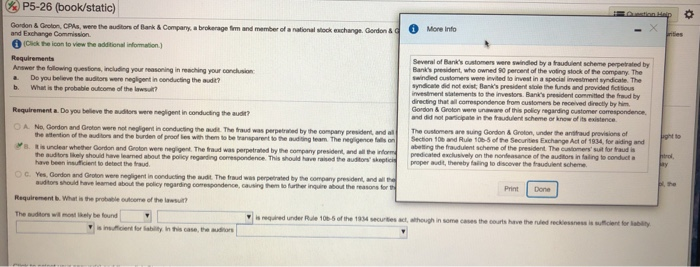

O inties P5-26 (book/static) on. Gordon & Groton, CPMs, were the auditors of Bank & Company, a brokerage firm and member of a national Mock charge Gordon & O More Info and Exchange Commission Click the icon to view the additional information) Requirements Several of Bank's customers were winded by a fraudulent scheme perpetrated by Answer the following questions, including your reasoning in reaching your conclusion Bank's president, who owned percent of the voting stock of the company. The swindled customers were invited to invest in a special investment syndicate. The Do you believe the auditors were region in conducting the audit? syndicale did not exist Bank's president to the funds and provided fictitious b What is the probable outcome of the wall? investimentatements to the investors Bank's president committed the fraud by directing that all correspondence from customers be received directly by him. Gordon & Groton were unaware of this policy regarding customer correspondence Requirementa. Do you believe the auditors were negligent in conducting the audit? and did not participate in the fraudulent scheme or know of its existance OA NoGordon and Groton were not regiert in conducting the modt. The fraud was perpetrated by the company resident, and a The customers are suing Gordon & Groton, under the antifraud provisions of the ention of the auditors and the burden of proof te with them to be transparent to the auditing team. The nece is on Section 10 and Rule 105 of the Securities Exchange Act of 1934. for aiding and is undear whether Gordon and Groton were region. The road was perpetrated by the company president and the form betting the fraudulent scheme of the president. The customers' suit for fraudis the auditors likely should have learned about the policy regarding correspondence. This should have raised the auditors' skeptic predicted exclusively on the norasance of the auditors in faling to conducta have been insuficient to detect the trud proper sodt, thereby failing to discover the fraudulent scheme OC. Yes, Gordon and Groton were negligent in conducting the audit. The fraud was perpetrated by the company president, and in auditors should have learned about the policy regarding correspondence, causing them to further inquire about the reasons for Print Done Requirements. What is the probable outcome of the suit? The auditors will most likely be found is required under Rule 10 of the 1934 secues act, whough in some cases the courts have the ruled recklessness is sufficient for is incent for ability in this case, the audio the