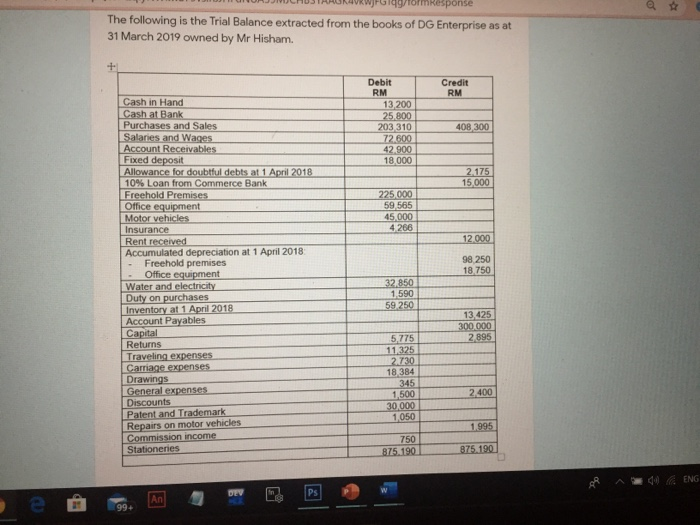

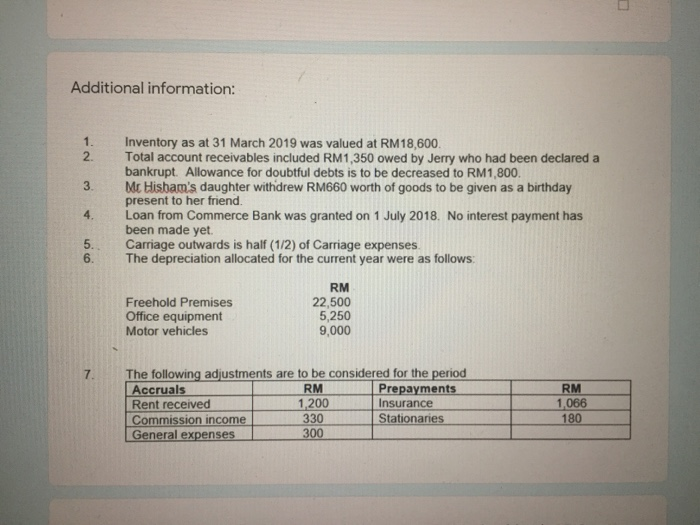

o response The following is the Trial Balance extracted from the books of DG Enterprise as at 31 March 2019 owned by Mr Hisham. Credit RM Debit RM 13 200 25,800 203 310 72 600 42.900 18.000 408 300 2.175 15 000 225.000 59,565 45,000 4 266 12.000 98 250 18.750 Cash in Hand Cash at Bank Purchases and Sales Salaries and Wages Account Receivables Fixed deposit Allowance for doubtful debts at 1 April 2018 10% Loan from Commerce Bank Freehold Premises Office equipment Motor vehicles Insurance Rent received Accumulated depreciation at 1 April 2018 Freehold premises Office equipment Water and electricity Duty on purchases Inventory at 1 April 2018 Account Payables Capital Returns Traveling expenses Carriage expenses Drawings General expenses Discounts Patent and Trademark Repairs on motor vehicles Commission income Stationeries 32,850 1,590 59 250 13,425 300.000 2,895 5,775 11 325 2.730 18,384 345 1500 30.000 1050 2,400 1.995 750 875.190 875190 ENG DEV An 99. Additional information: 1. 2. 3 Inventory as at 31 March 2019 was valued at RM18,600. Total account receivables included RM1,350 owed by Jerry who had been declared a bankrupt. Allowance for doubtful debts is to be decreased to RM1,800. Mc Hisham's daughter withdrew RM660 worth of goods to be given as a birthday present to her friend. Loan from Commerce Bank was granted on 1 July 2018. No interest payment has been made yet Carriage outwards is half (1/2) of Carriage expenses. The depreciation allocated for the current year were as follows: 4. 5. 6. Freehold Premises Office equipment Motor vehicles RM 22,500 5,250 9,000 7. The following adjustments are to be considered for the period Accruals RM Prepayments Rent received 1,200 Insurance Commission income 330 Stationaries General expenses 300 RM 1,066 180 Commission income General expenses 330 300 Insurance Stationaries 1,066 180 Prepare the Statement of Profit or Loss for the year ended 31 March 2019. 20 points Upload your answer in PDF format with FULL NAME, STUDENT ID and GROUP. * 1 Add File 13 points Prepare the Statement of Financial Position as at 31 March 2019. Upload your answer in PDF format with your FULL NAME, STUDENT ID, and GROUP. * 1 Add File Back Next Page 4 of 6 Dlour submit nasswords through Google Forms