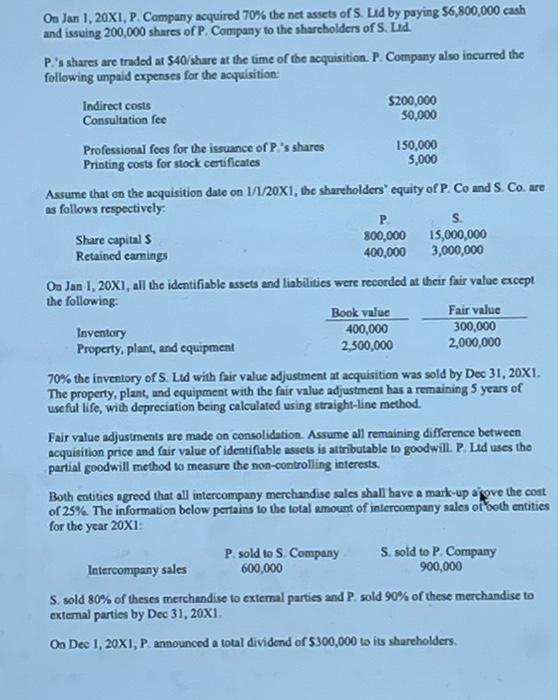

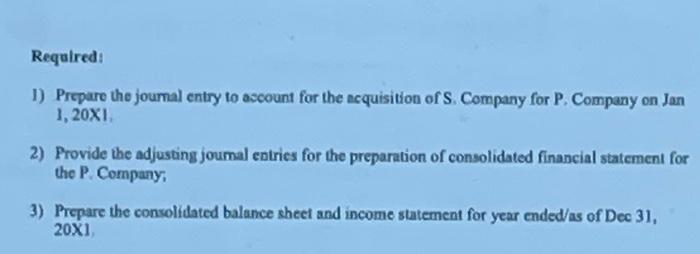

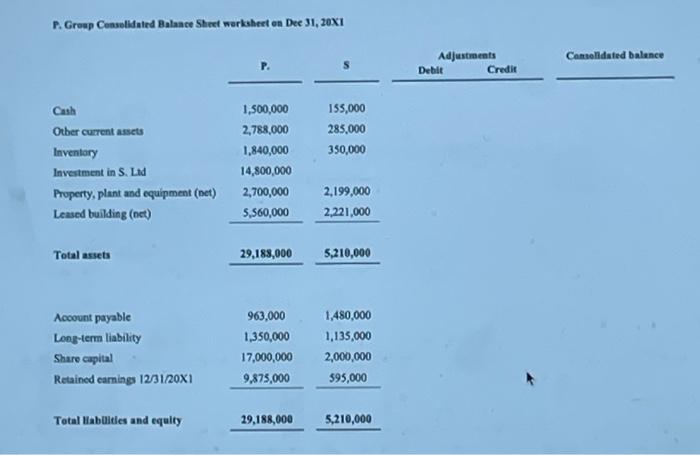

Oa Jan 1, 20X1, P. Company acquired 70% the net assets of S. Ld by paying $6,800,000cash and issuing 200,000 shares of P, Company to the sharebolders of S. Led. P. 's shares are traded at $40 share at the time of the acquisition. P. Company also incurred the following unpaid expenses for the acquisition: Assume that on the acquisition date on 1/1/20X, the shareholders" equity of P. Co and S. Co, are as follows remertivelve Oa Jan 1,20X1, all the identifiable assets and liabilities were recorded at their fair value except 70% the inventory of S. Led with fair value adjustment at acquisition was sold by Dec 31, 20X1. The property, plant, and equipment with the fair value adjustment has a remaining 5 years of useful life, with depreciation being calculated using straight-line method. Fair value adjustments are made on consolidation. Assume all remaining difference between acquisition price and fair value of identifiable assets is attributable to goodwill. P. LAd uses the partial goodwill method to measure the non-controlling interests. Both entities agreed that all intercompany merchandise sales shall bave a mark-up ajpve the coat of 25%. The information below pertains to the total amount of intercompany sales of ooth entities for the year 20X1: S. sold 80% of theses merchandise to external parties and P. sold 90% of these merchandise to extemal parties by Dec 31, 20X1. Oa Dec 1,20XI,P. announced a total dividend of $300,000 to its sharcholders. Required! 1) Prepare the joumal entry to ascount for the acquisition of S. Company for P. Company on Jan 1,201. 2) Provide the adjusting joumal entries for the preparation of consolidated financial statement for the P. Company; 3) Prepare the consolidated balance sheet and income statement for year ended/as of Dec 31, 201, P. Greap CeasolMated Balance Sheet werksheet en Dec 31, 20XI Oa Jan 1, 20X1, P. Company acquired 70% the net assets of S. Ld by paying $6,800,000cash and issuing 200,000 shares of P, Company to the sharebolders of S. Led. P. 's shares are traded at $40 share at the time of the acquisition. P. Company also incurred the following unpaid expenses for the acquisition: Assume that on the acquisition date on 1/1/20X, the shareholders" equity of P. Co and S. Co, are as follows remertivelve Oa Jan 1,20X1, all the identifiable assets and liabilities were recorded at their fair value except 70% the inventory of S. Led with fair value adjustment at acquisition was sold by Dec 31, 20X1. The property, plant, and equipment with the fair value adjustment has a remaining 5 years of useful life, with depreciation being calculated using straight-line method. Fair value adjustments are made on consolidation. Assume all remaining difference between acquisition price and fair value of identifiable assets is attributable to goodwill. P. LAd uses the partial goodwill method to measure the non-controlling interests. Both entities agreed that all intercompany merchandise sales shall bave a mark-up ajpve the coat of 25%. The information below pertains to the total amount of intercompany sales of ooth entities for the year 20X1: S. sold 80% of theses merchandise to external parties and P. sold 90% of these merchandise to extemal parties by Dec 31, 20X1. Oa Dec 1,20XI,P. announced a total dividend of $300,000 to its sharcholders. Required! 1) Prepare the joumal entry to ascount for the acquisition of S. Company for P. Company on Jan 1,201. 2) Provide the adjusting joumal entries for the preparation of consolidated financial statement for the P. Company; 3) Prepare the consolidated balance sheet and income statement for year ended/as of Dec 31, 201, P. Greap CeasolMated Balance Sheet werksheet en Dec 31, 20XI