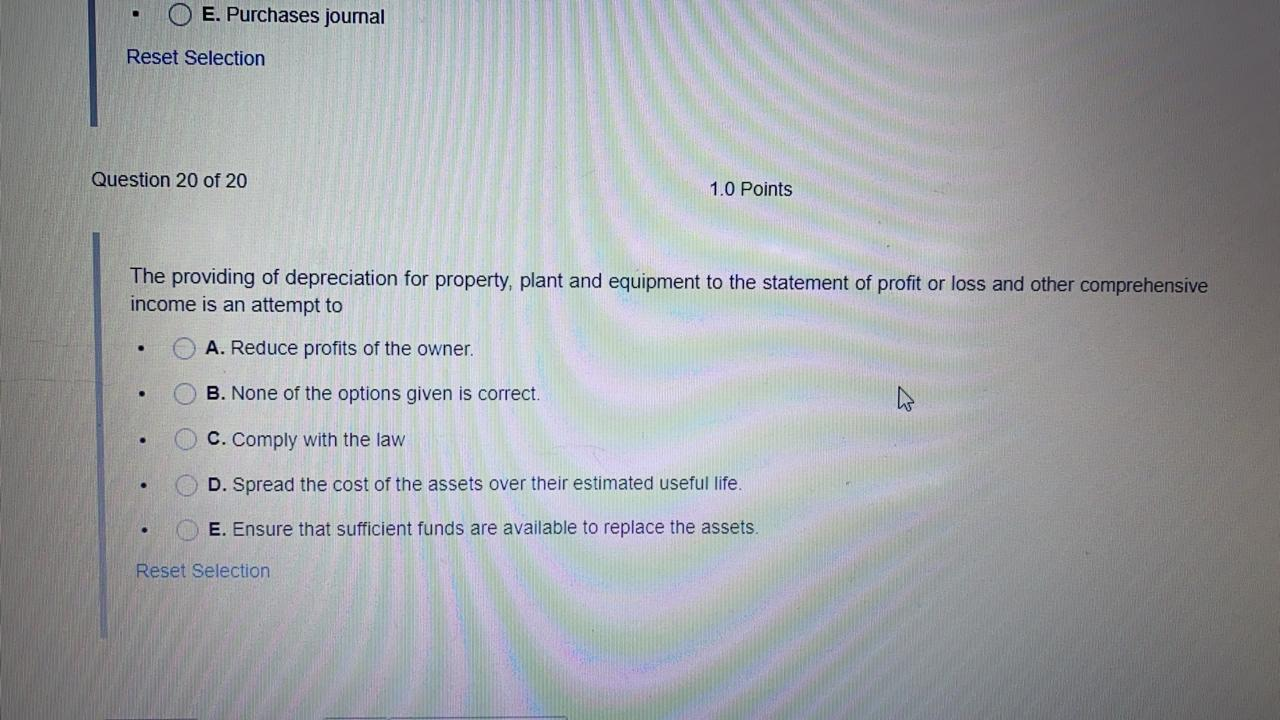

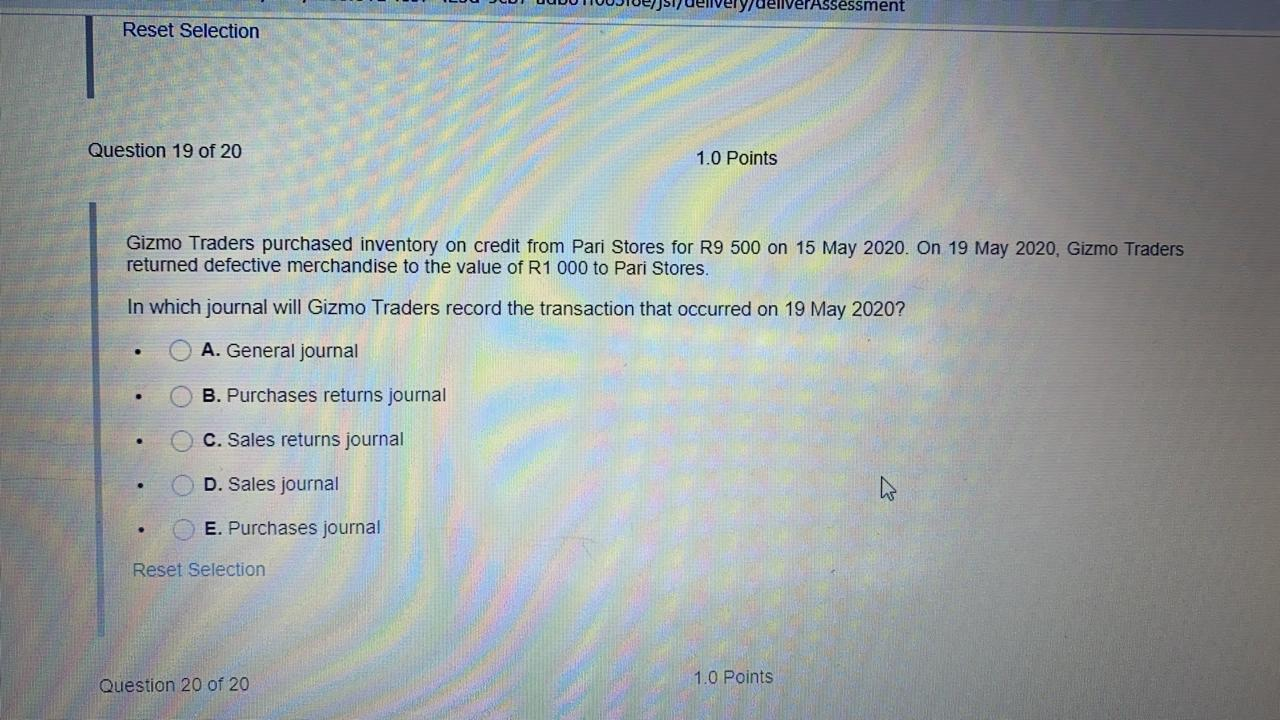

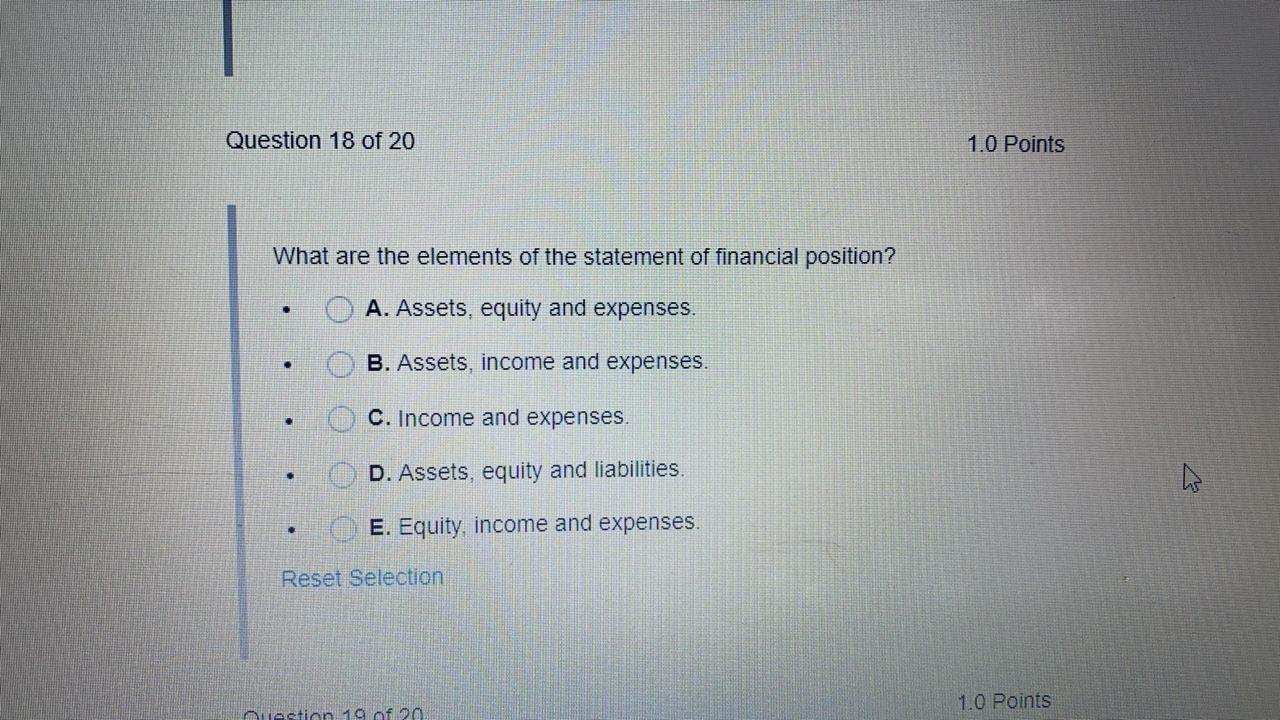

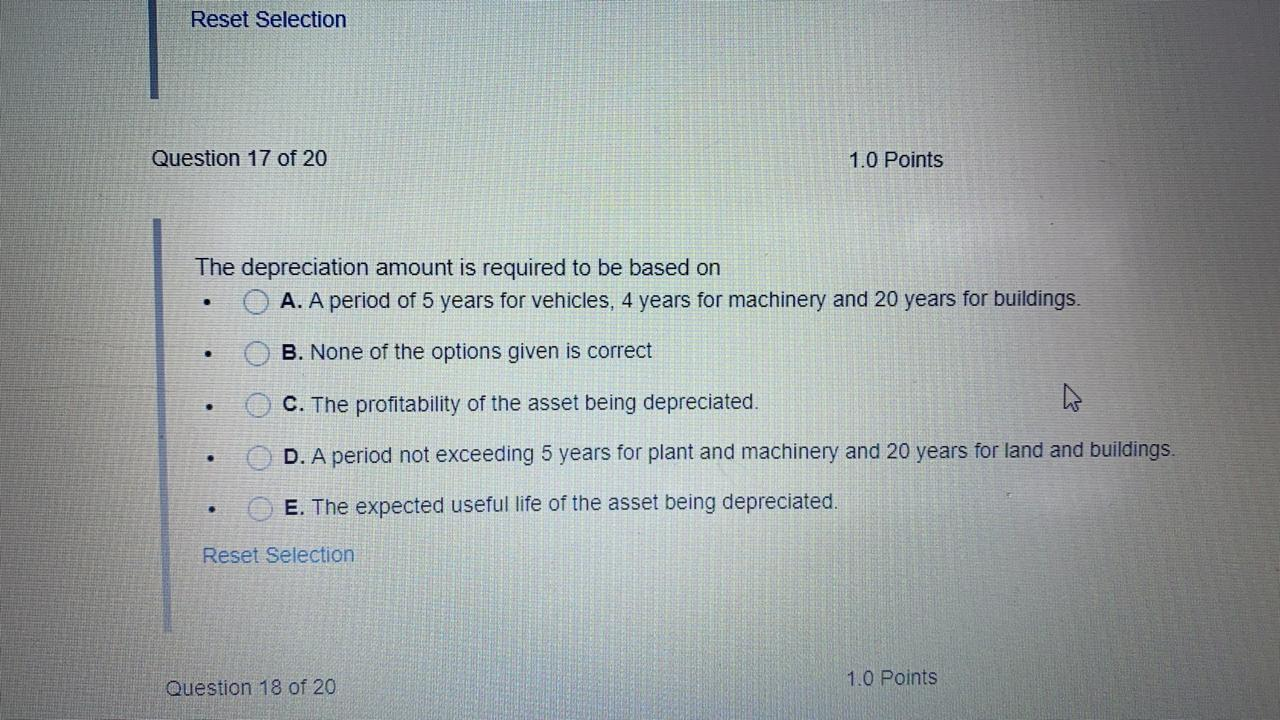

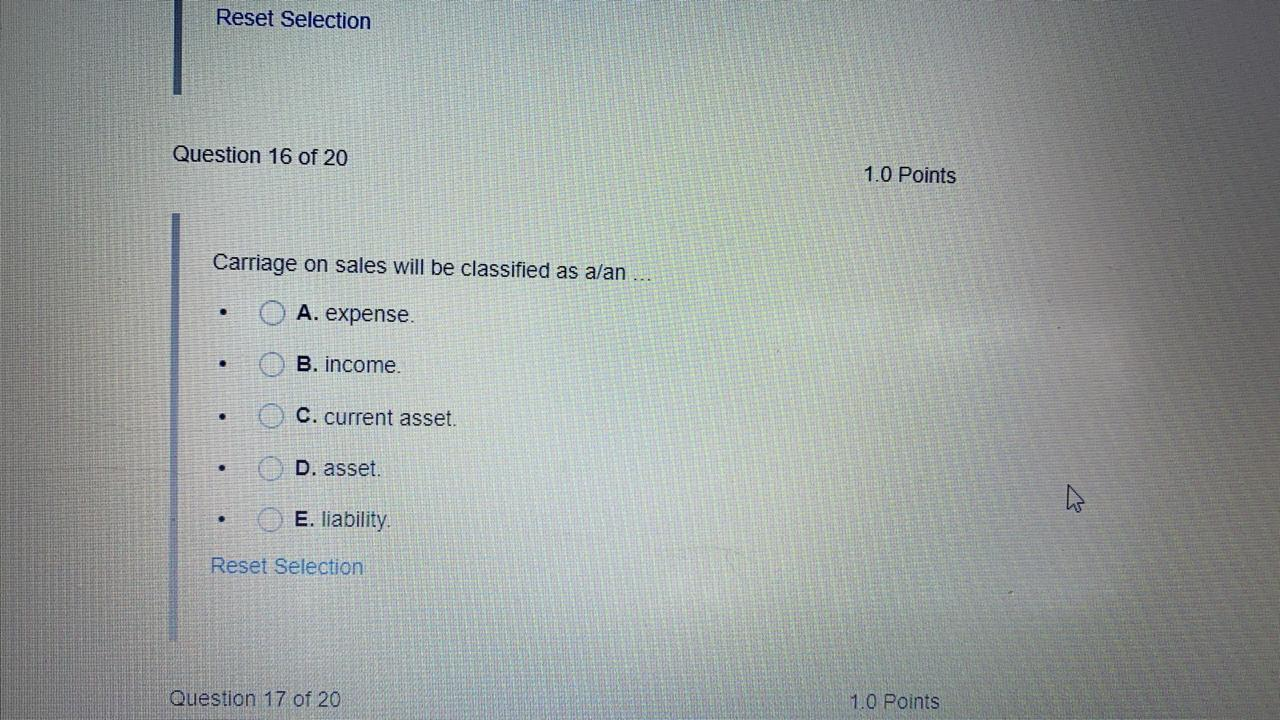

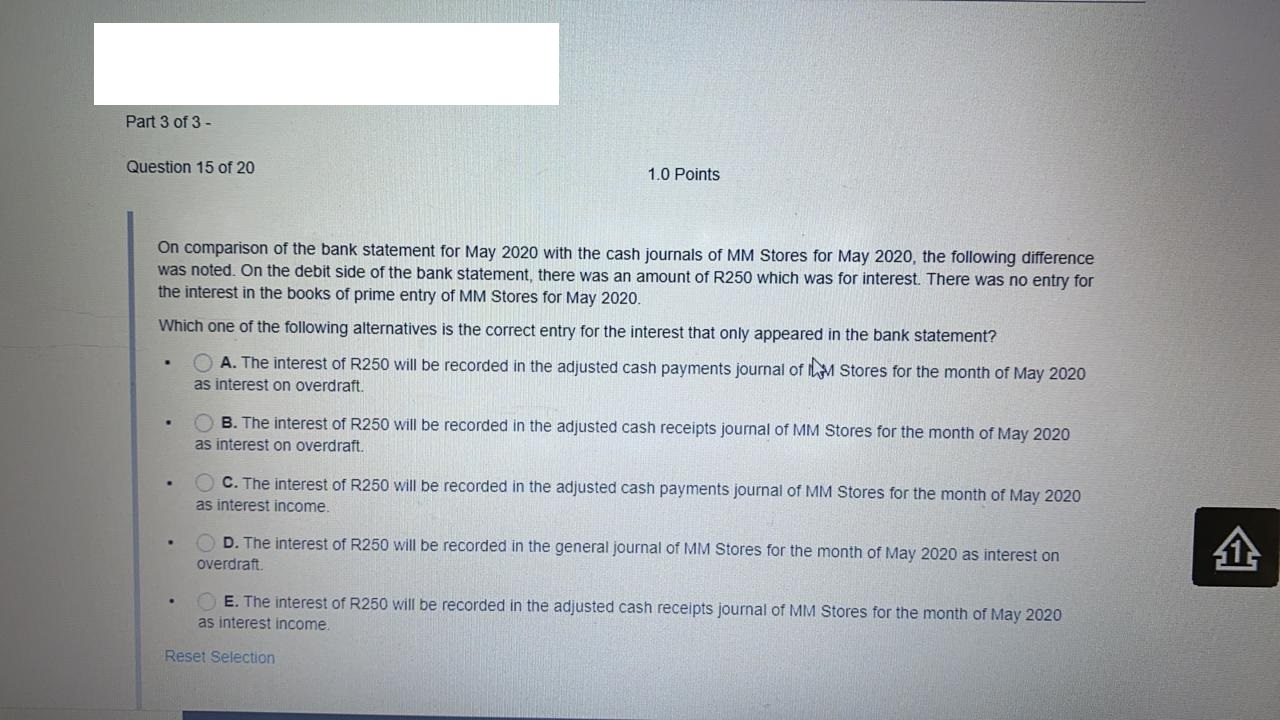

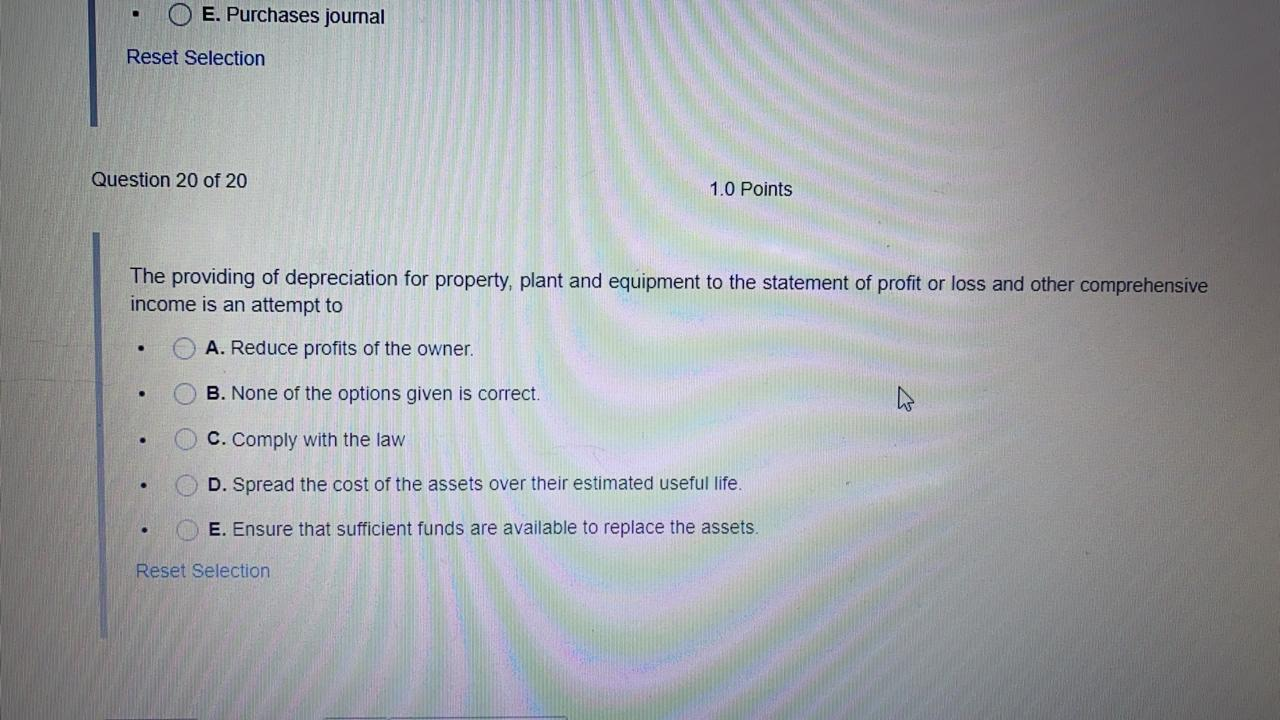

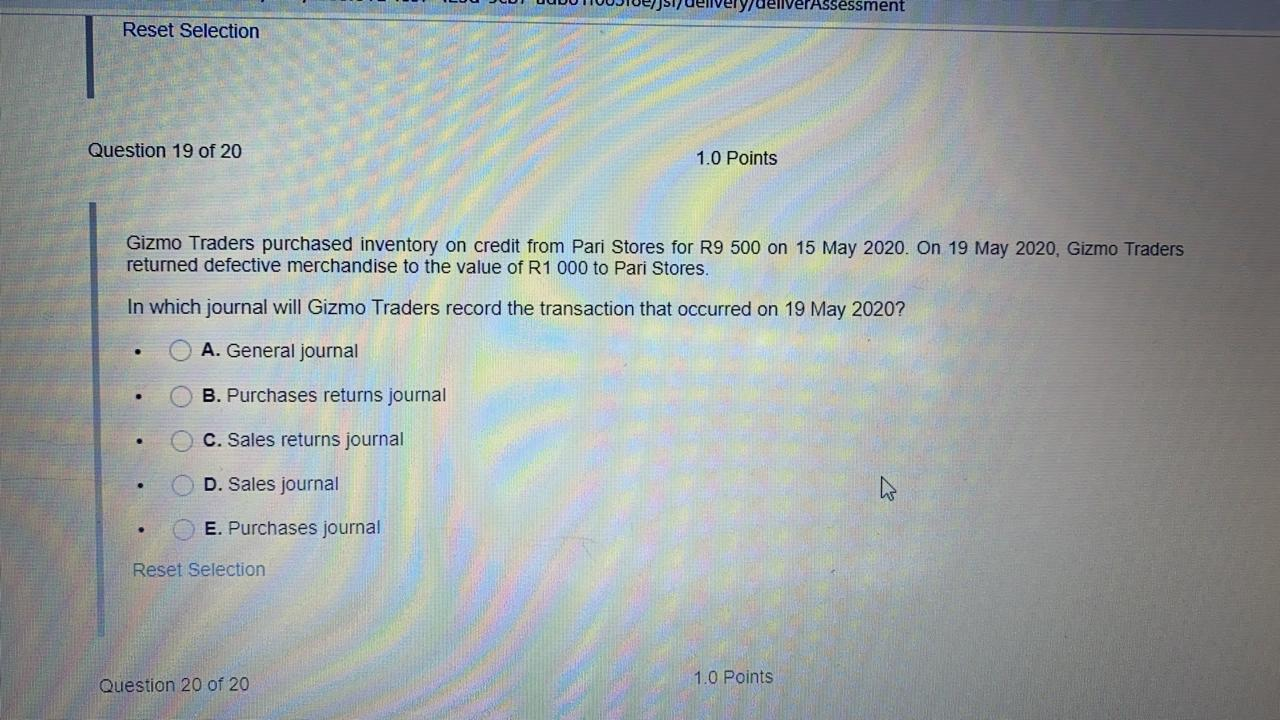

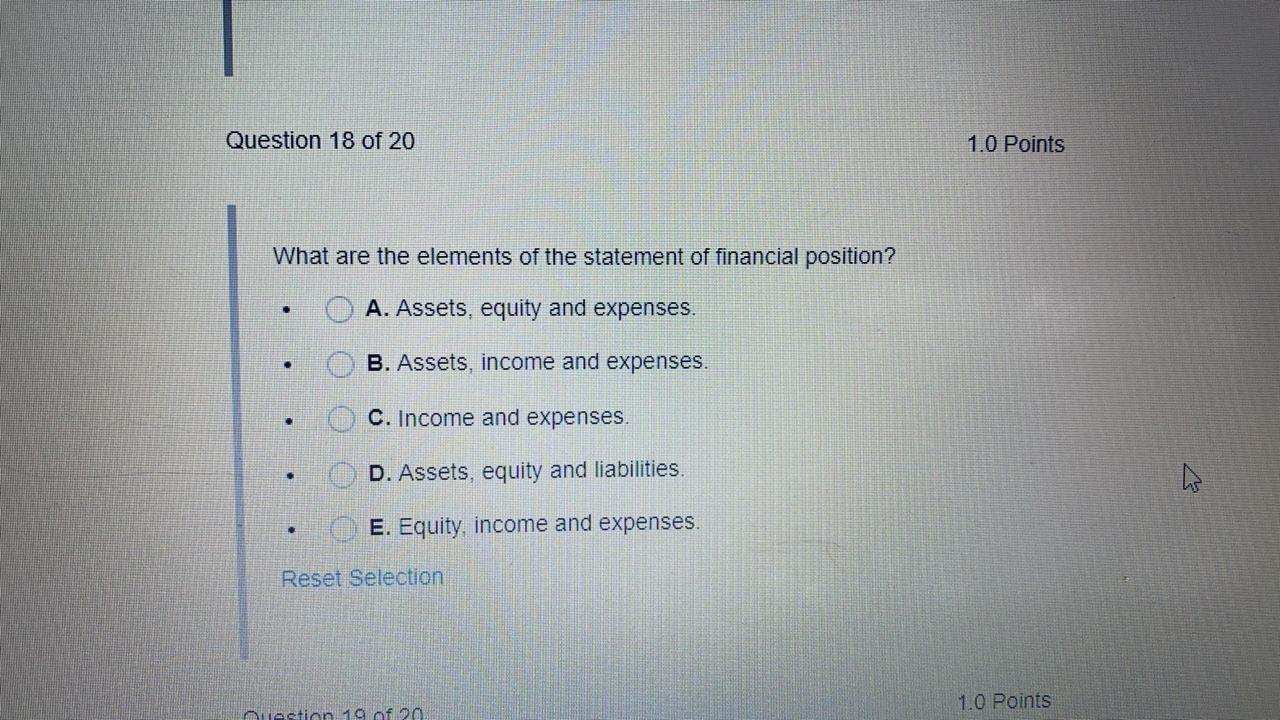

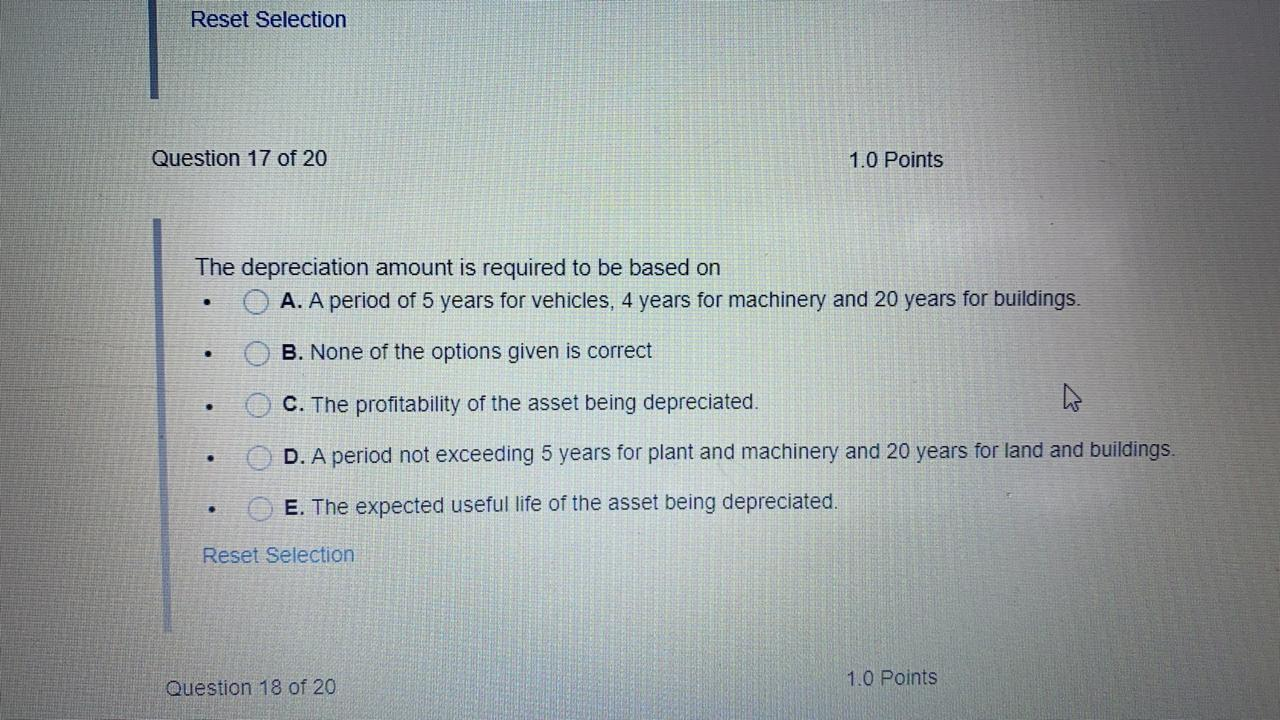

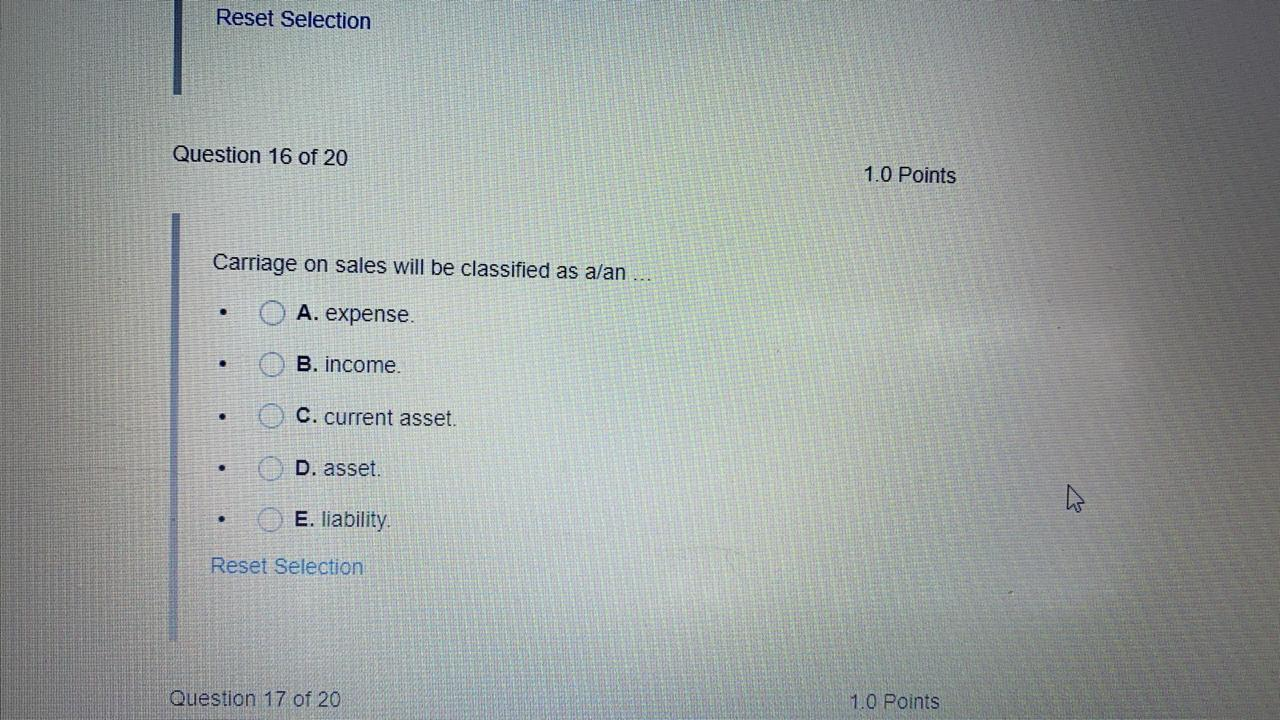

