Answered step by step

Verified Expert Solution

Question

1 Approved Answer

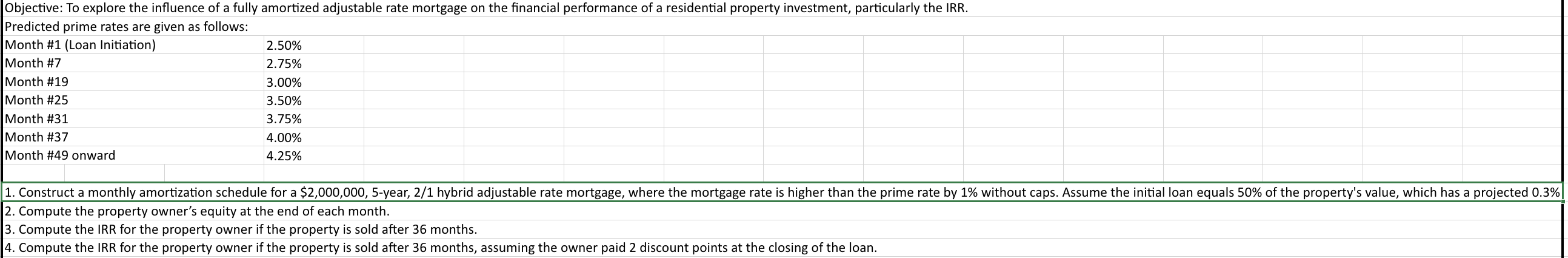

Objective: To explore the influence of a fully amortized adjustable rate mortgage on the financial performance of a residential property investment, particularly the IRR. Predicted

Objective: To explore the influence of a fully amortized adjustable rate mortgage on the financial performance of a residential property investment, particularly the IRR. Predicted prime rates are given as follows:

Compute the property owner's equity at the end of each month.

Compute the IRR for the property owner if the property is sold after months.

Compute the IRR for the property owner if the property is sold after months, assuming the owner paid discount points at the closing of the loan.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started