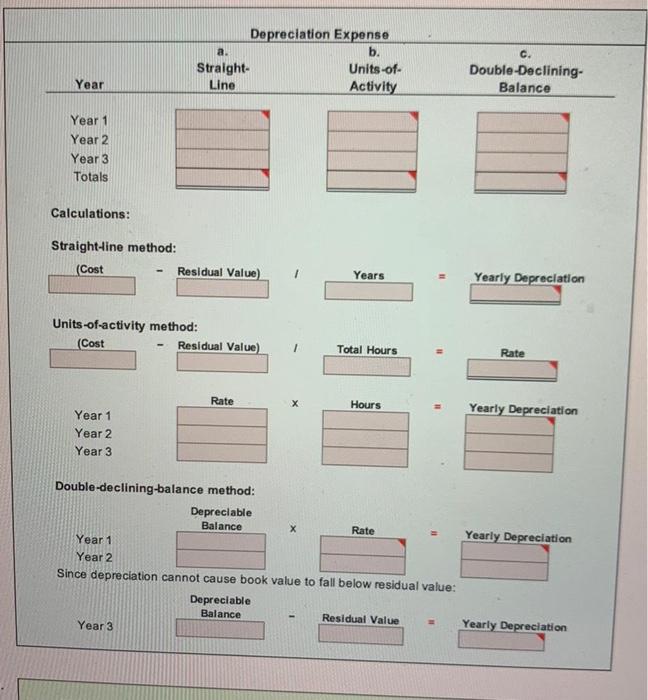

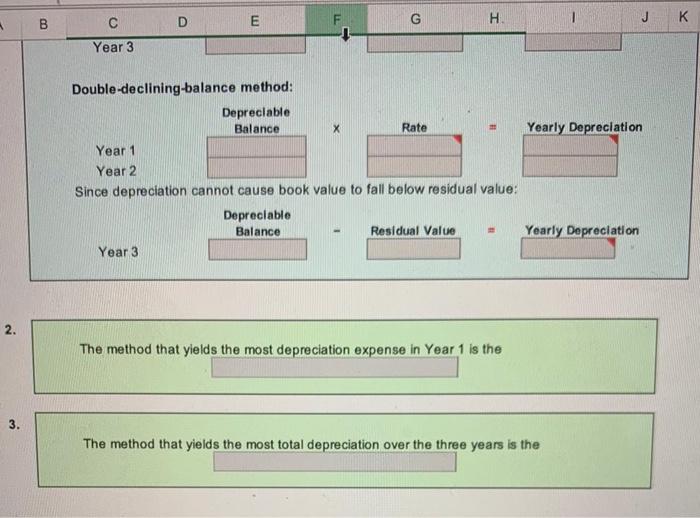

OBJ. 2 1. a. Year 1: straight ne depreciation 22,500 PR 10-2A comparing three depreciation methods Dexter Industries purchased packaging equipment on January 8 for $72,000. The equip ment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $4,500. The equipment was used for 7,600 hours during Year 1, 6,000 hours in Year 2, and 4,400 hours in Year 3. Instructions 1. Determine the amount of depreciation expense for the three years ending December 31 by (a) the straight-line method, (b) the units-of-activity method, and (c) the double- declining balance method. Also determine the total depreciation expense for the three years by each method. The following columnar headings are suggested for recording the depreciation expense amounts: Excel Show Me How Straight- Line Method Depreciation Expense Units-of- Double-Declining- Activity Balance Method Method Year 2. What method yields the highest depreciation expense for Year 1? 3. What method yields the most depreciation over the three-year life of the equipment? OBJ. 2 a. Year 1: 565,250 Excel PR 10-3A Depreciation by three methods; partial years Perdue Company purchased equipment on April 1 for $270,000. The equipment was expected to have a useful life of three years, or 18,000 operating hours, and a residual value of $9,000. The equipment was used for 7,500 hours during Year 1, 5,500 hours in Year 2, 4,000 hours in Year 3, and 1,000 hours in Year 4. Instructions Determine the amount of depreciation expense for the years ended December 31, Year 1. Year 2 Year 3, and Year 4, by (a) the straight-line method, (b) the units-of-activity method, and (c) the double-declining-balance method. 1.b. Year 1: $320,000 depreciation expense PR 10-4A Depreciation by two methods; sale of fixed asset OBJ. 2.3 New lithographic equipment, acquired at a cost of $800,000 on March 1 of Year 1 (begin- ning of the fiscal year), his an estimated useful life of five years and an estimated residual value of $90,000. The manager requested information regarding the effect of alternative methods on the amount of depreciation expense each year. On March 4 of Year 5, the equipment was sold for $135,000. Excel General Ledger Copyright 2018. Arights besarvad, may not be copied, and, or sluplicate in whole or in part. WON 09.200-303 Depreciation Expense a. b. Straight- Units-of- Line Activity C. Double-Declining- Balance Year Year 1 Year 2 Year 3 Totals Calculations: Straight-line method: (Cost Residual Value) Years Yearly Depreciation Units-of-activity method: (Cost Residual Value) 1 Total Hours Rate Rate Hours Yearly Depreciation Year 1 Year 2 Year 3 Yearly Depreciation Double-declining-balance method: Depreciable Balance Rate Year 1 Year 2 Since depreciation cannot cause book value to fall below residual value: Depreciable Balance Residual Value Year 3 Yearly Depreciation D E 00 G H. J K Year 3 Yearly Depreciation Double-declining-balance method: Depreciable Balance Rate Year 1 Year 2 Since depreciation cannot cause book value to fall below residual value: Depreclable Balance Residual Value Year 3 - Yearly Depreciation 2 . The method that yields the most depreciation expense in Year 1 is the 3. The method that yields the most total depreciation over the three years is the