Question

Oates Company's payroll for the week ending January 15 amounted to $150,000. The following deductions were withheld from employees' salaries and wages: Federal Income

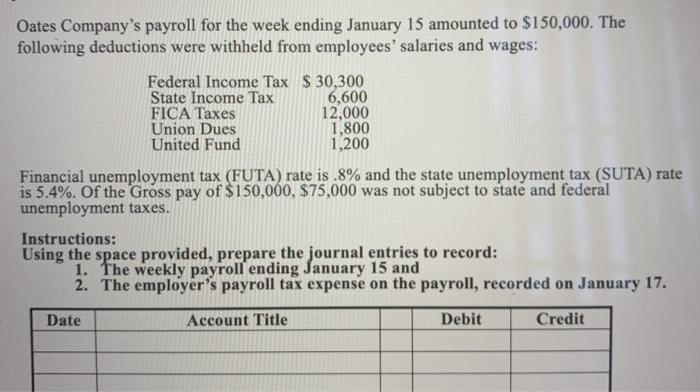

Oates Company's payroll for the week ending January 15 amounted to $150,000. The following deductions were withheld from employees' salaries and wages: Federal Income Tax $30,300 State Income Tax 6,600 12,000 FICA Taxes Union Dues United Fund 1,800 1,200 Financial unemployment tax (FUTA) rate is .8% and the state unemployment tax (SUTA) rate is 5.4%. Of the Gross pay of $150,000, $75,000 was not subject to state and federal unemployment taxes. Instructions: Using the space provided, prepare the journal entries to record: The weekly payroll ending January 15 and 1. 2. The employer's payroll tax expense on the payroll, recorded on January 17. Date Account Title Debit Credit

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

1 2 Account Title Salaries expense Federal Income tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Financial Accounting

Authors: Warren, Reeve, Duchac

12th Edition

1133952410, 9781133952411, 978-1133952428

Students also viewed these Accounting questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App