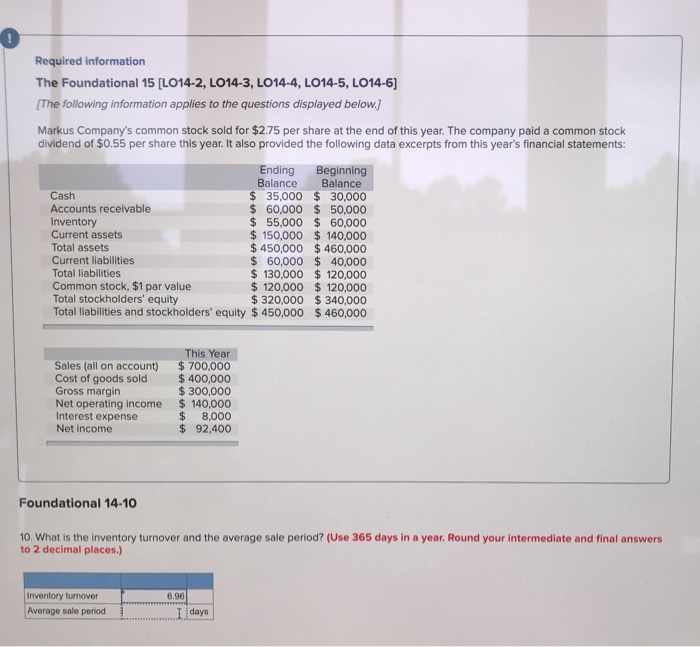

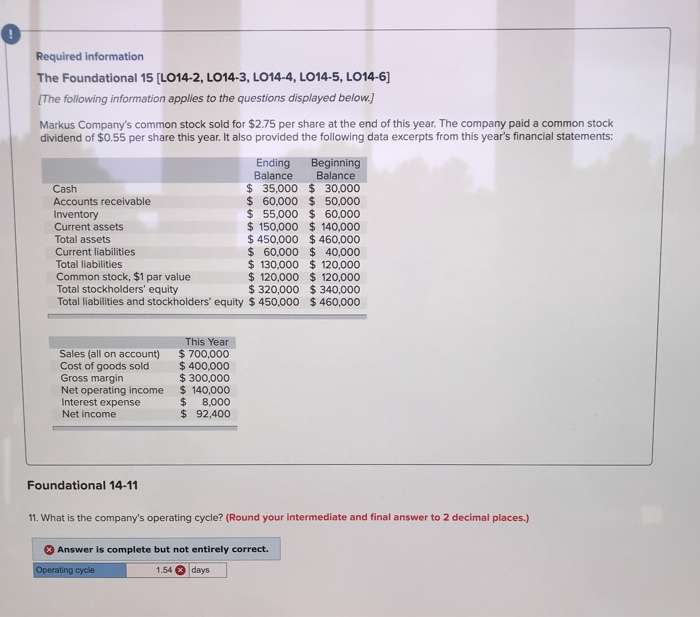

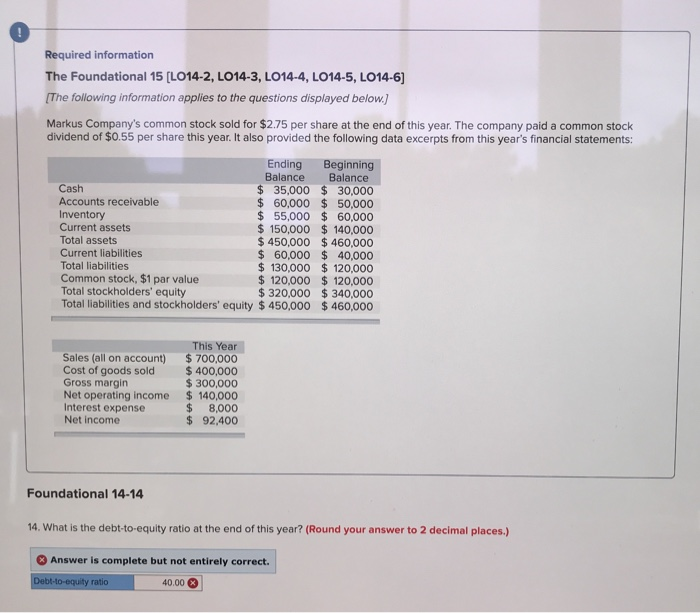

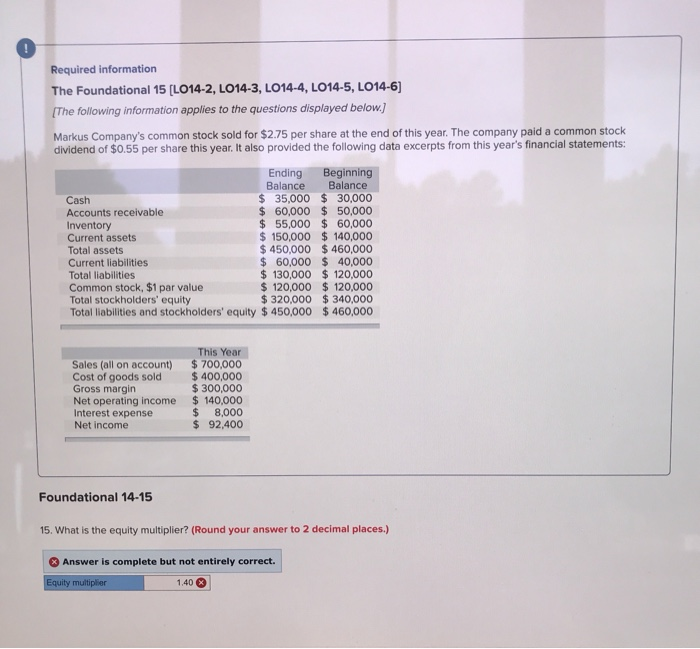

O Required information The Foundational 15 [L014-2, L014-3, LO14-4, LO14-5, LO14-6] [The following information applies to the questions displayed below.) Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Beginning Balance Balance Cash $ 35,000 $ 30,000 Accounts receivable $ 60,000 $ 50,000 Inventory $ 55,000 $ 60,000 Current assets $ 150,000 $ 140,000 Total assets $ 450,000 $ 460,000 Current liabilities $ 60,000 $ 40,000 Total liabilities $ 130,000 $ 120,000 Common stock, $1 par value $ 120,000 $ 120,000 Total stockholders' equity $ 320,000 $340,000 Total liabilities and stockholders' equity $ 450,000 $ 460,000 This Year Sales (all on account) $ 700,000 Cost of goods sold $ 400,000 Gross margin $ 300,000 Net operating income $ 140,000 Interest expense $ 8,000 Net income $ 92,400 Foundational 14-10 10. What is the inventory turnover and the average sale period? (Use 365 days in a year. Round your intermediate and final answers to 2 decimal places.) 6.96 Inventory turnover Average sale period days Required information The Foundational 15 [LO14-2, L014-3, L014-4, LO14-5, L014-6) The following information applies to the questions displayed below.) Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Beginning Balance Balance Cash $ 35,000 $ 30,000 Accounts receivable $ 60,000 $50,000 Inventory $ 55,000 $ 60,000 Current assets $ 150,000 $ 140,000 Total assets $ 450,000 $ 460,000 Current liabilities $ 60,000 $ 40,000 Total liabilities $ 130,000 $ 120,000 Common stock, $1 par value $ 120,000 $ 120,000 Total stockholders' equity $ 320,000 $340,000 Total liabilities and stockholders' equity $ 450,000 $ 460,000 Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $ 700,000 $ 400,000 $ 300,000 $ 140,000 $ 8,000 $ 92,400 Foundational 14-11 11. What is the company's operating cycle? (Round your intermediate and final answer to 2 decimal places.) Answer is complete but not entirely correct. Operating cycle 1.54 x days Required information The Foundational 15 [LO14-2, L014-3, L014-4, L014-5, L014-6) [The following information applies to the questions displayed below.) Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Beginning Balance Balance Cash $ 35,000 $ 30,000 Accounts receivable $ 60,000 $ 50,000 Inventory $ 55,000 $ 60,000 Current assets $ 150,000 $ 140,000 Total assets $ 450,000 $ 460,000 Current liabilities $ 60,000 $ 40,000 Total liabilities $ 130,000 $ 120,000 Common stock, $1 par value $ 120,000 $ 120,000 Total stockholders' equity $ 320,000 $340,000 Total liabilities and stockholders' equity $ 450,000 $ 460,000 This Year Sales (all on account) $700,000 Cost of goods sold $ 400,000 Gross margin $ 300,000 Net operating income $ 140,000 Interest expense $ 8,000 Net Income $ 92,400 Foundational 14-14 14. What is the debt-to-equity ratio at the end of this year? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Debt-to-equity ratio 40.00 Required information The Foundational 15 (L014-2, L014-3, L014-4, LO14-5, LO14-6] [The following information applies to the questions displayed below.) Markus Company's common stock sold for $2.75 per share at the end of this year. The company paid a common stock dividend of $0.55 per share this year. It also provided the following data excerpts from this year's financial statements: Ending Beginning Balance Balance Cash $ 35,000 $ 30,000 Accounts receivable $ 60,000 $ 50,000 Inventory $ 55,000 $ 60,000 Current assets $ 150,000 $ 140,000 Total assets $ 450,000 $ 460,000 Current liabilities $ 60,000 $ 40,000 Total liabilities $ 130,000 $ 120,000 Common stock, $1 par value $ 120,000 $ 120,000 Total stockholders' equity $ 320,000 $340,000 Total liabilities and stockholders' equity $ 450,000 $ 460,000 Sales (all on account) Cost of goods sold Gross margin Net operating income Interest expense Net income This Year $ 700,000 $ 400,000 $ 300,000 $ 140,000 $ 8,000 $ 92,400 Foundational 14-15 15. What is the equity multiplier? (Round your answer to 2 decimal places.) Answer is complete but not entirely correct. Equity multiplier 1.40