Question

Objective: Your client, Cookie, Inc., has asked you to prepare select portions of its 2023 Federal tax return (Form 1120). In order to prepare the

Objective: Your client, Cookie, Inc., has asked you to prepare select portions of its 2023 Federal tax return (Form 1120). In order to prepare the 2023 tax return, you must correctly reconcile Cookie's financial accounting income ("book income") to its taxable income.

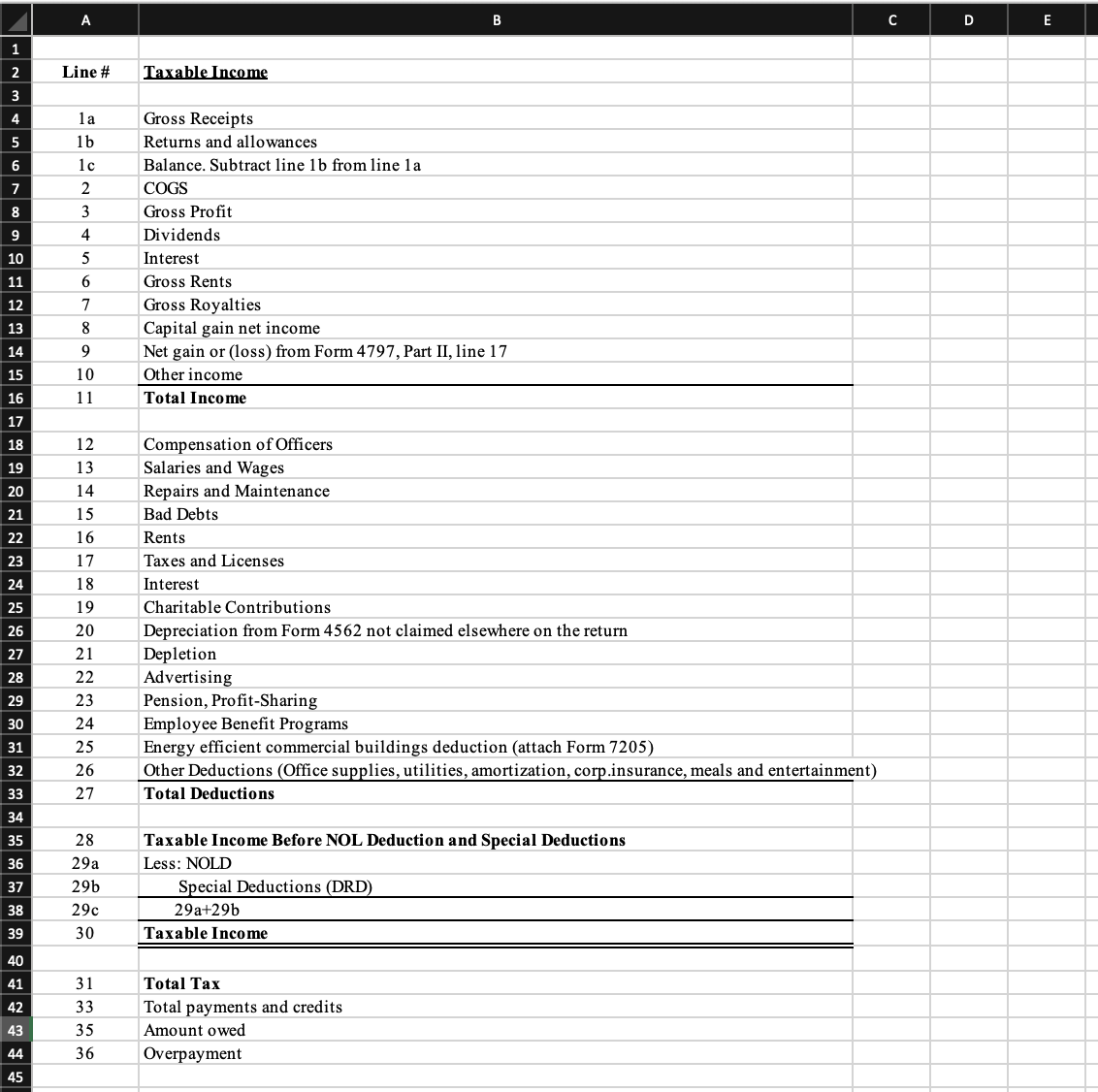

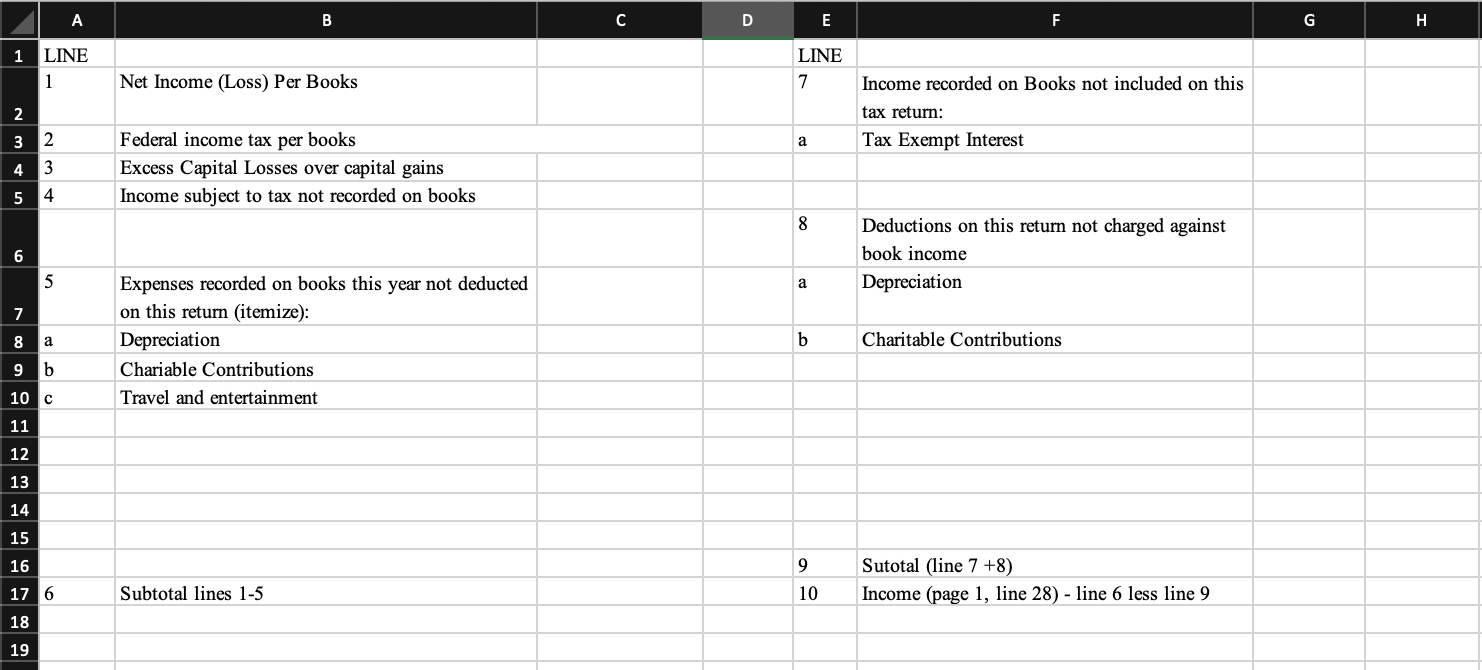

Forms: All tax forms can be obtained from the IRS's website at www.irs.gov. You will need to prepare Form 1120 (pg 1 and Schedule M-1 only). Other pages, forms and schedules may be helpful in computing taxable income for Cookie; however, they do not need to be completed for this project (e.g. Schedule D, Form 4562). Required: Use the information below to prepare selected portions of the corporate income tax return for Cookie, Inc. for the tax year ended December 31, 2023. Submit the completed Form 1120 pg 1, and Form 1120 Schedule M-1, a completed book-tax reconciliation workpaper, and all supporting calculations. The book-tax reconciliation workpaper and supporting calculations can be completed in Excel. Facts: Cookie, Inc. is a manufacturer, distributor and retailer with all operations located in the state of Illinois. Cookie is taxed as a C-Corporation and was incorporated on June 1, 2007. Cookie is located at the following address: 55 South Clark Street, Champaign, IL 61822. Cookie's employer identification number (EIN) is: 55-5559999. Cookie has total assets as of December 31, 2023 of $7,035,000.

