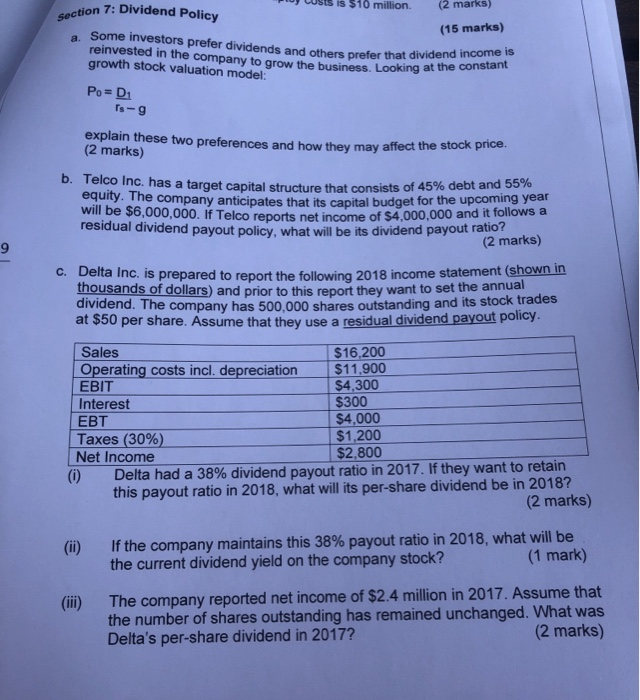

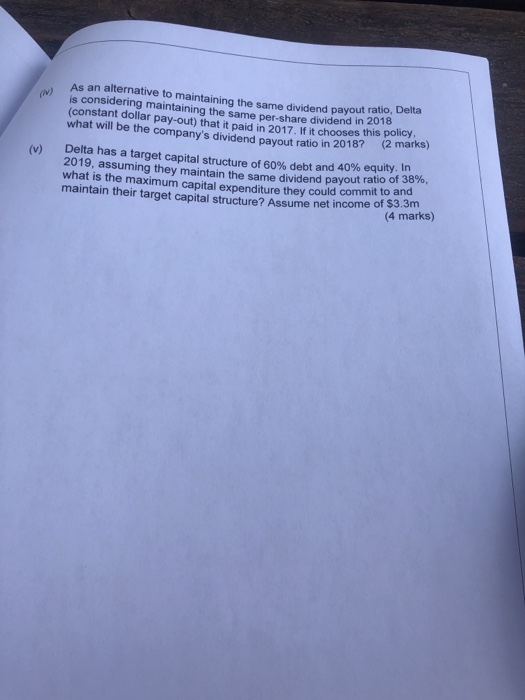

o LUSIS is $16 million. Section 7: Dividend Policy (2 marks) (15 marks) a. Some investors prefer dividends and others prefer that divid reinvested in the company to grow the business. Looking growth stock valuation model: nas and others prefer that dividend income is y to grow the business. Looking at the constant Po=D Ts-g explain these two preferences and how they may affect the stock price (2 marks) b. Telco Inc. has a target capital structure that consists of 45% deo ital structure that consists of 45% debt and 55% equity. The company anticipates that its capital budget for the upcoming year will be $6,000,000. If Telco reports net income of $4,000,000 and it too residual dividend payout policy, what will be its dividend payout rau (2 marks) 9 c. Delta Inc. is prepared to report the following 2018 income statement sho thousands of dollars) and prior to this report they want to set the annual dend. The company has 500,000 shares outstanding and its stock trades at $50 per share. Assume that they use a residual dividend payout policy. $16,200 Sales Operating costs incl. depreciation $11.900 EBIT $4,300 Interest $300 EBT $4,000 Taxes (30%) $1,200 Net Income $2,800 Delta had a 38% dividend payout ratio in 2017. If they want to retain this payout ratio in 2018, what will its per-share dividend be in 2018? (2 marks) If the company maintains this 38% payout ratio in 2018, what will be the current dividend yield on the company stock? company stock? (1 mark) The company reported net income of $2.4 million in 2017. Assume that the number of shares outstanding has remained unchanged. What was Delta's per-share dividend in 2017? (2 marks) As an alternative to maintaining the same dividend payout ratio, Delta is considering maintaining the same per-share dividend in 2018 (constant dollar pay-out) that it paid in 2017 If it chooses this poudy. what will be the company's dividend payout ratio in 2018? (2 marks) Delta has a target capital structure of 60% debt and 40% equity. In 2019, assuming they maintain the same dividend payout ratio of 3670 what is the maximum capital expenditure they could commit to and maintain their target capital structure Assume net income of $3.5m (4 marks)