanner Statement of Cash Flows 189 a b. c. Additional information: Dividends paid during the year on preference shares were RM50,000 and on ordinary shares were RM72,000. A plant was disposed of for RM200,000. Its carrying amount was RM230,000. Land was revalued and surplus on revaluation was RM100,000. No property was acquired or disposed during the year. There was no amortisation of development expenditure. No new investments were acquired. t. Preference shares and debentures were redeemed. No premium was paid for the redemption. Required: Prepare the statement of cash flows. d. e. Type here to search 20 a 4) ENG 2:28 PM 6/11/2020 o Danny Crane Entity's statement of profit or loss and other comprehensive income and statements of firencial PDF Chapter 19 AFA2.pdf PDE CHAPTER 5 QUESTIONS AFA2.pc X + File C:/Users/ASUS/Downloads/CHAPTER%205%20QUESTIONS%20AFA2.pdf 5 of 14 5.5 Draw Erase A position are given below. Statement of Profit or Loss and Other Comprehensive Income for the Year ended 31 December x5 RM'000 Revenue (sales) Materials consumed Staff cost Depreciation Loss on sale of plant 1,440 (140) (180) (200 (301 890 50 Interest expense Gain on sale of investment Income from investment Profit before taxation Taxation Profit after taxation Other comprehensive income Surplus on revaluation of land Total comprehensive income (210) 715 100 815 Statements of Financial Position as at 31 December Ordinary shares Preference shares Revaluation reserve Retained earnings Non-current liabilities 8 percent debentures Current liabilities Bankoverdoft x5 RM'000 1,320 500 210 913 x4 RM'000 1,100 550 110 320 400 450 oo Type here to search 20 a )) ENG 2:28 PM 6/11/2020 PDF Chapter 19 AFA2.pdf PDE CHAPTER 5 QUESTIONS AFA2.pc X + o File C:/Users/ASUS/Downloads/CHAPTER%205%20QUESTIONS%20AFA2.pdf 5 of 14 Draw Erase A Wer vom ICICISIVE come Surplus on revaluation of land Total comprehensive income 100 815 Statements of Financial Position as at 31 December X5 RM'000 1,320 500 210 913 x4 RM'000 1,100 550 110 320 Ordinary shares Preference shares Revaluation reserve Retained earnings Non-current liabilities 8 percent debentures Current liabilities Bank overdraft Trade payables Tax payable 400 450 80 55 120 42 25 3,488 2,717 Non-current assets Land and building (revalued) Accumulated depreciation -- building Plant and machinery - carrying value Development expenditure Investment Current assets Inventories Trade receivables Cash in hand 1,750 (120) 1,170 478 110 1,650 (110) 790 280 40 33 27 3,488 56 20 31 2,717 Type here to search 20 a )) ENG 2:28 PM 6/11/2020 DE Chapter 19 AFA2.pdf DE CHAPTER 5 QUESTIONS AFA2.pc X + File C:/Users/ASUS/Downloads/CHAPTER%205%20QUESTIONS%20AFA2.pdf + 6 of 14 Draw Erase A 470 110 280 Development expenditure Investment Current assets Inventories Trade receivables Cash in hand 56 20 40 33 27 3,488 31 2,717 Scanned with CamScanner Statement of Cash Flows 189 a b. c. Additional information: Dividends paid during the year on preference shares were RM50,000 and on ordinary shares were RM72,000. A plant was disposed of for RM200,000. Its carrying amount was RM230,000. Land was revalued and surplus on revaluation was RM100,000. No property was acquired or disposed during the year. There was no amortisation of development expenditure. No new investments were acquired. t. Preference shares and debentures were redeemed. No premium was paid for the redemption. Required: Prepare the statement of cash flows. d. e. Type here to search 20 a 4) ENG 2:28 PM 6/11/2020