Answered step by step

Verified Expert Solution

Question

1 Approved Answer

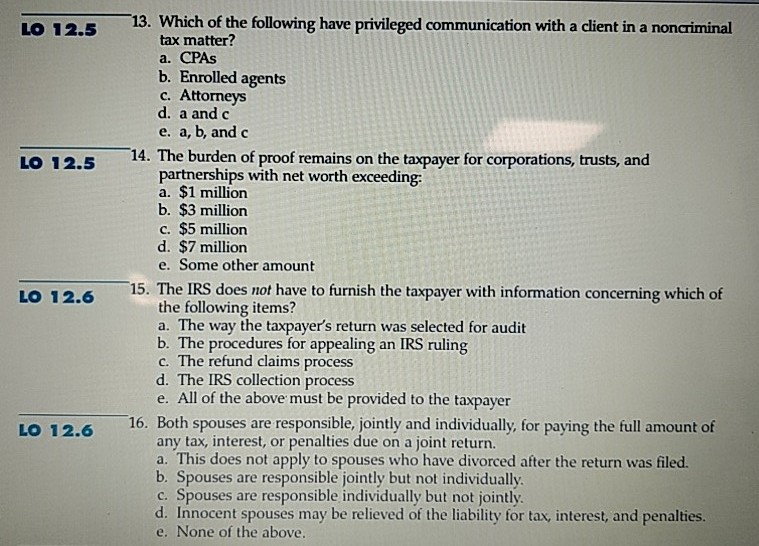

O2513. Which of the following have privileged communication with a client in a noncriminal tax matter? a. CPAs b. Enrolled agents c. Attorneys d. a

O2513. Which of the following have privileged communication with a client in a noncriminal tax matter? a. CPAs b. Enrolled agents c. Attorneys d. a and c e. a, b, and c LO 12.5 14. The burden of proof remains on the taxpayer for corporations, trusts, and partnerships with net worth exceeding a. $1 million b. $3 million c. $5 million d. $7 million e. Some other amount 15. The IRS does not have to furnish the taxpayer with information concerning which of the following items? a. The way the taxpayer's return was selected for audit b. The procedures for appealing an IRS ruling C. The refund claims process d. The IRS collection process e. All of the above must be provided to the taxpayer 1026 16. Both spouses are responsible, jointly and individually, for paying the full amount of any tax, interest, or penalties due on a joint return. a. This does not apply to spouses who have divorced after the return was filed. pouses are responsible jointly but not individually c. Spouses are responsible individually but not jointly d. Innocent spouses may be relieved of the liability for tax, interest, and penalties. e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started