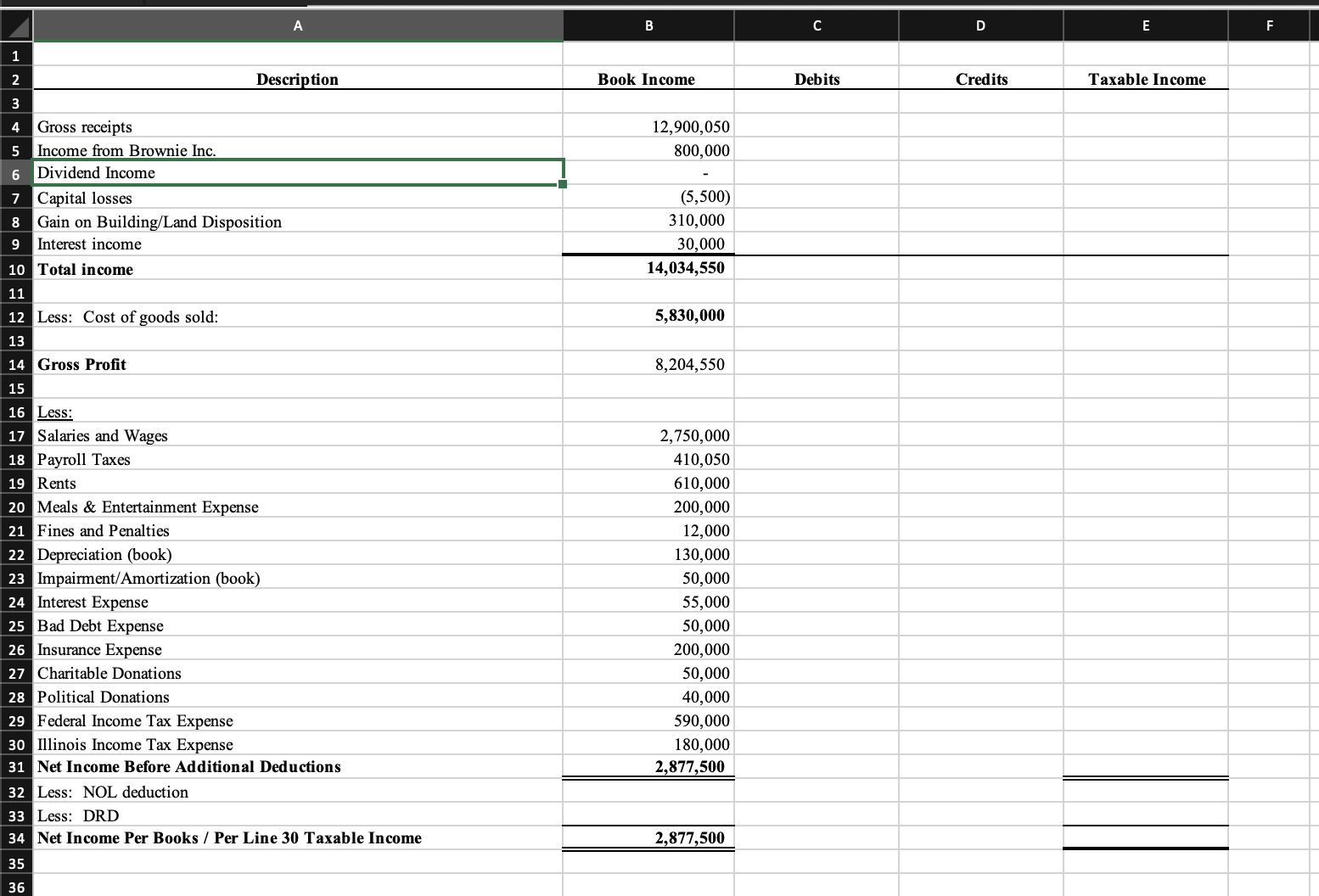

Cookie, Inc.'s Financial Statements (i.e., book) show the following income and expenses: INCOME Sales Revenue 12,900,050 Income from Brownie, Inc. (equity method accounting)800,000 Net Capital Loss (5,500) Gain on Building/Land Sale 310,000 Interest Income 30,000 EXPENSES Cost of Goods Sold 5,830,000 Salaries and Wages 2,750,000 Payroll Taxes 410,050 Rents 610,000 Meals & Entertainment Expense 200,000 Fines and Penalties 12,000 Depreciation (book) 130,000 Impairment/Amortization (book) 50,000 Interest Expense 55,000 Bad Debt Expense 50,000 Insurance Expense 200,000 Charitable Donations 50,000 Political Donations 40,000 Federal Income Tax Expense 590,000 Illinois Income Tax Expense 180,000 BOOK NET INCOME 2,877,500 1. Interest Income. Cookie's interest income includes $15,000 of interest from corporate bonds, $10,000 of interest income for a City of Chicago municipal bond, and $5,000 of interest income from other savings accounts. 2. Investment in Brownie, Inc. Cookie has a 40% investment in Brownie, Inc. For book purposes, Cookie recorded their pro rata share of Brownie, Inc.'s earnings. Cookie's also received $120,000 in dividend income from the 40% investment in Brownie, Inc., which they have held since 2017. 3. Bad Debt Expense. Cookie sells its products wholesale to distributors and retailers throughout the Midwest. For financial reporting purposes, Cookie increased its allowance for doubtful accounts for fiscal year 2023 by $50,000. However, at the end of the tax year, using specific identification, Cookie deemed just $12,000 of the accounts receivable as uncollectible, generating $12,000 of bad debt expense for tax purposes. 4. Patent. On June 1, 2021, Cookie acquired a patent (not as part of a business acquisition) for $125,000. The original patent had a 17-year life, 135 months of which were remaining at the time of acquisition. For financial reporting purposes, Cookie recorded a $50,000 impairment of the patent in 2023. 5. Depreciation. Cookie uses the MACRS depreciation tables to calculate depreciation expense for tax purposes and straight-line depreciation for financial reporting purposes. In the current year, as in all prior years, Cookie took advantage of bonus depreciation but did not claim IRC Section 179 expensing. The following is a listing of Cookie's assets: Depreciable Property Placed in Service Date Initial Cost Office Building April 29, 2019 $550,000 Machinery October 15, 2021 $80,000 Equipment June15, 2022 $35,000 Vehicle 1 (less than 6,000 lbs.) July 30, 2022 $65,000 Warehouse November 1, 2022 $950,000 Machine 3 January 23, 2023 $150,000 Furniture 2 February 15, 2023 $60,000 Computer 1 October 20, 2023 $25,000 Cookie records depreciation expense for the warehouse and machinery in COGS (book depreciation in COGS is $55,000) and the remaining book depreciation expense of $130,000 is reported on a separate line in the income statement and relates to SG&A (line 20 of Form 1120). 