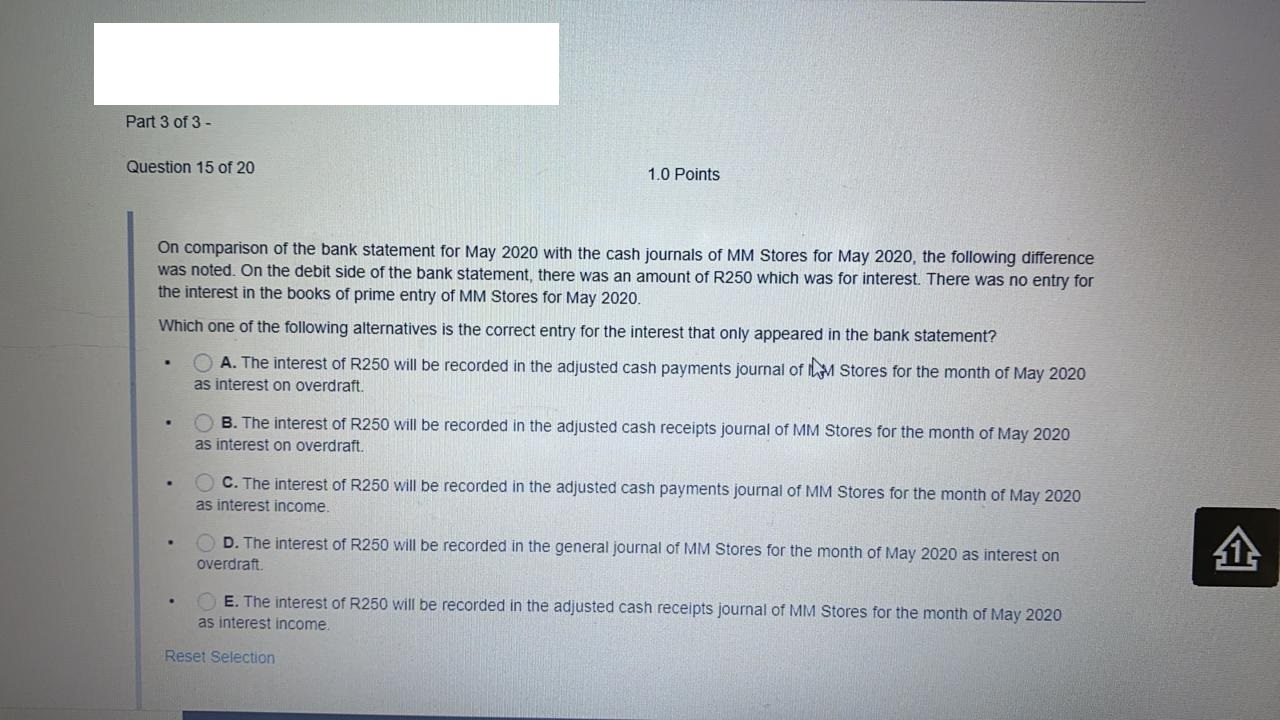

O E. Purchases journal Reset Selection Question 20 of 20 1.0 Points The providing of depreciation for property, plant and equipment to the statement of profit or loss and other comprehensive income is an attempt to A. Reduce profits of the owner. B. None of the options given is correct. . C. Comply with the law D. Spread the cost of the assets over their estimated useful life. E. Ensure that sufficient