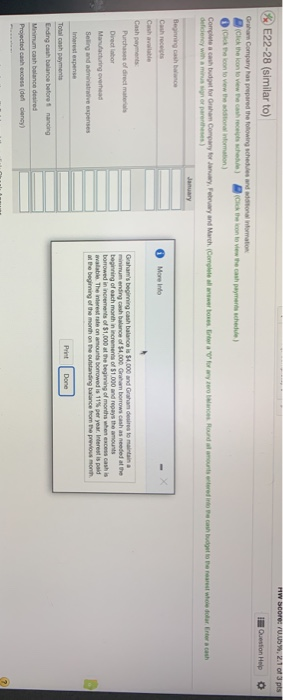

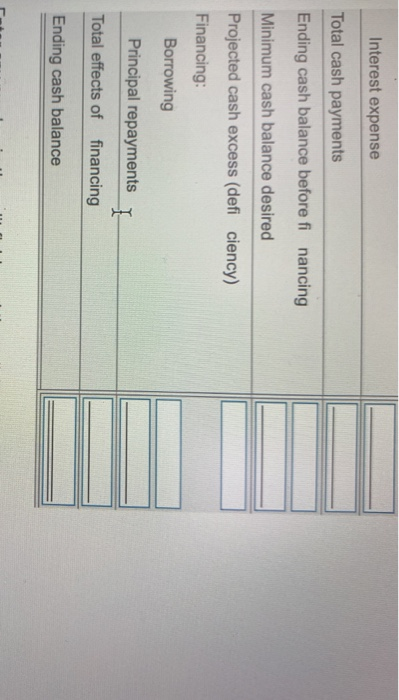

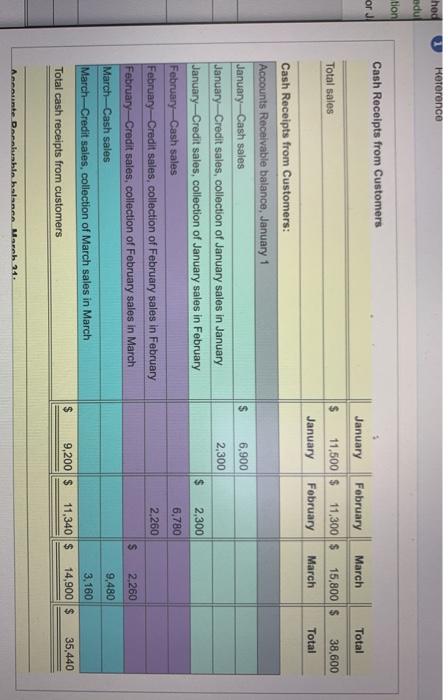

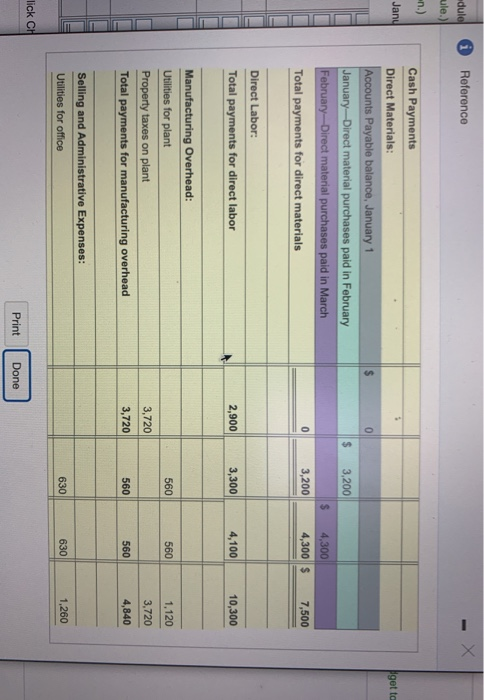

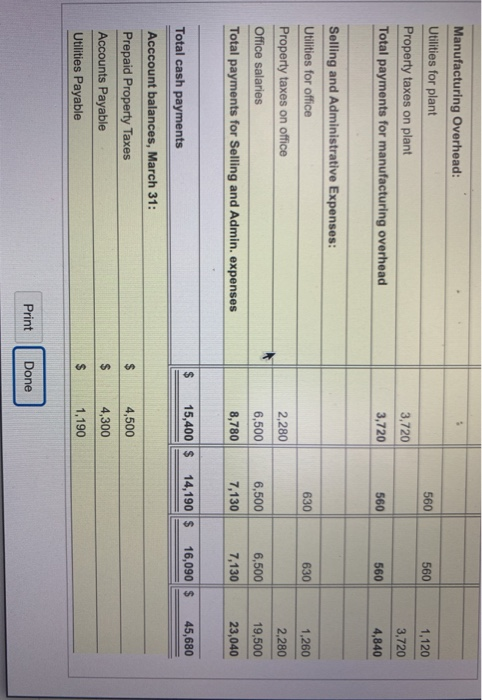

O HV scored UU, 2.1 of 3 pts E22-28 (similar to) Question Help Graham Company has prepared the following schedules and formation Click the loon to view the cash recipe che Chekhe won to view the cash payment schedule con to view the formation Concurs a cah budout for the Company for January February and March (Complete lewerbome. Ertera for wyroon Hound of morts entered into a can but to be rewet whole doterre a cah deficiency with a missioner parents) January Beginning cashbac Cash More info Cash available Cash payments Purchases of direct materials Graham's beginning cash balance is $4.000 and Graham deres to maintain a minimum ending cash balance of $4.000 Graham borrows cash as needed at the Direct labor beginning of each month in increments of 51.000 and repays the amounts borrowed in increments of $1.000 at the beginning of months when excess cash is Manufacturing overhead valable. The interest rate on amounts borrowed is 11% per your interest is paid Seling and administrative expenses at the beginning of the month on the standing balance from the previous month Interest expense Print Done Total cash payments Ending cash balance before 1 nancing Minimum cash balance desired Projected cash excess den Dency) Interest expense Total cash payments Ending cash balance before financing Minimum cash balance desired Projected cash excess (deficiency) Financing Borrowing Principal repayments I Total effects of financing Ending cash balance hed Heterence edu tion Cash Receipts from Customers or J Total Total sales January February March 11,500 $ 11,300 $ 