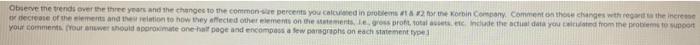

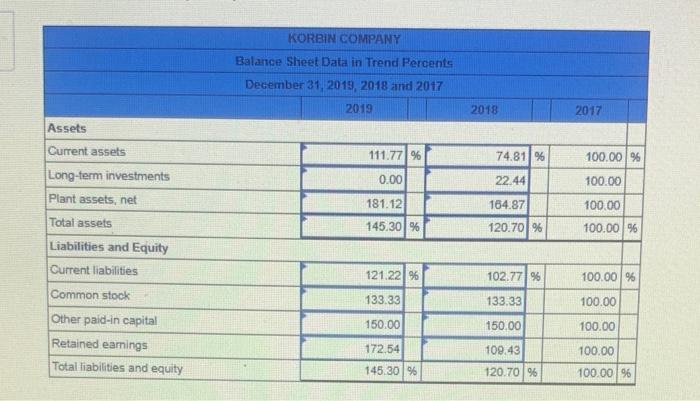

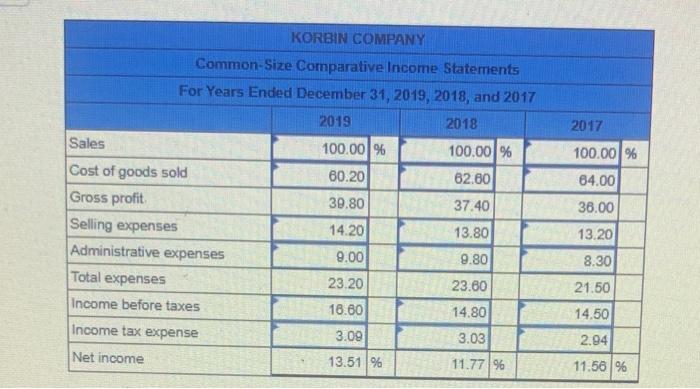

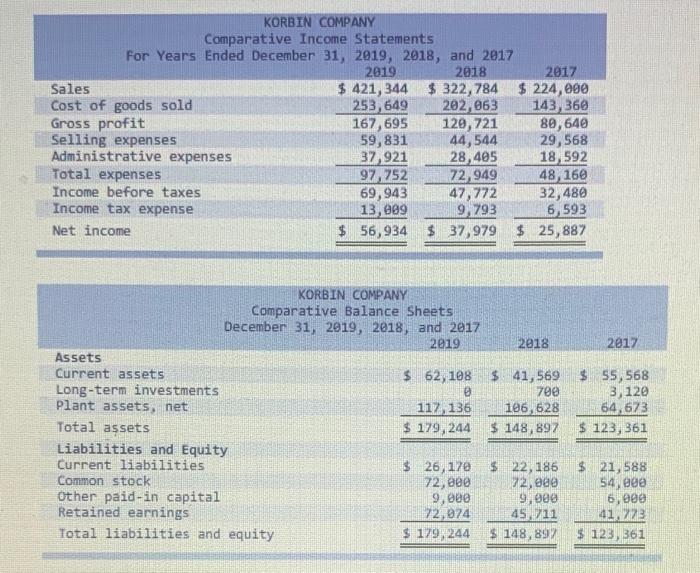

Obieve the trends over the three years and the changes to the common percents you calculated in problem for the Korbin Company comment on the changes with the increase ex decrease of themes and the relation to how they affected other mens on the ment, le gross proft. totalude the data you from the problemstown your comments Your wer part one ha page and encompass a few argraphs on each statement type KORBIN COMPANY Balance Sheet Data in Trend Percents December 31, 2019, 2018 and 2017 2019 2018 2017 Assets Current assets 111.77% 74.81% 100.00 % 0.00 Long-term investments Plant assets, net 22.44 100.00 164.87 181.12 145.30% Total assets 100.00 100.00 % 120.70% Liabilities and Equity Current liabilities 102.77% 100.00% Common stock 121.22 %6 133.33 133.33 100.00 150.00 150.00 100.00 Other paid-in capital Retained earnings Total liabilities and equity 172.54 109.43 145,30 % 100.00 100.00 % 120.70% KORBIN COMPANY Common-Size Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales 100.00% 100.00 % 100.00% 60.20 62.60 64.00 39.80 37.40 36.00 14.20 13.80 13.20 Cost of goods sold Gross profit Selling expenses Administrative expenses Total expenses Income before taxes Income tax expense Net income 9.00 9.80 8.30 23.20 23.60 21.50 16.60 14.80 14.50 3.03 2.94 3.09 13.51% 11.77% 11.56% KORBIN COMPANY Comparative Income Statements For Years Ended December 31, 2019, 2018, and 2017 2019 2018 2017 Sales $ 421, 344 $ 322,784 $ 224,000 Cost of goods sold 253,649 202,063 143) 360 Gross profit 167,695 129,721 80,640 Selling expenses 59,831 44,544 29,568 Administrative expenses 37,921 28,405 18 592 Total expenses 97,752 72,949 48,160 Income before taxes 69,943 47,772 32,480 Income tax expense 13,009 9,793 6,593 Net income $ 56,934 $ 37,979 $ 25,887 KORBIN COMPANY Comparative Balance Sheets December 31, 2019, 2018, and 2017 2019 2018 2017 Assets Current assets $ 62, 108 $ 41,569 $ 55,568 Long-term investments 700 3,120 plant assets, net 117, 136 106,628 64,673 Total assets $ 179,244 $ 148,897 $ 123, 361 Liabilities and Equity Current liabilities $ 26,170 $ 22,186 $ 21,588 Common stock 72,000 72, ee 54,900 Other paid-in capital 9,800 9,000 6,990 Retained earnings 72,074 45211 41,228 Total liabilities and equity $ 179,244 $ 148,89% $ 123, 361