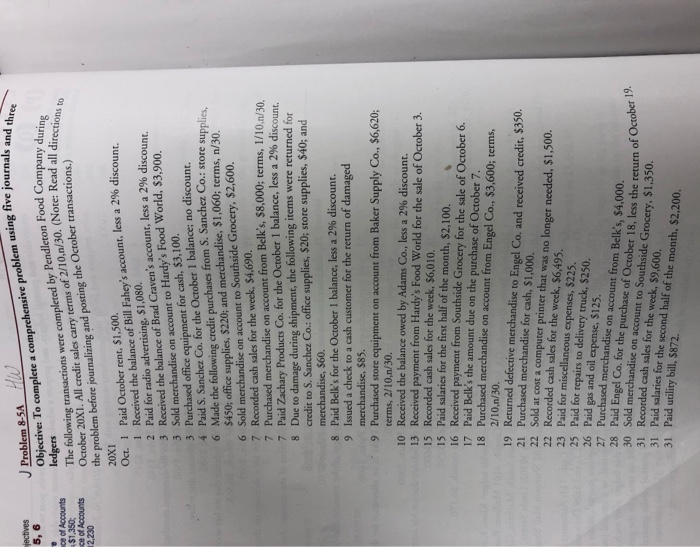

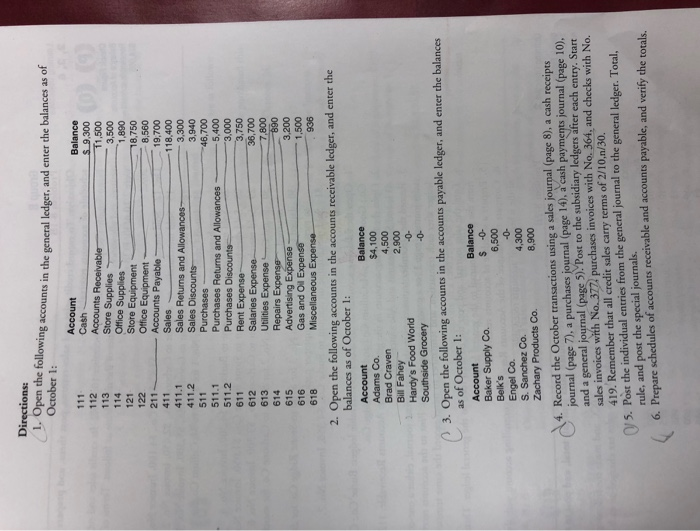

Objective: To complete a comprehensive problem using five journals and three e completed by Pendleton Food Company during October 20X1. All credit sales carry terms of 2/10,n/30. (Note: Read all directions to Problem 8-5A COF saAgoak The following transactions were 0SEIS the problem before journalizing and posting the October transactions.) IXO hosip 6Ze ssa uno0e 1 Received the balance of Bill Fahey's 2 Paid for radio advertising, $1,080. 3 Received the balance of Brad Craven's account, less a 2% discount Hardy's Food World, $3,900. o1 Junoooe uo 3sipurypu PIOS 3 Purchased office equipment for cash, $3,100. 4 Paid S. Sanchez Co. for the October 1 balance; no discount. 6 Made the following credit purchases from S. Sanchez Co.: store supplies $450; office supplies, $220; and merchandise, $1,060; terms, n/30, 6 Sold merchandise on account to Southside Grocery, $2,600. 7 Recorded cash sales for the week, $4,690. 7 Purchased merchandise on account from Belk's, $8,000; terms, 1/10,n/30 7 Paid Zachary Products Co. for the October 1 balance, less a 2% discount . 8 Due to damage during shipment, the following items were returned for credit to S. Sanchez Co.: office supplies, $20; store. merchandise, $60. supplies, $40; and 8 Paid Belk's for the October 1 balance, less a 2% discount. 9 Issued a check to a cash customer for the return of damaged merchandise, $85. 9 Purchased store equipment on account from Baker Supply Co., $6,620; E 10 Received the balance owed by Adams Co., less a 2% discount. 13 Received payment from Hardy's Food World for the sale of October 3. 15 Recorded cash sales for the week, $6,010. e15 Paid salaries for the first half of the month, $2,100. 16 Received payment from Southside Grocery for the sale of October 6. 17 Paid Belk's the amount due on the purchase of October 7. 18 Purchased merchandise on account from Engel Co., $3,600; terms, 2/10,n/30. 19 Returned defective merchandise to Engel Co. and received credit, $350. 21 Purchased merchandise for cash, $1,000. longer needed, $1,500. ou sEM ieup Juud ndu0 s00 t poS 2 22 Recorded cash sales for the week, $6,495. 23 Paid for miscellaneous expenses, $225. 25 Paid for repairs to delivery truck, $250. 26 Paid gas and oil expense, $125. 27 Purchased merchandise on account from Belk's, $4,000. 28 Paid Engel Co. for the purchase of October 18, less the return of October 19. 30 Sold merchandise on account to Southside Grocery, $1,350. 31 Recorded cash sales for the week, $9,600. 31 Paid salaries for the second half of the month, $2,200. 31 Paid utility bill, $872. Directions: 1. Open the tollowing accounts in the general ledger, and enter the balances as of October 1: 000 6 S 009'L 009' 068' 0SL8L 099 8 uno aaaa areunoooy Store Supplies Office Supplies Store Equipment Office Equipment Accounts Payable 00L'6 00t8L1 00 unoos sele 00L 9t 00t0 000'e. 1 Rent Expense- Salaries Expense- Utilities Expense Repairs Expense Advertising Expense Gas and Oil Expense Miscellaneous Expense- 00L 90 008'L 068 002E 3 5 919 009 96 2. Open the following accounts in the accounts receivable ledger, and enter the balances as of October 1: 00L 009 006 -0- Bill Fahey Hardy's Food World Southside Grocery payable ledger, and enter the balances unoooe aa ui sauno0oe 0: 3. Open the following as of October 1: uno 009 -0- 000 006'8 4. Record the October transactions using a sales journal (page 8), a cash receipts journal (page 7), a purchases journal (page 14), a cash payments journal (page 10), and a general journal (page 5). Post to the subsidiary ledgers after each entry. Start sales invoices with No. 377 purchases invoices with No. 364, and checks with No. 419. Remember that all credit sales carry terms of 2/10,n/30. 5. Post the individual entries from the general journal rule, and post the special journals. 6. Prepare schedules of accounts receivable and accounts payable, and verify the toOtals. Zachary Products Co. to the general ledger. Total