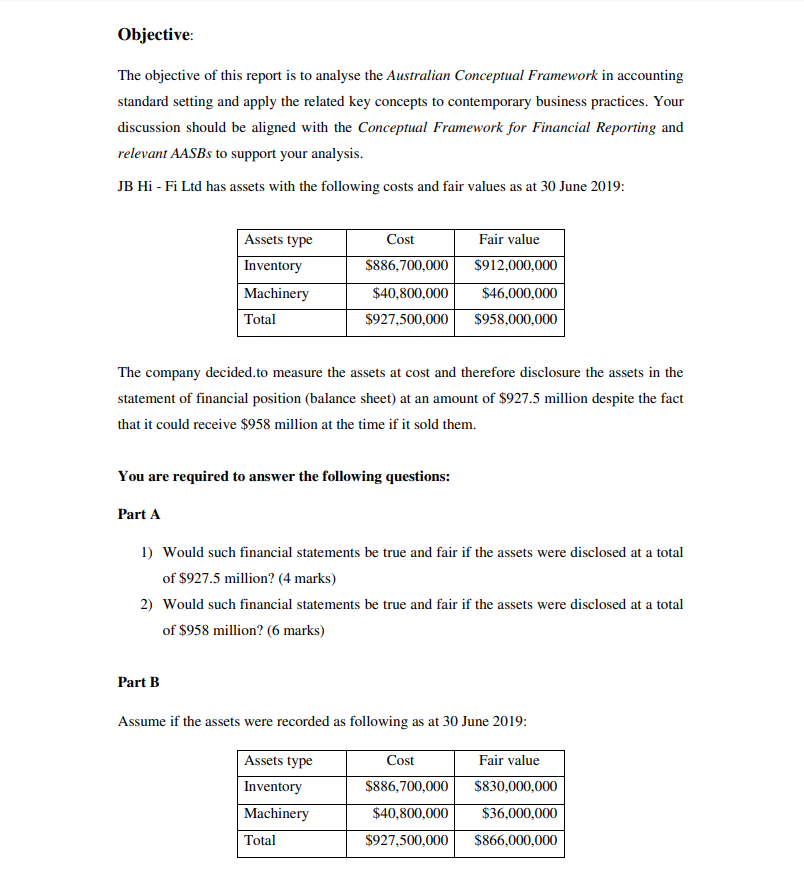

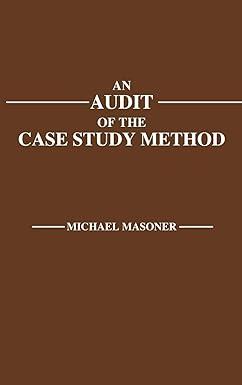

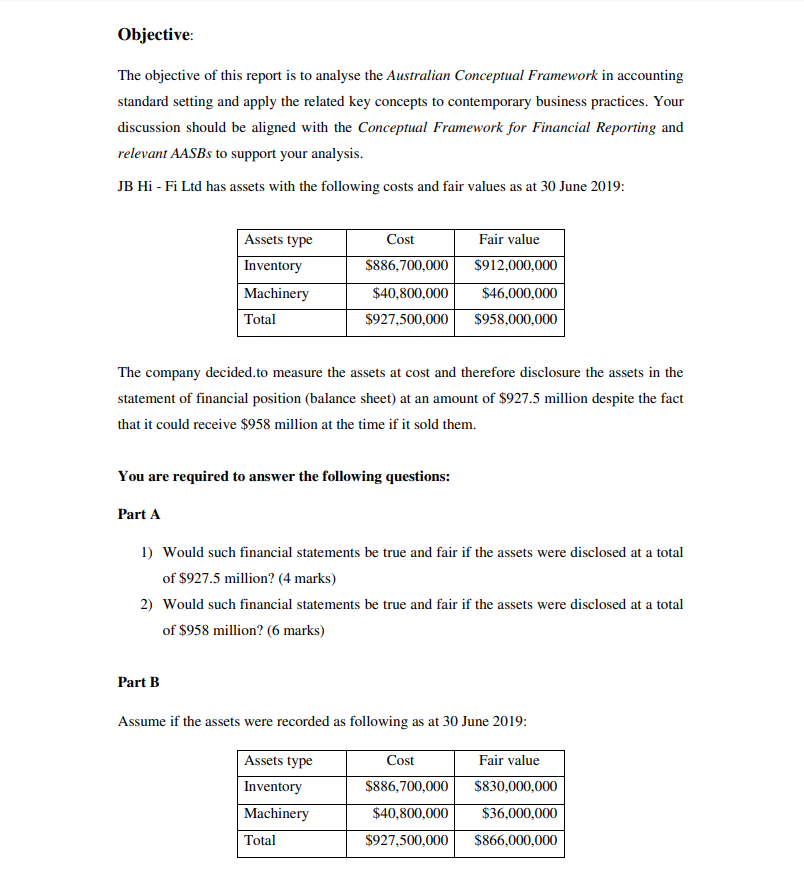

Objective: The objective of this report is to analyse the Australian Conceptual Framework in accounting standard setting and apply the related key concepts to contemporary business practices. Your discussion should be aligned with the Conceptual Framework for Financial Reporting and relevant AASBs to support your analysis. JB Hi-Fi Ltd has assets with the following costs and fair values as at 30 June 2019: Cost Fair value Assets type Inventory Machinery Total $886,700,000 $40,800,000 $927,500,000 $912,000,000 $46,000,000 $958,000,000 The company decided to measure the assets at cost and therefore disclosure the assets in the statement of financial position (balance sheet) at an amount of $927.5 million despite the fact that it could receive $958 million at the time if it sold them. You are required to answer the following questions: Part A 1) Would such financial statements be true and fair if the assets were disclosed at a total of $927.5 million? (4 marks) 2) Would such financial statements be true and fair if the assets were disclosed at a total of $958 million? (6 marks) Part B Assume if the assets were recorded as following as at 30 June 2019: Assets type Inventory Machinery Total Cost $886,700,000 $40,800,000 $927,500,000 Fair value $830,000,000 $36,000,000 $866,000,000 3) Would such financial statements be true and fair if the assets were disclosed at a total of $866 million because inventory and machinery actually could be sold at those values? (6 marks) Objective: The objective of this report is to analyse the Australian Conceptual Framework in accounting standard setting and apply the related key concepts to contemporary business practices. Your discussion should be aligned with the Conceptual Framework for Financial Reporting and relevant AASBs to support your analysis. JB Hi-Fi Ltd has assets with the following costs and fair values as at 30 June 2019: Cost Fair value Assets type Inventory Machinery Total $886,700,000 $40,800,000 $927,500,000 $912,000,000 $46,000,000 $958,000,000 The company decided to measure the assets at cost and therefore disclosure the assets in the statement of financial position (balance sheet) at an amount of $927.5 million despite the fact that it could receive $958 million at the time if it sold them. You are required to answer the following questions: Part A 1) Would such financial statements be true and fair if the assets were disclosed at a total of $927.5 million? (4 marks) 2) Would such financial statements be true and fair if the assets were disclosed at a total of $958 million? (6 marks) Part B Assume if the assets were recorded as following as at 30 June 2019: Assets type Inventory Machinery Total Cost $886,700,000 $40,800,000 $927,500,000 Fair value $830,000,000 $36,000,000 $866,000,000 3) Would such financial statements be true and fair if the assets were disclosed at a total of $866 million because inventory and machinery actually could be sold at those values? (6 marks)