Question

Objective: Prepare the basic financial statements and budgets for financial planning Teatime is a sole proprietorship owns by Alee which is located at Lot 4,

Objective: Prepare the basic financial statements and budgets for financial planning

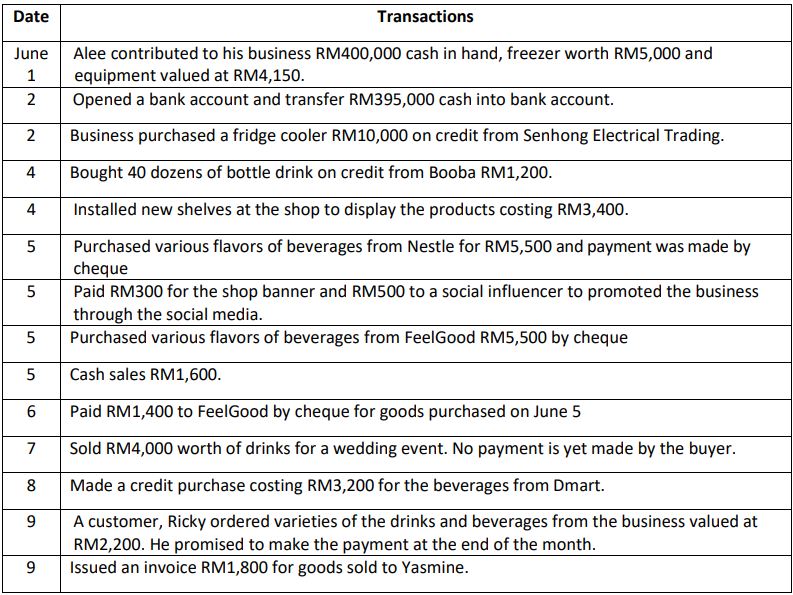

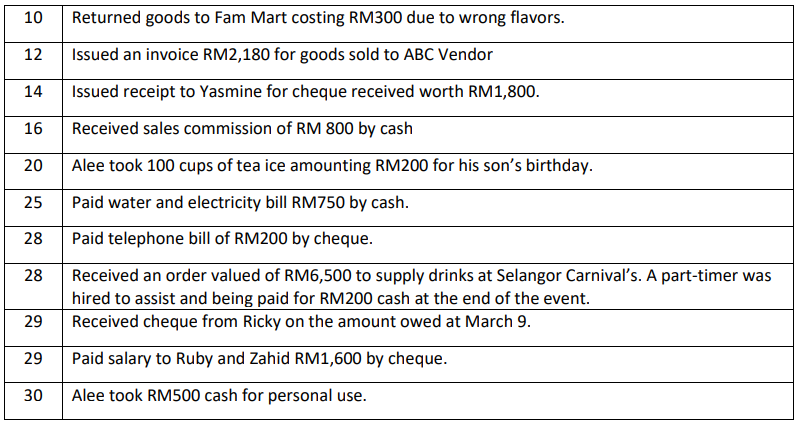

Teatime is a sole proprietorship owns by Alee which is located at Lot 4, De Centrum Mall, Jalan Ikram-Uniten, Kajang, Selangor. The business activity is selling and trading variety of drinks and beverages. The business opensfrom 8.00am to 5.00 pm every day. Alee started his business on 1 March 2023 with his own money and assets. To assist him, Alee hired two shop assistants; Ruby and Zahid. Both of them will be paid RM2,000 per month each. The following are transactions of Teatime for the month of June 2023:

Additional information: The shop is having a vacant space where Alee rented it out to a printing business owned by Carol for RM500 per month. As agreed in the agreement, Carol will be paying the rental by cheque at the end of each month. For record, the payment for June has been received by Alee on June 30.

Required: Prepare for the month of June 2023

i) Journal

ii) Ledgers/ T-account and balance off the account

iii) Trial Balance

iv) Statement of Profit or Loss for the month ended 30 June 2023

v) Statement of Financial Position as at 30 June 2023

\begin{tabular}{|c|l|} \hline 10 & Returned goods to Fam Mart costing RM300 due to wrong flavors. \\ \hline 12 & Issued an invoice RM2,180 for goods sold to ABC Vendor \\ \hline 14 & Issued receipt to Yasmine for cheque received worth RM1,800. \\ \hline 16 & Received sales commission of RM 800 by cash \\ \hline 20 & Alee took 100 cups of tea ice amounting RM200 for his son's birthday. \\ \hline 25 & Paid water and electricity bill RM750 by cash. \\ \hline 28 & Paid telephone bill of RM200 by cheque. \\ \hline 28 & ReceivedanordervaluedofRM6,500tosupplydrinksatSelangorCarnivals.Apart-timerwashiredtoassistandbeingpaidforRM200cashattheendoftheevent. \\ \hline 29 & Received cheque from Ricky on the amount owed at March 9. \\ \hline 29 & Paid salary to Ruby and Zahid RM1,600 by cheque. \\ \hline 30 & Alee took RM500 cash for personal use. \\ \hline \end{tabular}Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started