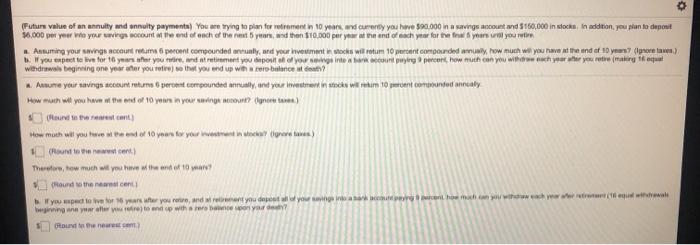

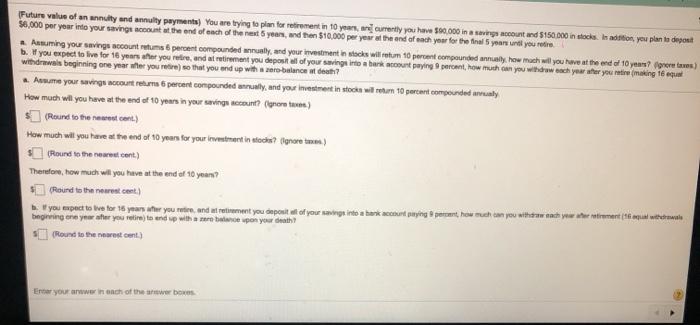

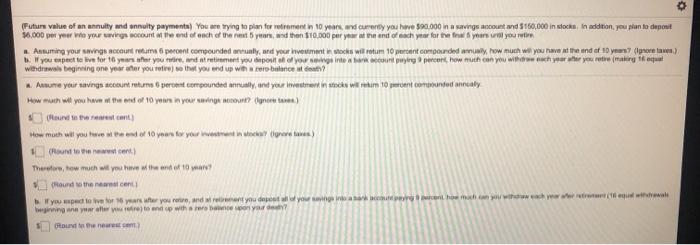

o (Future value of an annuity and annuity payments) You are trying to plan for retirement in 10 years, and currently you have $90.000 ina savings account and 5150,000 in stock. In addition, you plan to deposit $6.000 per your to your count of the end of each of the next years, and then $10.000 per year at the end of each year for yours wol your Asuming your savings account to 6 percent compounded only, and your investment locks will retum 10 percent compounded by how much you have at the end of 10 years (more) . W you expect to live for to your after you mireand retirement you deposit an el your into a son court paying percent how much can you with charter your retro making it equat withdrawal beginning one year after you refines that you end up with a cor balance death? Anume your savings account returns percent compounded annually and your investment in stocks will return 10 percent commented analy How much will you have the end of 10 years in your waving mount (ne) found the cont How much will you tweet yours for your search irere) to www cent) Therefore, how much will you have the end of 10 {Round to the cent you spectator 15 years after you and you do your inocent ho nacho www.chriwwali egyar feed where you? Pouden) Future value of an annuity and annuity payments You are lying to plan for retirement in 10 y currently you have $90,000 in a sings count and $150.000 in stock. In addition you plan to deposit $6,000 per year into your savings account at the end of each of the next years, and then $10,000 per year at the end of each year for the final 5 years until you retire. Assuming your savings account runs percent compounded and your investment in acts will retum 10 percent compounded annually, how much will you have at the end of 10 years? (preretes) b. you expect to live for 16 years after your and a retirement you depost of your serving into a bankcount paying percent, how much can you withdrawach your atter you retire making 16 qus withdrawals beginning one year her you retire) so that you end up with a balance at death? Asume your savings account returns 6 percent compounded rully, and your investment in stocks will return 10 percent compounded waly How much will you have at the end of 10 years in your servings account? (nor) (Round to the new cont.) How much will you are at the end of 10 years for your investment in dies? nore) (Round to the nearest cont.) Therefore, how much will you have at the end of 10 year? Round to the nearest cent) you expect to live for 16 year after you retro, and at retirement you deposit ut of your songs into a bank account paying percent, how much can you withdraw math yw her motrement (18 weitere bnging one year after you retire to end up with a more upon your death * Round to the nearest cent) En your wer in each of the web o (Future value of an annuity and annuity payments) You are trying to plan for retirement in 10 years, and currently you have $90.000 ina savings account and 5150,000 in stock. In addition, you plan to deposit $6.000 per your to your count of the end of each of the next years, and then $10.000 per year at the end of each year for yours wol your Asuming your savings account to 6 percent compounded only, and your investment locks will retum 10 percent compounded by how much you have at the end of 10 years (more) . W you expect to live for to your after you mireand retirement you deposit an el your into a son court paying percent how much can you with charter your retro making it equat withdrawal beginning one year after you refines that you end up with a cor balance death? Anume your savings account returns percent compounded annually and your investment in stocks will return 10 percent commented analy How much will you have the end of 10 years in your waving mount (ne) found the cont How much will you tweet yours for your search irere) to www cent) Therefore, how much will you have the end of 10 {Round to the cent you spectator 15 years after you and you do your inocent ho nacho www.chriwwali egyar feed where you? Pouden) Future value of an annuity and annuity payments You are lying to plan for retirement in 10 y currently you have $90,000 in a sings count and $150.000 in stock. In addition you plan to deposit $6,000 per year into your savings account at the end of each of the next years, and then $10,000 per year at the end of each year for the final 5 years until you retire. Assuming your savings account runs percent compounded and your investment in acts will retum 10 percent compounded annually, how much will you have at the end of 10 years? (preretes) b. you expect to live for 16 years after your and a retirement you depost of your serving into a bankcount paying percent, how much can you withdrawach your atter you retire making 16 qus withdrawals beginning one year her you retire) so that you end up with a balance at death? Asume your savings account returns 6 percent compounded rully, and your investment in stocks will return 10 percent compounded waly How much will you have at the end of 10 years in your servings account? (nor) (Round to the new cont.) How much will you are at the end of 10 years for your investment in dies? nore) (Round to the nearest cont.) Therefore, how much will you have at the end of 10 year? Round to the nearest cent) you expect to live for 16 year after you retro, and at retirement you deposit ut of your songs into a bank account paying percent, how much can you withdraw math yw her motrement (18 weitere bnging one year after you retire to end up with a more upon your death * Round to the nearest cent) En your wer in each of the web