Question

(Objective: Audit Considerations) Three Stooges City has approached you concerning the audit of its 2017 financial statements. State law requires the city to have an

(Objective: Audit Considerations)

Three Stooges City has approached you concerning the audit of its 2017 financial statements. State law requires the city to have an audit and submit the audited financial report to the state. New elections at the beginning of the fiscal year resulted in a change in the administration of the city. Your firm and the audit firm that conducted the prior year's audit have been asked by the city to submit bids for the current year's audit. Since the new city administration is quite inexperienced, it has not provided you with a formal request for proposal (RFP). Therefore, you have the prior year's audit and financial reports, and little more information than the following for fiscal year 2017.

1. The new city controller is a certified public accountant who worked for a firm that specialized in government audits.

2. For the last three years the city has received a clean audit opinion. The prior auditor has declined the opportunity to perform the 2017 audit.

3. The city is receiving grants and other aid from state and federal sources totaling $3,977,000.

4. Total budgeted revenues for the year were $20,980,000 and expenditures were $25,749,000. Approximately 48 percent of revenues are from property taxes.

5. The city has six governmental funds, three enterprise funds, and an agency fund. You are also familiar with the city's downtown development district, which was not reported in the city's prior year financial statements.

6. It is five months until the end of fiscal year 2017.

7. You recently read in the newspaper that an employee at the citys wastewater facility has sued the city for wrongful termination. The employee was an accountant who claimed that wastewater billings were improperly being refunded to the new administrators and their families.

Required

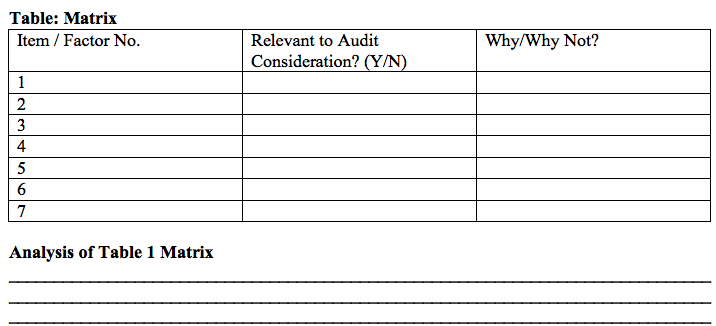

Prior to determining whether you would be interested in submitting a bid for the audit, you decide to use the information you have to draw up a list of factors that would affect the cost of your bid. Provide your list and explain why each item would affect your fee bid. In the format of the following graph:

Table: Matrix Item / Factor No. Why/Why Not? Relevant to Audit Consideration? (Y/N) 2 4 5 6 7 Analysis of Table 1 Matrix

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started