Answered step by step

Verified Expert Solution

Question

1 Approved Answer

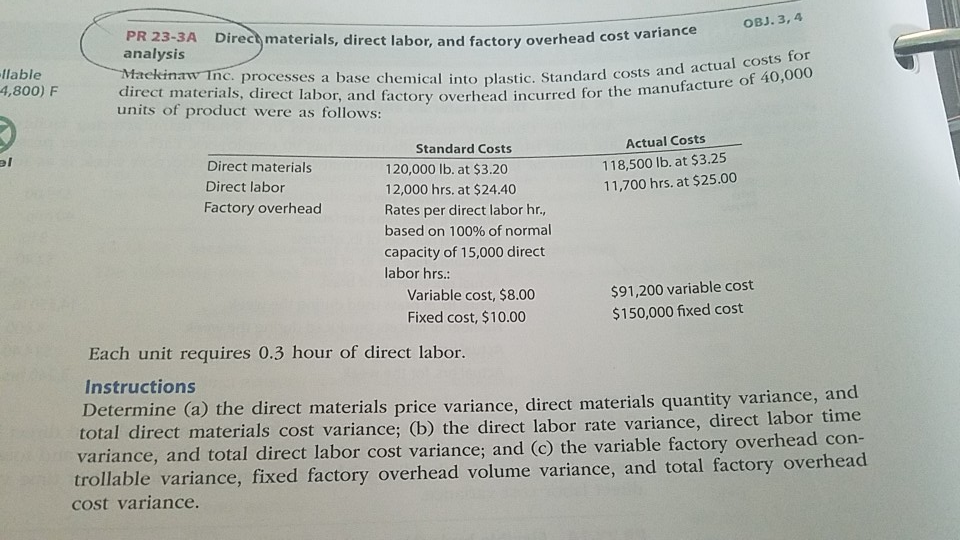

OBJ. 3, 4 PR 23-3A Direct materials, direct labor, and factory overhead cost variance analysis lable 4,800) F nc. proces ses a base chemical into

