Answered step by step

Verified Expert Solution

Question

1 Approved Answer

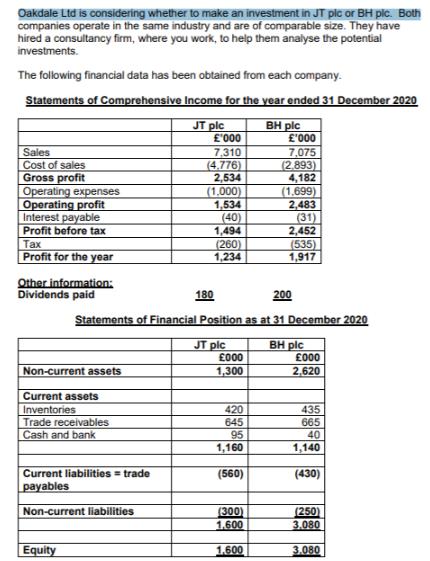

Oakdale Ltd is considering whether to make an investment in JT plc or BH plc. Both companies operate in the same industry and are

Oakdale Ltd is considering whether to make an investment in JT plc or BH plc. Both companies operate in the same industry and are of comparable size. They have hired a consultancy firm, where you work, to help them analyse the potential investments. The following financial data has been obtained from each company. Statements of Comprehensive Income for the year ended 31 December 2020 BH plc Sales Cost of sales Gross profit Operating expenses Operating profit Interest payable Profit before tax Tax Profit for the year Other information: Dividends paid Non-current assets Current assets Inventories Trade receivables Cash and bank Current liabilities = trade payables 200 Statements of Financial Position as at 31 December 2020 JT pic BH plc Non-current liabilities Equity JT plic '000 7,310 (4.776) 2,534 (1.000) 1,534 (40) 1,494 (260) 1,234 180 000 1,300 420 645 95 1,160 (560) (300) 1.600 '000 7,075 (2.893) 4,182 (1,699) 2,483 (31) 1.600 2,452 (535) 1,917 000 2,620 435 665 40 1,140 (430) (250) 3.080 3.080

Step by Step Solution

There are 3 Steps involved in it

Step: 1

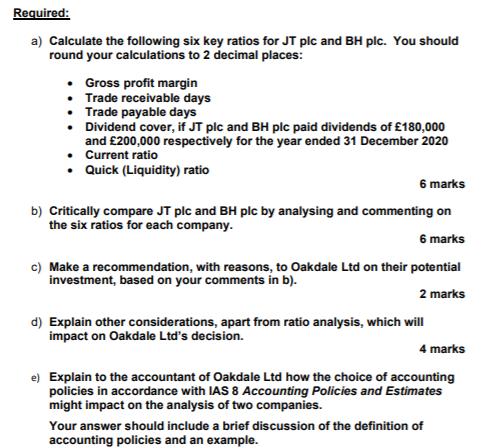

Answer b Critical comparison of JT plc and BH plc Gross Profit Margin BH plc has a significantly higher gross profit margin than JT plc indicating bet...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started