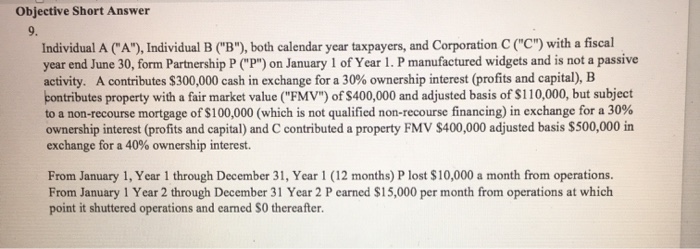

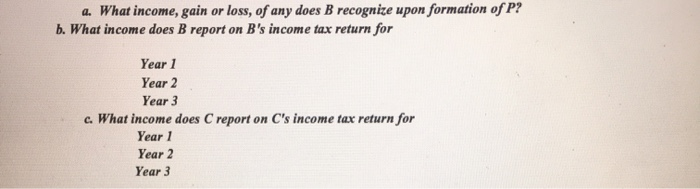

Objective Short Answer Individual A ("A"), Individual B ("B"), both calendar year taxpayers, and Corporation C ("C") with a fiscal year end June 30, form Partnership P ("P") on January 1 of Year 1. P manufactured widgets and is not a passive activity. A contributes $300,000 cash in exchange for a 30% ownership interest (profits and capital), B pontributes property with a fair market value ("FMV") of $400,000 and adjusted basis of $110,000, but subject to a non-recourse mortgage of $100,000 (which is not qualified non-recourse financing) in exchange for a 30% ownership interest (profits and capital) and C contributed a property FMV $400,000 adjusted basis $500,000 in exchange for a 40% ownership interest. From January 1, Year 1 through December 31, Year 1 (12 months) P lost $10,000 a month from operations. From January 1 Year 2 through December 31 Year 2 P earned $15,000 per month from operations at which point it shuttered operations and camed SO thereafter. a. What income, gain or loss, of any does B recognize upon formation of P? b. What income does B report on B's income tax return for Year 1 Year 2 Year 3 c. What income does C report on C's income tax return for Year 1 Year 2 Year 3 Objective Short Answer Individual A ("A"), Individual B ("B"), both calendar year taxpayers, and Corporation C ("C") with a fiscal year end June 30, form Partnership P ("P") on January 1 of Year 1. P manufactured widgets and is not a passive activity. A contributes $300,000 cash in exchange for a 30% ownership interest (profits and capital), B pontributes property with a fair market value ("FMV") of $400,000 and adjusted basis of $110,000, but subject to a non-recourse mortgage of $100,000 (which is not qualified non-recourse financing) in exchange for a 30% ownership interest (profits and capital) and C contributed a property FMV $400,000 adjusted basis $500,000 in exchange for a 40% ownership interest. From January 1, Year 1 through December 31, Year 1 (12 months) P lost $10,000 a month from operations. From January 1 Year 2 through December 31 Year 2 P earned $15,000 per month from operations at which point it shuttered operations and camed SO thereafter. a. What income, gain or loss, of any does B recognize upon formation of P? b. What income does B report on B's income tax return for Year 1 Year 2 Year 3 c. What income does C report on C's income tax return for Year 1 Year 2 Year 3