Answered step by step

Verified Expert Solution

Question

1 Approved Answer

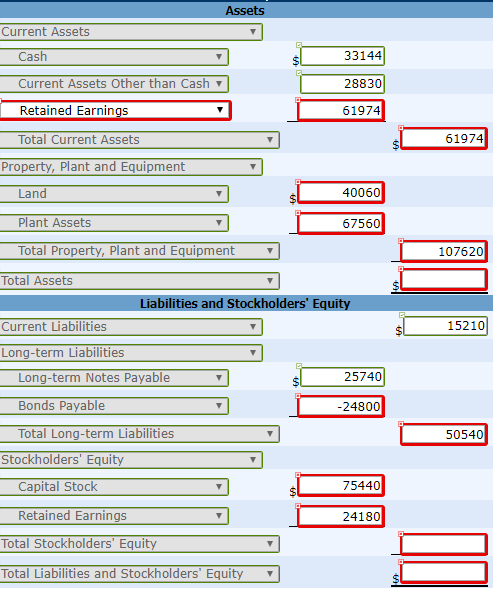

obim Inc., had the following condensed balance sheet at the end of operations for 2013. JOBIM INC. BALANCE SHEET DECEMBER 31, 2013 Cash $8,640 Current

obim Inc., had the following condensed balance sheet at the end of operations for 2013.

| JOBIM INC. BALANCE SHEET DECEMBER 31, 2013 | ||||||

| Cash | $8,640 | Current liabilities | $15,210 | |||

| Current assets other than cash | 28,830 | Long-term notes payable | 25,740 | |||

| Investments | 20,280 | Bonds payable | 24,800 | |||

| Plant assets (net) | 67,560 | Capital stock | 75,440 | |||

| Land | 40,060 | Retained earnings | 24,180 | |||

| $165,370 | $165,370 | |||||

During 2014, the following occurred.

| 1. | A tract of land was purchased for $10,630. | |

| 2. | Bonds payable in the amount of $19,900 were retired at par. | |

| 3. | An additional $10,160 in capital stock was issued at par. | |

| 4. | Dividends totaling $9,376 were paid to stockholders. | |

| 5. | Net income was $29,940 after deducting depreciation of $13,850. | |

| 6. | Land was purchased through the issuance of $22,200 in bonds. | |

| 7. | Jobim Inc. sold part of its investment portfolio for $12,790. This transaction resulted in a gain of $2,330 for the company. The company classifies the investments as available-for-sale. | |

| 8. | Both current assets (other than cash) and current liabilities remained at the same amount. |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started