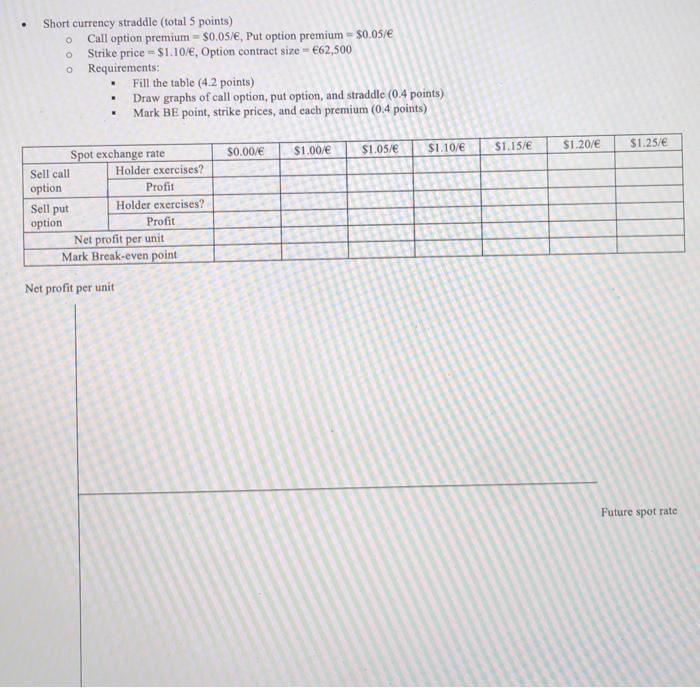

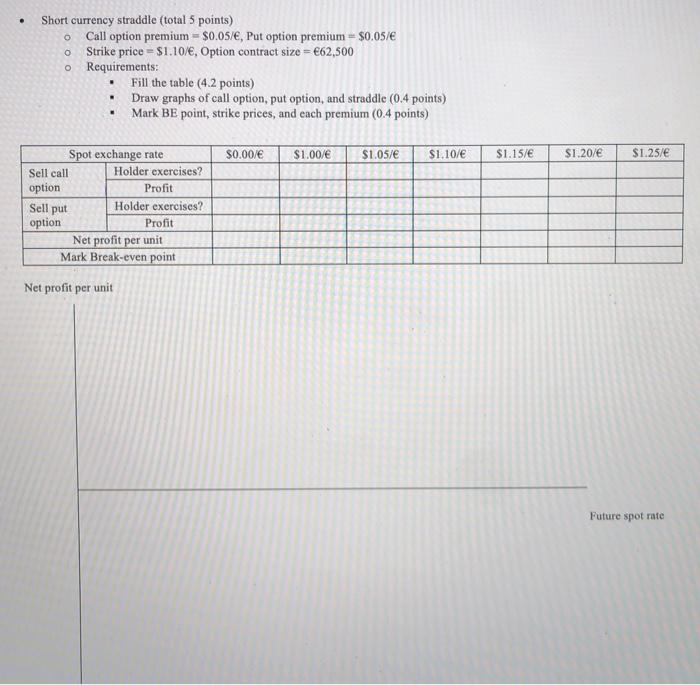

O O Short currency straddle (total 5 points) Call option premium - $0.05/, Put option premium = $0.05/ Strike price = $1.10/, Option contract size = 62,500 Requirements: Fill the table (4.2 points) Draw graphs of call option, put option, and straddle (0.4 points) Mark BE point, strike prices, and each premium (0,4 points) $1.00/ $1.05/ $1. 10/ $1.15/ $1.20/ $1.25 $0.00/ Spot exchange rate Sell call Holder exercises? option Profit Holder exercises? option Profit Net profit per unit Mark Break-even point Sell put Net profit per unit Future spot rate . o Short currency straddle (total 5 points) Call option premium = $0.05/, Put option premium = $0.05/ o Strike price = $1.10/, Option contract size = 62,500 o Requirements: Fill the table (4.2 points) Draw graphs of call option, put option, and straddle (0.4 points) Mark BE point, strike prices, and each premium (0.4 points) $0.00/ $1.00/ $1.0S/E $1.10/ $1.15/ $1.20/ $1.25/ Spot exchange rate Sell call Holder exercises? option Profit Holder exercises? option Profit Net profit per unit Mark Break-even point Sell put Net profit per unit Future spot rate O O Short currency straddle (total 5 points) Call option premium - $0.05/, Put option premium = $0.05/ Strike price = $1.10/, Option contract size = 62,500 Requirements: Fill the table (4.2 points) Draw graphs of call option, put option, and straddle (0.4 points) Mark BE point, strike prices, and each premium (0,4 points) $1.00/ $1.05/ $1. 10/ $1.15/ $1.20/ $1.25 $0.00/ Spot exchange rate Sell call Holder exercises? option Profit Holder exercises? option Profit Net profit per unit Mark Break-even point Sell put Net profit per unit Future spot rate . o Short currency straddle (total 5 points) Call option premium = $0.05/, Put option premium = $0.05/ o Strike price = $1.10/, Option contract size = 62,500 o Requirements: Fill the table (4.2 points) Draw graphs of call option, put option, and straddle (0.4 points) Mark BE point, strike prices, and each premium (0.4 points) $0.00/ $1.00/ $1.0S/E $1.10/ $1.15/ $1.20/ $1.25/ Spot exchange rate Sell call Holder exercises? option Profit Holder exercises? option Profit Net profit per unit Mark Break-even point Sell put Net profit per unit Future spot rate