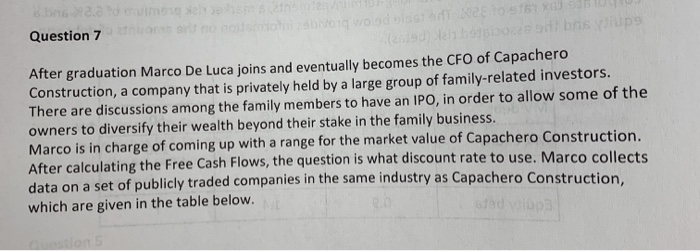

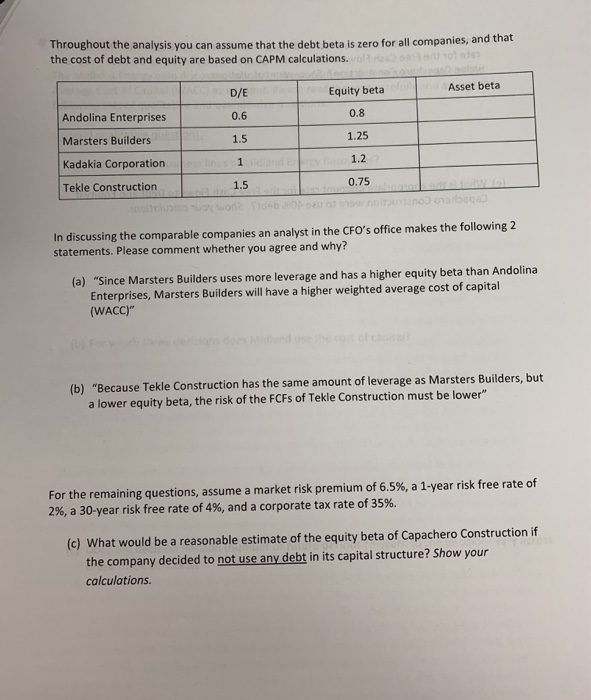

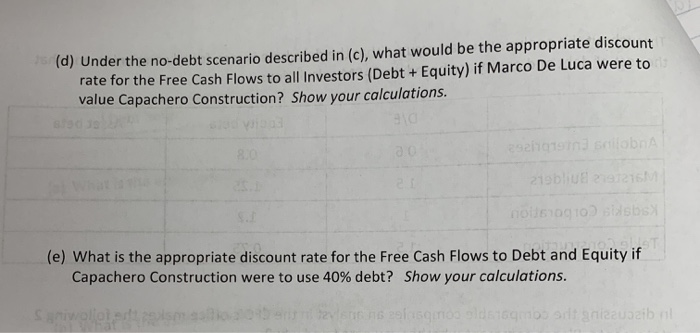

O S Question 7 After graduation Marco De Luca joins and eventually becomes the CFO of Capachero Construction, a company that is privately held by a large group of family-related investors. There are discussions among the family members to have an IPO, in order to allow some of the owners to diversify their wealth beyond their stake in the family business. Marco is in charge of coming up with a range for the market value of Capachero Construction. After calculating the Free Cash Flows, the question is what discount rate to use. Marco collects data on a set of publicly traded companies in the same industry as Capachero Construction. which are given in the table below. Throughout the analysis you can assume that the debt beta is zero for all companies, and that the cost of debt and equity are based on CAPM calculations Equity beta Asset beta 0.8 D/E 0.6 1.5 on lines 1 1.5 Andolina Enterprises Marsters Builders Kadakia Corporation Tekle Construction L dland 1.25 1.2 0.75 In discussing the comparable companies an analyst in the CFO's office makes the following 2 statements. Please comment whether you agree and why? (a) "Since Marsters Builders uses more leverage and has a higher equity beta than Andolina Enterprises, Marsters Builders will have a higher weighted average cost of capital (WACC)" (b) "Because Tekle Construction has the same amount of leverage as Marsters Builders, but a lower equity beta, the risk of the FCFs of Tekle Construction must be lower" For the remaining questions, assume a market risk premium of 6.5%, a 1-year risk free rate of 2%, a 30-year risk free rate of 4%, and a corporate tax rate of 35%. (c) What would be a reasonable estimate of the equity beta of Capachero Construction if the company decided to not use any debt in its capital structure? Show your calculations. (d) Under the no-debt scenario described in (c), what would be the appropriate discount rate for the Free Cash Flows to all Investors (Debt + Equity) if Marco De Luca were to value Capachero Construction? Show your calculations. ngoba bu 16M (e) What is the appropriate discount rate for the Free Cash Flows to Debt and Equity if Capachero Construction were to use 40% debt? Show your calculations. Solo2 Olandeza zibil