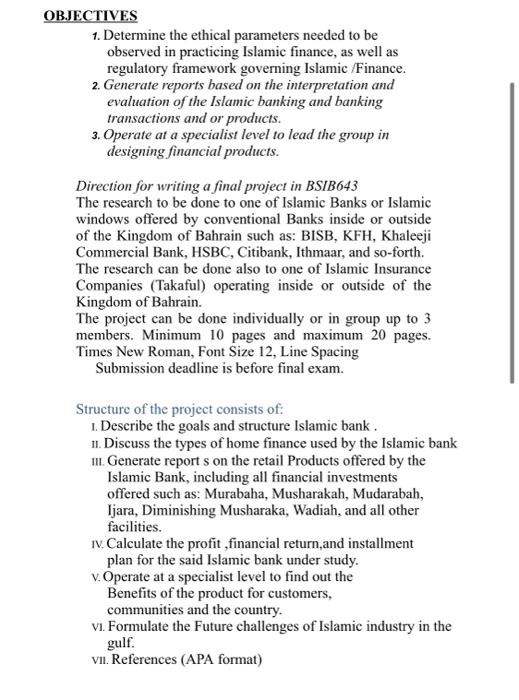

OBJECTIVES 1. Determine the ethical parameters needed to be observed in practicing Islamic finance, as well as regulatory framework governing Islamic Finance. 2. Generate reports based on the interpretation and evaluation of the Islamic banking and banking transactions and or products. 3. Operate at a specialist level to lead the group in designing financial products. Direction for writing a final project in BSIB643 The research to be done to one of Islamic Banks or Islamic windows offered by conventional Banks inside or outside of the Kingdom of Bahrain such as: BISB, KFH, Khaleeji Commercial Bank, HSBC, Citibank, Ithmaar, and so forth. The research can be done also to one of Islamic Insurance Companies (Takaful) operating inside or outside of the Kingdom of Bahrain The project can be done individually or in group up to 3 members. Minimum 10 pages and maximum 20 pages. Times New Roman, Font Size 12, Line Spacing Submission deadline is before final exam. Structure of the project consists of: 1. Describe the goals and structure Islamic bank. 11. Discuss the types of home finance used by the Islamic bank m. Generate reports on the retail Products offered by the Islamic Bank, including all financial investments offered such as: Murabaha, Musharakah, Mudarabah, Ijara, Diminishing Musharaka, Wadiah, and all other facilities. IV. Calculate the profit financial return, and installment plan for the said Islamic bank under study. v. Operate at a specialist level to find out the Benefits of the product for customers, communities and the country. vi. Formulate the Future challenges of Islamic industry in the gulf. VII. References (APA format) OBJECTIVES 1. Determine the ethical parameters needed to be observed in practicing Islamic finance, as well as regulatory framework governing Islamic Finance. 2. Generate reports based on the interpretation and evaluation of the Islamic banking and banking transactions and or products. 3. Operate at a specialist level to lead the group in designing financial products. Direction for writing a final project in BSIB643 The research to be done to one of Islamic Banks or Islamic windows offered by conventional Banks inside or outside of the Kingdom of Bahrain such as: BISB, KFH, Khaleeji Commercial Bank, HSBC, Citibank, Ithmaar, and so forth. The research can be done also to one of Islamic Insurance Companies (Takaful) operating inside or outside of the Kingdom of Bahrain The project can be done individually or in group up to 3 members. Minimum 10 pages and maximum 20 pages. Times New Roman, Font Size 12, Line Spacing Submission deadline is before final exam. Structure of the project consists of: 1. Describe the goals and structure Islamic bank. 11. Discuss the types of home finance used by the Islamic bank m. Generate reports on the retail Products offered by the Islamic Bank, including all financial investments offered such as: Murabaha, Musharakah, Mudarabah, Ijara, Diminishing Musharaka, Wadiah, and all other facilities. IV. Calculate the profit financial return, and installment plan for the said Islamic bank under study. v. Operate at a specialist level to find out the Benefits of the product for customers, communities and the country. vi. Formulate the Future challenges of Islamic industry in the gulf. VII. References (APA format)