Answered step by step

Verified Expert Solution

Question

1 Approved Answer

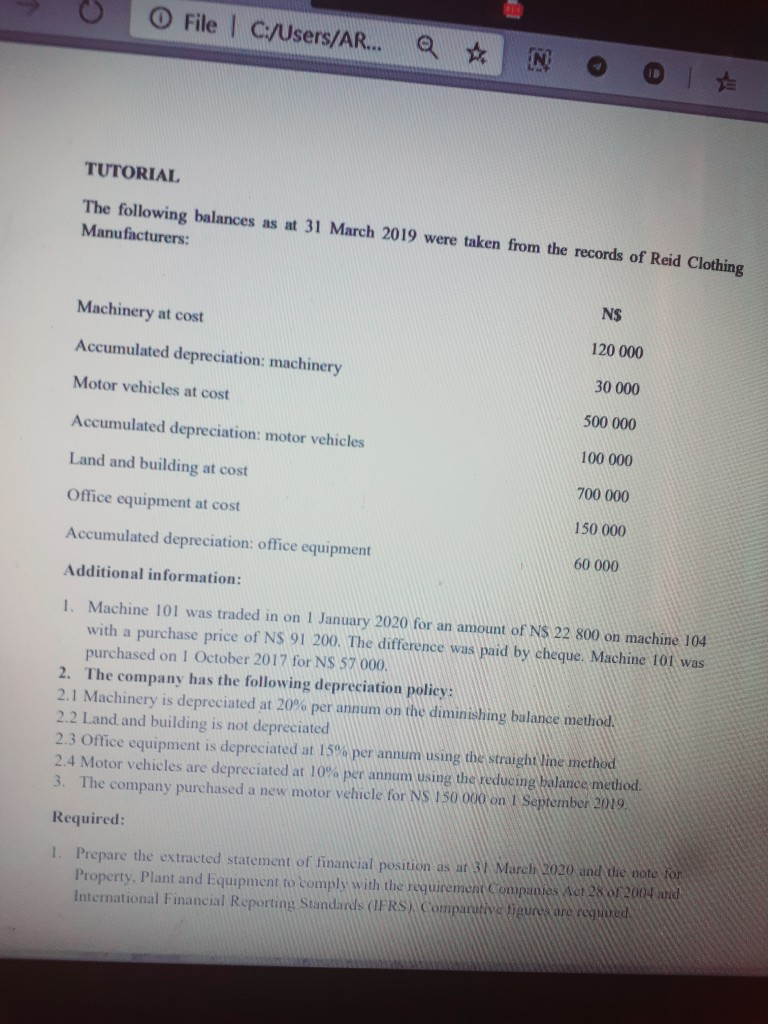

O File | C:/Users/AR... TUTORIAL The following balances as at 31 March 2019 were taken from the records of Reid Clothing Manufacturers: Machinery at cost

O File | C:/Users/AR... TUTORIAL The following balances as at 31 March 2019 were taken from the records of Reid Clothing Manufacturers: Machinery at cost NS Accumulated depreciation: machinery 120 000 Motor vehicles at cost 30 000 500 000 Accumulated depreciation: motor vehicles Land and building at cost 100 000 700 000 Office equipment at cost Accumulated depreciation: office equipment 150 000 Additional information: 60 000 1. Machine 101 was traded in on 1 January 2020 for an amount of NS 22 800 on machine 104 with a purchase price of NS 91 200. The difference was paid by cheque. Machine 101 was purchased on 1 October 2017 for NS 57 000. 2. The company has the following depreciation policy: 2.1 Machinery is depreciated at 20% per annum on the diminishing balance method. 2.2 Land and building is not depreciated 2.3 Office equipment is depreciated at 15% per annum using the straight line method 2.4 Motor vehicles are depreciated at 10% per annum using the reducing balance method. 3. The company purchased a new motor vehicle for NS 750 000 on 1 September 2019, Required: 1. Prepare the extracted statement of financial position as at 32 March 2020 and die note Property. Plant and Equipment to comply with the requirement Companies Act 280/2004 and International Financial Reporting Standards (IFRS). Comparativa ligures are required

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started