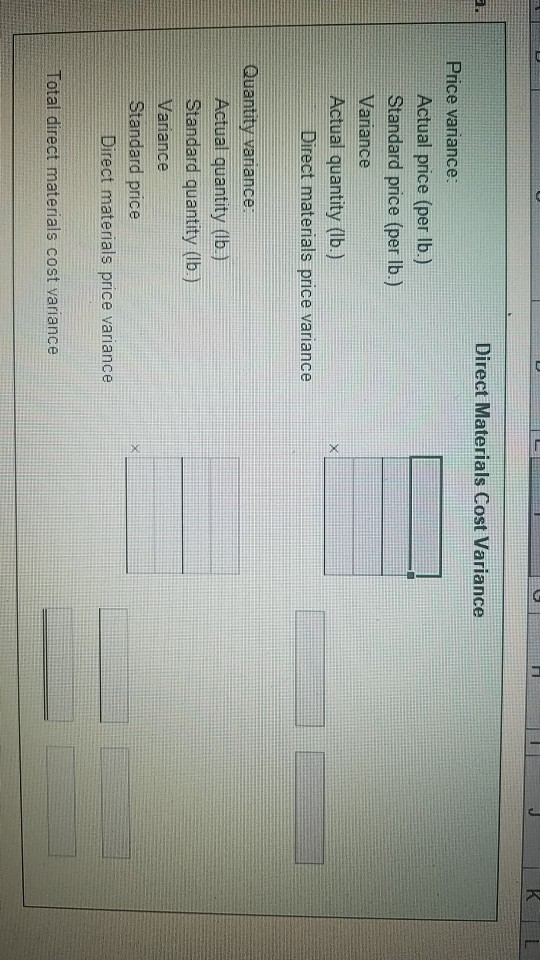

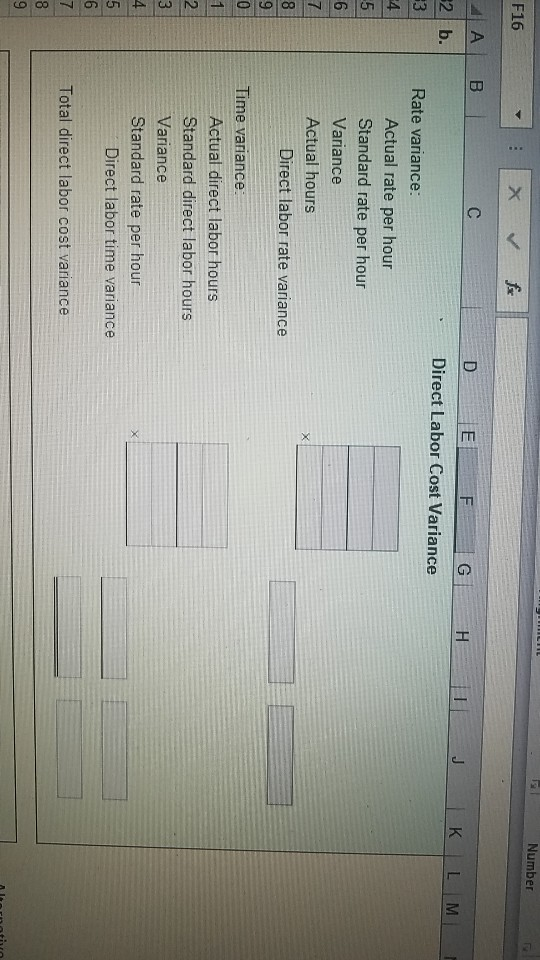

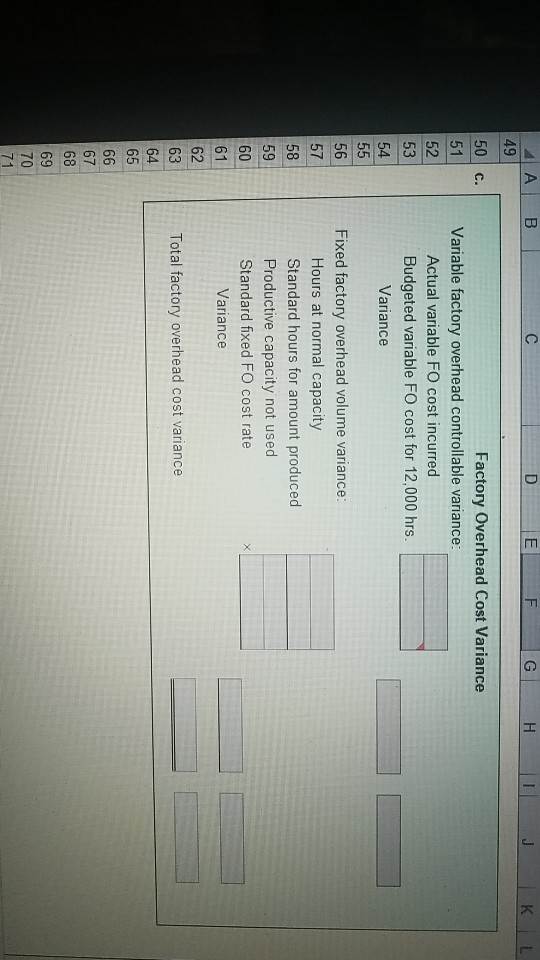

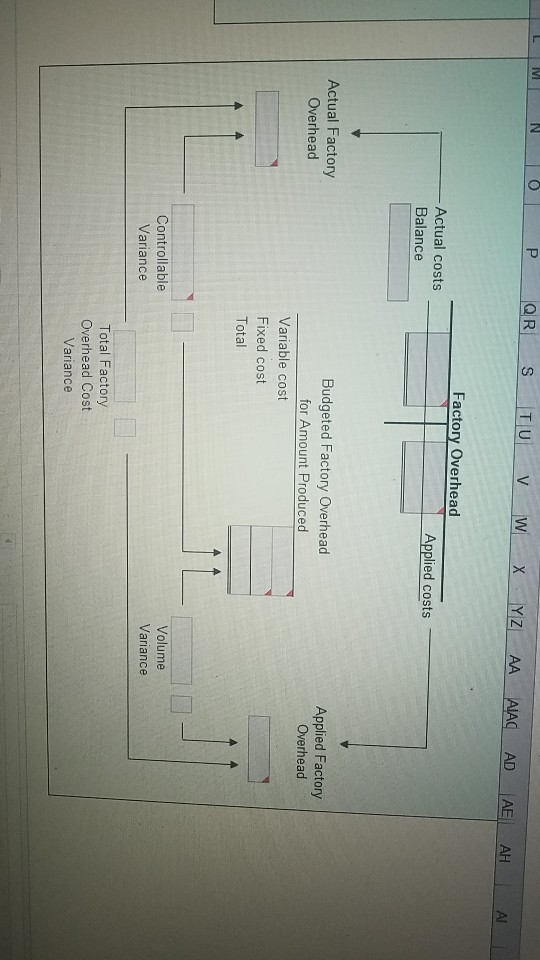

OBJ. 3, 4 PR 23-3A Direct materials, direct labor, and factory overhead cost variance analysis lable 4,800) F nc. proces ses a base chemical into plastic. Standard costs and actual costs to manufacture of 40,000 direct materials, direct labor, and factory overhead incurred for the units of product were as follows: Actual Costs 118,500 lb. at $3.25 11,700 hrs. at $25.00 Standard Costs el Direct materials Direct labor Factory overhead 120,000 lb. at $3.20 12,000 hrs. at $24.40 Rates per direct labor hr., based on 100% of normal capacity of 15,000 direct labor hrs. Variable cost, $8.00 Fixed cost, $10.00 $91,200 variable cost $150,000 fixed cost Each unit requires 0.3 hour of direct labor. Instructions Determine (a) the direct materials price variance, direct materials quanti total direct materials cost variance; (b) the direct labor rate variance variance, and total direct labor cost variance; and (c) the variable fac trollable ty variance, and direct labor time variance, fixed factory overhead volume variance, and total factory overhead cost variance KIL Direct Materials Cost Variance Price variance: Actual price (per lb.) Standard price (per lb.) Variance Actual quantity (lb.) Direct materials price variance Quantity variance Actual quantity (b) Standard quantity (lb) Vaiance Standard price Direct materials price variance Total direct materials cost variance Number F16 A B 2 b. K L M Direct Labor Cost Variance Rate variance Actual rate per hour Standard rate per hour Variance Actual hours Direct labor rate variance Time variance Actual direct labor hours Standard direct labor hours Variance Standard rate per hour Direct labor time variance Total direct labor cost variance 49 50 c. Factory Overhead Cost Variance Variable factory overhead controllable variance 52 53 Actual variable FO cost incurred Budgeted variable FO cost for 12,000 hrs. Variance 56 Fixed factory overhead volume variance 57 58 59 60 61 62 63 Hours at normal capacity Standard hours for amount produced Productive capacity not used Standard fixed FO cost rate Variance Total factory overhead cost variance 65 67 68 69 70 Factory Overhead Actual costs Balance Applied costs Actual Factory Overhead Budgeted Factory Overhead for Amount Produced Applied Factory Overhead Variable cost Fixed cost Total Controllable Variance Volume Variance Total Factory Overhead Cost Variance

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started