Answered step by step

Verified Expert Solution

Question

1 Approved Answer

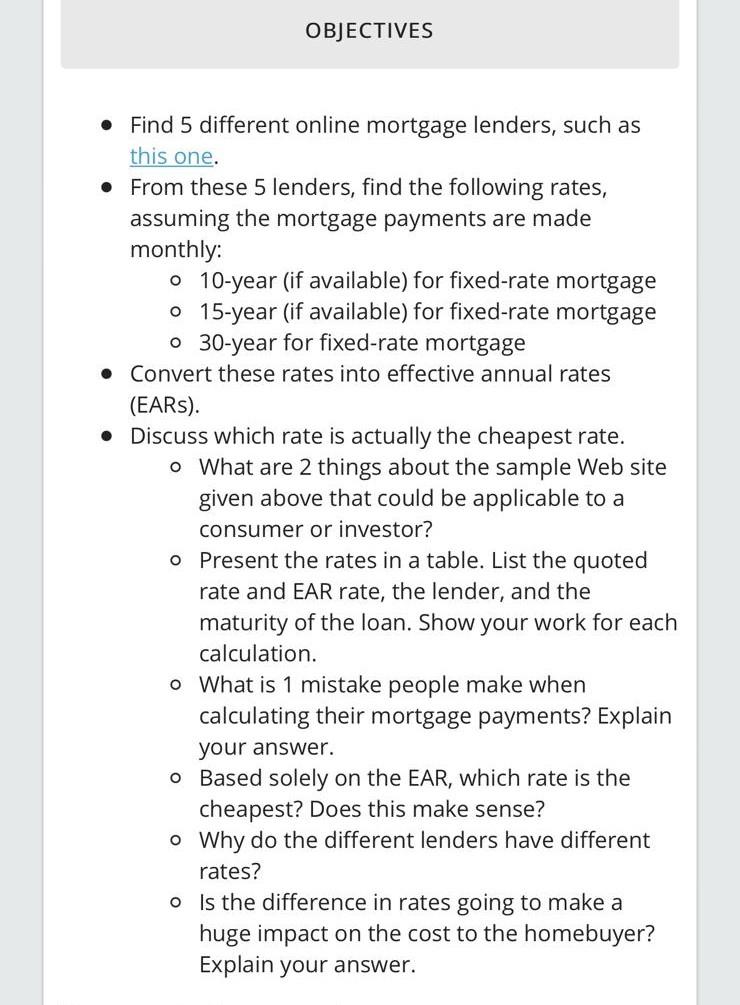

OBJECTIVES Find 5 different online mortgage lenders, such as this one. From these 5 lenders, find the following rates, assuming the mortgage payments are made

OBJECTIVES Find 5 different online mortgage lenders, such as this one. From these 5 lenders, find the following rates, assuming the mortgage payments are made monthly: o 10-year (if available) for fixed-rate mortgage o 15-year (if available) for fixed-rate mortgage o 30-year for fixed-rate mortgage Convert these rates into effective annual rates (EARs). Discuss which rate is actually the cheapest rate. o What are 2 things about the sample Web site given above that could be applicable to a consumer or investor? o Present the rates in a table. List the quoted rate and EAR rate, the lender, and the maturity of the loan. Show your work for each calculation. o What is 1 mistake people make when calculating their mortgage payments? Explain your answer. o Based solely on the EAR, which rate is the cheapest? Does this make sense? o Why do the different lenders have different rates? o Is the difference in rates going to make a huge impact on the cost to the homebuyer? Explain your answer. OBJECTIVES Find 5 different online mortgage lenders, such as this one. From these 5 lenders, find the following rates, assuming the mortgage payments are made monthly: o 10-year (if available) for fixed-rate mortgage o 15-year (if available) for fixed-rate mortgage o 30-year for fixed-rate mortgage Convert these rates into effective annual rates (EARs). Discuss which rate is actually the cheapest rate. o What are 2 things about the sample Web site given above that could be applicable to a consumer or investor? o Present the rates in a table. List the quoted rate and EAR rate, the lender, and the maturity of the loan. Show your work for each calculation. o What is 1 mistake people make when calculating their mortgage payments? Explain your answer. o Based solely on the EAR, which rate is the cheapest? Does this make sense? o Why do the different lenders have different rates? o Is the difference in rates going to make a huge impact on the cost to the homebuyer? Explain your

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started