funds are available to replace the assets. Reset Selection verAssessment Reset Selection Question 19 of 20 1.0 Points Gizmo Traders purchased inventory on credit from Pari Stores for R9 500 on 15 May 2020. On 19 May 2020, Gizmo Traders returned defective merchandise to the value of R1 000 to Pari Stores. In which journal will Gizmo Traders record the transaction that occurred on 19 May 2020? A. General journal B. Purchases returns journal C. Sales returns journal . D. Sales journal . E. Purchases journal Reset Selection Question 20 of 20 1.0 Points Question 18 of 20 1.0 Points What are the elements of the statement of financial position? A. Assets, equity and expenses. . B. Assets, income and expenses. . C. Income and expenses. .. D. Assets, equity and liabilities. . E. Equity, income and expenses. Reset Selection 1.0 Points Action 10 of 20. Reset Selection Question 17 of 20 1.0 Points The depreciation amount is required to be based on A. A period of 5 years for vehicles, 4 years for machinery and 20 years for buildings. B. None of the options given is correct . W C. The profitability of the asset being depreciated. D. A period not exceeding 5 years for plant and machinery and 20 years for land and buildings. 0 0 E. The expected useful life of the asset being depreciated. Reset Selection 1.0 Points Question 18 of 20 Reset Selection Question 16 of 20 1.0 Points Carriage on sales will be classified as alan ... . A. expense. . B. income C. current asset. D. asset. . E. liability Reset Selection Question 17 of 20 1.0 Points Part 3 of 3 - Question 15 of 20 1.0 Points On comparison of the bank statement for May 2020 with the cash journals of MM Stores for May 2020, the following difference was noted. On the debit side of the bank statement, there was an amount of R250 which was for interest. There was no entry for the interest in the books of prime entry of MM Stores for May 2020. Which one of the following alternatives is the correct entry for the interest that only appeared in the bank statement? O A. The interest of R250 will be recorded in the adjusted cash payments journal of Tom Stores for the month of May 2020 as interest on overdraft. OB. The interest of R250 will be recorded in the adjusted cash receipts journal of MM Stores for the month of May 2020 as interest on overdraft. OC. The interest of R250 will be recorded in the adjusted cash payments journal of MM Stores for the month of May 2020 as interest income. OD. The interest of R250 will be recorded in the general journal of MM Stores for the month of May 2020 as interest on overdraft. E. The interest of R250 will be recorded in the adjusted cash receipts journal of MM Stores for the month of May 2020 as interest income. Reset Selection