6. Gain on Sale of Business Property (Building and Land). For financial reporting purposes, there was a $310,000 gain from the sale of a building/land used in Cookie's business. The proceeds from the sale were allocated as follows: building sold for $830,000, land sold for $200,000. The property was purchased several years ago for $700,000 ($600,000 for the building, $100,000 for the land). For tax purposes, the building had accumulated depreciation at the time of sale of $128,200. Cookie does not have non-recaptured Section 1231 losses. 7. Fines and Penalties. In December 2023, Cookie paid a $12,000 fine to the State of Illinois related to a health code violation in its manufacturing facilities. 8. Charitable Donations. The company donated $50,000 cash to the Red Cross (a qualifying charitable organization). 9. Political Donations. The company donated $40,000 cash to the governor's re-election campaign. 10. Sale of Stock. Cookie realized the following gains and losses from the sale of stock: Stock Sales Proceeds Cost Basis Holding Period Venture, Inc. $20,000 $23,000 Short-term Opportunity, Inc. $10,000 $27,500 Long-term Great Idea, Inc. $65,000 $50,000 Long-term 11. Meals and Entertainment. Throughout 2023, Cookie incurred $160,000 on meals and $40,000 on entertainment expenses during the ordinary course of business.

12. Estimated Payments. Cookie made a $147,500 federal estimated tax payment and $45,000 state estimated tax payment for each quarter of 2023. You need not compute any estimated tax penalties. 13. Net Operating Loss Carryover. Cookie has a remaining net operating loss carryover of $400,000 from 2020, that they elected not to carryback, and a net operating loss carryover from 2022 of $150,000.

12345 Gross receipts Income from Brownie Inc. 6 Dividend Income 7 Capital losses A B C D Description Book Income 12,900,050 800,000 (5,500) 8 Gain on Building/Land Disposition 310,000 9 Interest income 30,000 14,034,550 10 Total income 11 12 Less: Cost of goods sold: 13 14 Gross Profit 15 16 Less: 5,830,000 8,204,550 17 Salaries and Wages 2,750,000 18 Payroll Taxes 410,050 19 Rents 610,000 20 Meals & Entertainment Expense 200,000 21 Fines and Penalties 12,000 22 Depreciation (book) 130,000 23 Impairment/Amortization (book) 50,000 24 Interest Expense 55,000 25 Bad Debt Expense 50,000 26 Insurance Expense 27 Charitable Donations 28 Political Donations 200,000 50,000 40,000 29 Federal Income Tax Expense 590,000 30 Illinois Income Tax Expense 180,000 2,877,500 31 Net Income Before Additional Deductions 32 Less: NOL deduction 33 Less: DRD 34 Net Income Per Books / Per Line 30 Taxable Income 2,877,500 35 36 E Debits Credits Taxable Income F

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started