Question

Oasis Footwear. Ltd. has been a recognized footwear company in South India. It is headquartered in Bangalore and has sales offices and franchises in almost

Oasis Footwear. Ltd. has been a recognized footwear company in South India. It is headquartered in Bangalore and has sales offices and franchises in almost all the states in South India. The company was experiencing dwindling sales revenue in the recent past. The merger of two other footwear firms created intense competition in the segment. Sam Alex (Sam) had recently joined Oasis Footwear. Ltd as a Managing Director (MD) and the responsibility to regain the lustre and bring back the past glory, fell on his shoulders. Sam felt the need of making substantial changes in the capital structure of the company to improve the turmoil the company is facing. However, he does not have much idea on various forms of capital structure and how it is likely to impact the value of Oasis Footwear. His financial decision involves choosing the right mix of the owned fund and borrowed funds in the capital structure.

Analyse the capital structure theories based on the following information (show the impact of capital structure on WACC and the firm value):

a. Net Income approach: assume that firm is using 30 crores debt initially, then goes for 40 crores.?

b. Traditional approach:?

i. Scenario I: No debt.

ii. Scenario II- 30 cr debt (Assume the given cost of debt and equity)

iii. Scenario III- 40 cr debt (kd=11% and Ke=14%)

iv. Scenario IV- 50 cr debt (kd=12% and Ke=14.5%)

v. What is the optimal level of D/E and WACC among the above scenarios?

c. Net Operating Income approach: Assume the overall cost of capital as 12.4%. Use scenarios where: [3 Marks]

i. Debt is 30 crores (Assume Kd=10%)

ii. Debt is 40 crores (Assume Kd=10%)

d. MM Proposition I: Scenario I= Unlevered; Scenario II= Levered with 30 cr debt (Assume the given cost of debt and equity). Show the arbitrage process.

e. MM Proposition II: The debt is 30 cr and follows the given cost of equity and debt. The Tax rate is 35%.

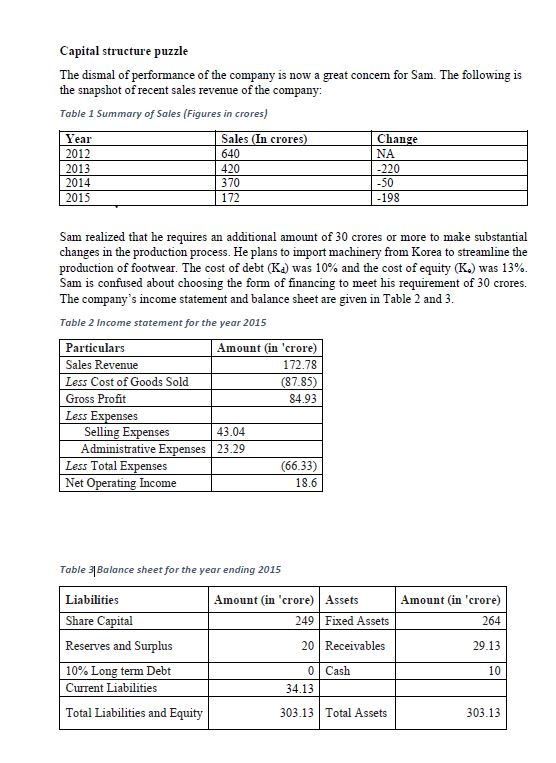

Capital structure puzzle The dismal of performance of the company is now a great concern for Sam. The following is the snapshot of recent sales revenue of the company: Table 1 Summary of Sales (Figures in crores) Year 2012 2013 2014 2015 Selling Expenses Sales (In crores) 640 420 370 172 Sam realized that he requires an additional amount of 30 crores or more to make substantial changes in the production process. He plans to import machinery from Korea to streamline the production of footwear. The cost of debt (Ka) was 10% and the cost of equity (K.) was 13%. Sam is confused about choosing the form of financing to meet his requirement of 30 crores. The company's income statement and balance sheet are given in Table 2 and 3. Table 2 Income statement for the year 2015 Particulars Sales Revenue Less Cost of Goods Sold Gross Profit Less Expenses 43.04 Administrative Expenses 23.29 Less Total Expenses Net Operating Income Amount (in 'crore) 172.78 (87.85) 84.93 (66.33) 18.6 Table 3 Balance sheet for the year ending 2015 Liabilities Share Capital Reserves and Surplus 10% Long term Debt Current Liabilities Total Liabilities and Equity Change -220 -50 -198 Amount (in 'crore) Assets 249 Fixed Assets 20 Receivables 0 Cash 34.13 303.13 Total Assets Amount (in 'crore) 264 29.13 10 303.13

Step by Step Solution

3.53 Rating (174 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER a Net Income approach Using the Net Income approach we assume that the firms net income is constant and any increase in debt results in a corresponding increase in earnings per share EPS The fo...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started