Question

Objective: CLO 2- To prepare consolidated financial statements for Malaysian company (CLO2: PLO6:C5) QUESTION 1 (20 MARKS) Given below are the statements of profit or

Objective: CLO 2- To prepare consolidated financial statements for Malaysian company (CLO2: PLO6:C5)

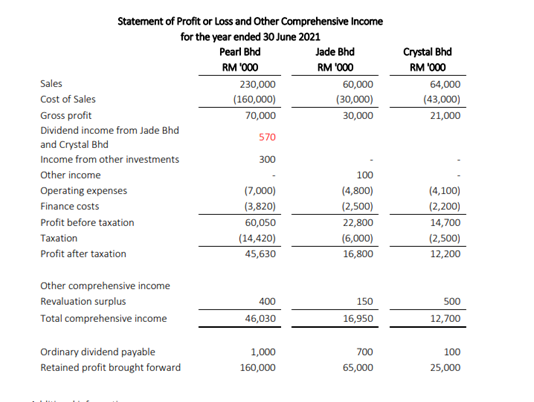

QUESTION 1 (20 MARKS) Given below are the statements of profit or loss and other comprehensive income of Pearl Bhd, Jade Bhd and Crystal Bhd for the year ended 30 June 2021

Additional information:

1. Pearl Bhd acquired 70% of the 70 million issued ordinary shares of Jade Bhd on 1 July 2018 for RM80 million. On this date, the retained profit of Jade Bhd was RM15 million.

2. On 1 July 2019, a total of 8 million out of the 10 million issued ordinary shares of Crystal Bhd was acquired at a cost of RM20 million. At that date, the retained profit of Crystal Bhd was RM10 million.

3. During the year 2021, Pearl Bhd sold goods valued of RM5 million to Crystal Bhd. A balance of RM1.5 million of the goods are remained in the inventory of Crystal Bhd at the end of the year. All sales are invoiced at a profit of 20% on sales.

4. Pearl Bhd also found to have an interest of 40% in another companies, Shine Bhd and Glow Bhd since year 2019. Shine Bhd reported a profit after tax in the year ended 2021 amounting to RM 10 million while Glow Bhds profits amounted to RM5 million.

5. All expenses and revenue are deemed to accrue evenly throughout the year.

6. Policy of the group is to measure non-controlling interests at their proportionate interest in the value of the net assets of the subsidiary.

Required:

a. Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive Income for the year ended 30 June 2021. (14 marks)

b. Determine the group retained profit balance as at 30 June 2021.

.

Sales Crystal Bhd RM 1000 64,000 (43,000) 21,000 Statement of Profit or loss and Other Comprehensive Income for the year ended 30 June 2021 Pearl Bhd Jade Bhd RM '000 RM 1000 230,000 60,000 Cost of Sales (160,000) (30,000) Gross profit 70,000 30,000 Dividend income from Jade Bhd 570 and Crystal Bhd Income from other investments 300 Other income 100 Operating expenses (7,000) (4,800) Finance costs (3,820) (2,500) Profit before taxation 60,050 22,800 Taxation (14,420) (6,000) Profit after taxation 45,630 16,800 (4,100) (2,200) 14,700 (2,500) 12,200 Other comprehensive income Revaluation surplus Total comprehensive income 400 150 16,950 500 12,700 46,030 Ordinary dividend payable Retained profit brought forward 1,000 160,000 700 65,000 100 25,000Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started