15,800 $ January February March 38,600 Total $ 6,900 2,300 $ 2,300 Cash Receipts from Customers: Accounts Receivable balance, January 1 January-Cash sales January--Credit sales, collection of January sales in January January-Credit sales, collection of January sales in February February-Cash sales February--Credit sales, collection of February sales in February February-Credit sales, collection of February sales in March March-Cash sales March-Credit sales, collection of March sales in March Total cash receipts from customers 6,780 2,260 $ 2,260 9,480 3,160 14,900 $ 9,200 $ 11,340 $ 35,440 Anunte Dennushia halana Manh 24. Reference X edule ule.) -n.) Jany get to 0 Cash Payments Direct Materials: Accounts Payable balance, January 1 January-Direct material purchases paid in February February-Direct material purchases paid in March Total payments for direct materials $ 3,200 4,300 4,300 $ 0 3,200 7,500 Direct Labor: Total payments for direct labor 2,900 3,300 4,100 10,300 560 560 1,120 Manufacturing Overhead: Utilities for plant Property taxes on plant Total payments for manufacturing overhead 3,720 3,720 3,720 560 560 4,840 1 Selling and Administrative Expenses: Utilities for office 630 630 1,260 lick CH Print Done 3 560 Manufacturing Overhead: Utilities for plant Property taxes on plant Total payments for manufacturing overhead 560 1,120 3,720 3,720 3,720 4,840 560 560 630 630 Selling and Administrative Expenses: Utilities for office Property taxes on office Office salaries Total payments for Selling and Admin. expenses 1,260 2,280 2,280 6,500 6,500 6,500 8,780 19,500 23,040 7,130 7,130 15,400 $ 14,190 $ 16,090 $ 45,680 Total cash payments Acccount balances, March 31: Prepaid Property Taxes Accounts Payable Utilities Payable $ 4,500 $ 4,300 $ 1,190 Print Done