Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Objectives: Understanding Stock Options: vesting, exercising and value to the employee; use of options for employee retention. The main idea of using options as an

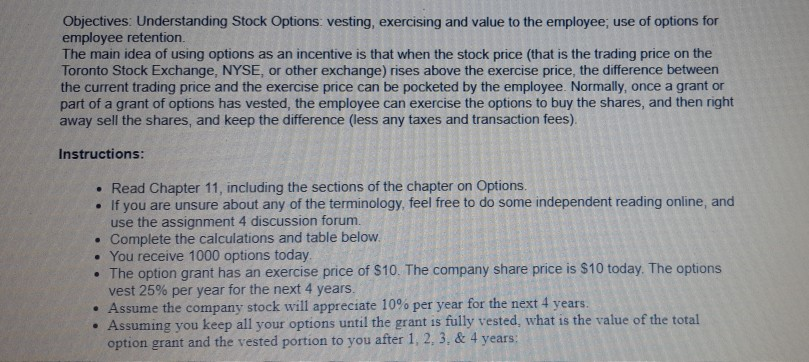

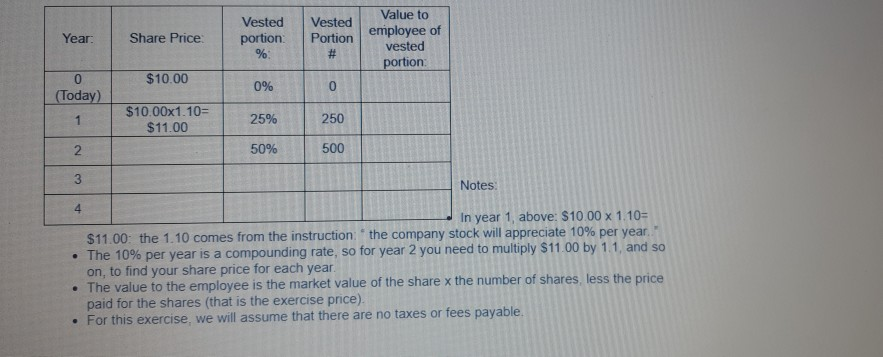

Objectives: Understanding Stock Options: vesting, exercising and value to the employee; use of options for employee retention. The main idea of using options as an incentive is that when the stock price (that is the trading price on the Toronto Stock Exchange, NYSE, or other exchange) rises above the exercise price, the difference between the current trading price and the exercise price can be pocketed by the employee. Normally, once a grant or part of a grant of options has vested, the employee can exercise the options to buy the shares, and then right away sell the shares, and keep the difference (less any taxes and transaction fees). Instructions: . Read Chapter 11, including the sections of the chapter on Options. If you are unsure about any of the terminology, feel free to do some independent reading online, and use the assignment 4 discussion forum Complete the calculations and table below. You receive 1000 options today. The option grant has an exercise price of $10. The company share price is $10 today. The options vest 25% per year for the next 4 years. Assume the company stock will appreciate 10% per year for the next 4 years. Assuming you keep all your options until the grant is fully vested, what is the value of the total option grant and the vested portion to you after 1, 2.3. & 4 years: Year: Share Price Vested portion % Vested Portion # Value to employee of vested portion $10.00 0 (Today) 0% 0 1 $10.00x1.10= $11.00 25% 250 50% 500 N 3 Notes: 4 In year 1, above: $10.00 x 1.10= $11.00: the 1.10 comes from the instruction the company stock will appreciate 10% per year. The 10% per year is a compounding rate, so for year 2 you need to multiply $11.00 by 1.1, and so on, to find your share price for each year The value to the employee is the market value of the share x the number of shares, less the price paid for the shares (that is the exercise price) . For this exercise, we will assume that there are no taxes or fees payable. Objectives: Understanding Stock Options: vesting, exercising and value to the employee; use of options for employee retention. The main idea of using options as an incentive is that when the stock price (that is the trading price on the Toronto Stock Exchange, NYSE, or other exchange) rises above the exercise price, the difference between the current trading price and the exercise price can be pocketed by the employee. Normally, once a grant or part of a grant of options has vested, the employee can exercise the options to buy the shares, and then right away sell the shares, and keep the difference (less any taxes and transaction fees). Instructions: . Read Chapter 11, including the sections of the chapter on Options. If you are unsure about any of the terminology, feel free to do some independent reading online, and use the assignment 4 discussion forum Complete the calculations and table below. You receive 1000 options today. The option grant has an exercise price of $10. The company share price is $10 today. The options vest 25% per year for the next 4 years. Assume the company stock will appreciate 10% per year for the next 4 years. Assuming you keep all your options until the grant is fully vested, what is the value of the total option grant and the vested portion to you after 1, 2.3. & 4 years: Year: Share Price Vested portion % Vested Portion # Value to employee of vested portion $10.00 0 (Today) 0% 0 1 $10.00x1.10= $11.00 25% 250 50% 500 N 3 Notes: 4 In year 1, above: $10.00 x 1.10= $11.00: the 1.10 comes from the instruction the company stock will appreciate 10% per year. The 10% per year is a compounding rate, so for year 2 you need to multiply $11.00 by 1.1, and so on, to find your share price for each year The value to the employee is the market value of the share x the number of shares, less the price paid for the shares (that is the exercise price) . For this exercise, we will assume that there are no taxes or fees payable

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started