Question

Objective: Construct a monthly repayment schedule for a purchase using a credit card. The Project: You have just received a new University of Mississippi credit

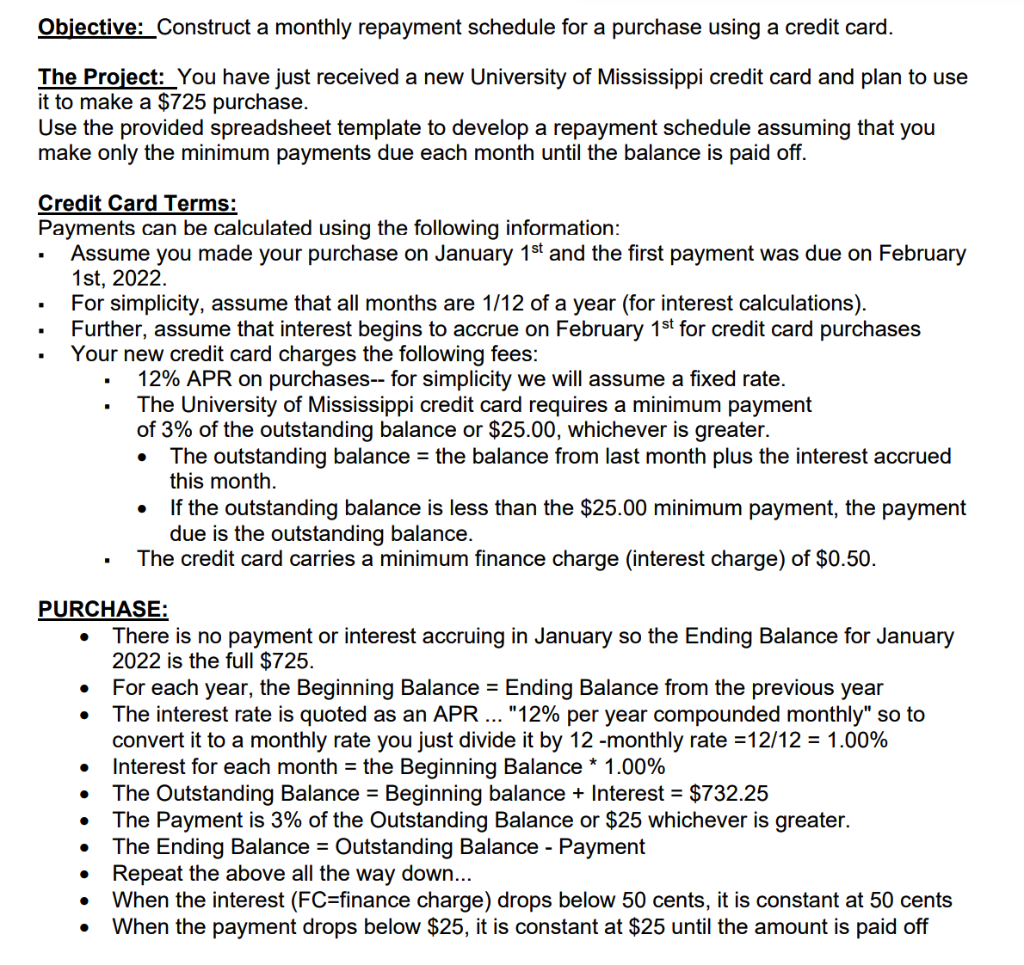

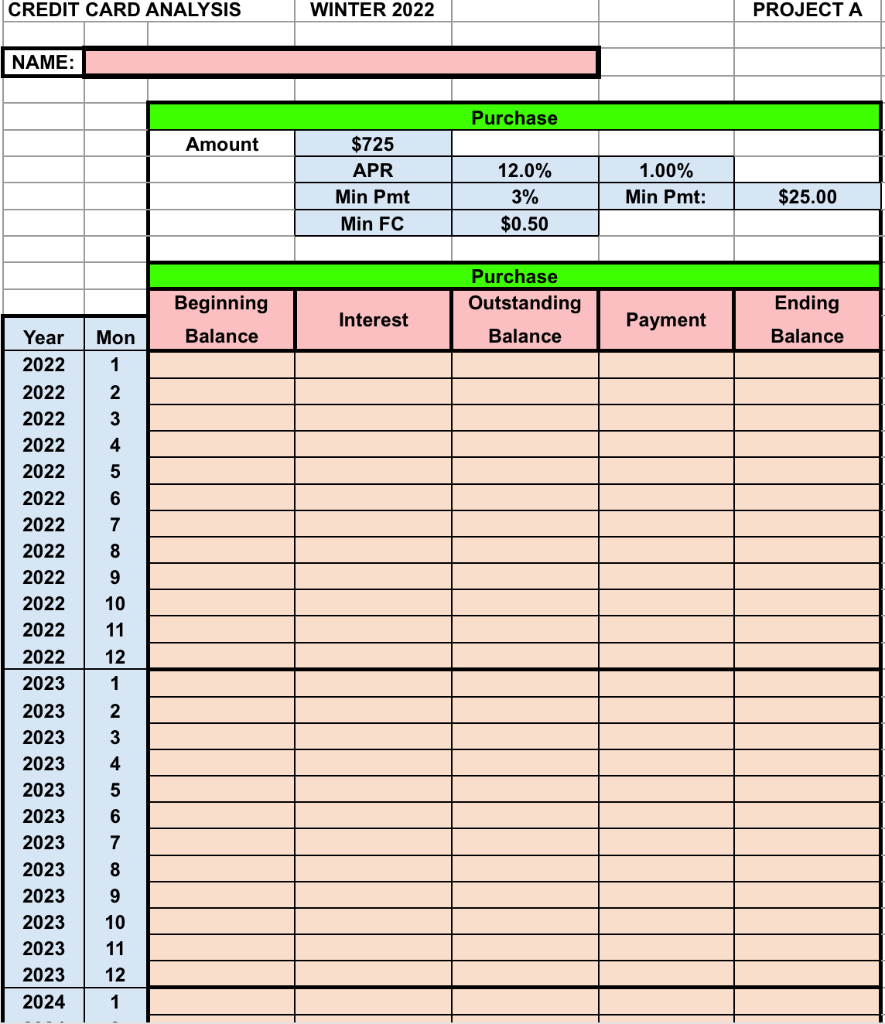

Objective: Construct a monthly repayment schedule for a purchase using a credit card. The Project: You have just received a new University of Mississippi credit card and plan to use it to make a $725 purchase. Use the provided spreadsheet template to develop a repayment schedule assuming that you make only the minimum payments due each month until the balance is paid off. Credit Card Terms: Payments can be calculated using the following information: Assume you made your purchase on January 1st and the first payment was due on February 1st, 2022. For simplicity, assume that all months are 1/12 of a year (for interest calculations). Further, assume that interest begins to accrue on February 1st for credit card purchases Your new credit card charges the following fees: 12% APR on purchases-- for simplicity we will assume a fixed rate. The University of Mississippi credit card requires a minimum payment of 3% of the outstanding balance or $25.00, whichever is greater. The outstanding balance = the balance from last month plus the interest accrued this month. If the outstanding balance is less than the $25.00 minimum payment, the payment due is the outstanding balance. The credit card carries a minimum finance charge (interest charge) of $0.50. PURCHASE: There is no payment or interest accruing in January so the Ending Balance for January 2022 is the full $725. For each year, the Beginning Balance = Ending Balance from the previous year The interest rate is quoted as an APR ... "12% per year compounded monthly" so to convert it to a monthly rate you just divide it by 12 -monthly rate =12/12 = 1.00% Interest for each month = the Beginning Balance * 1.00% The Outstanding Balance = Beginning balance + Interest = $732.25 The Payment is 3% of the Outstanding Balance or $25 whichever is greater. The Ending Balance = Outstanding Balance - Payment Repeat the above all the way down... When the interest (FC=finance charge) drops below 50 cents, it is constant at 50 cents When the payment drops below $25, it is constant at $25 until the amount is paid off Deliverable: Complete the Excel template, using the power of Excel to fill in the light orange columns.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started