Answered step by step

Verified Expert Solution

Question

1 Approved Answer

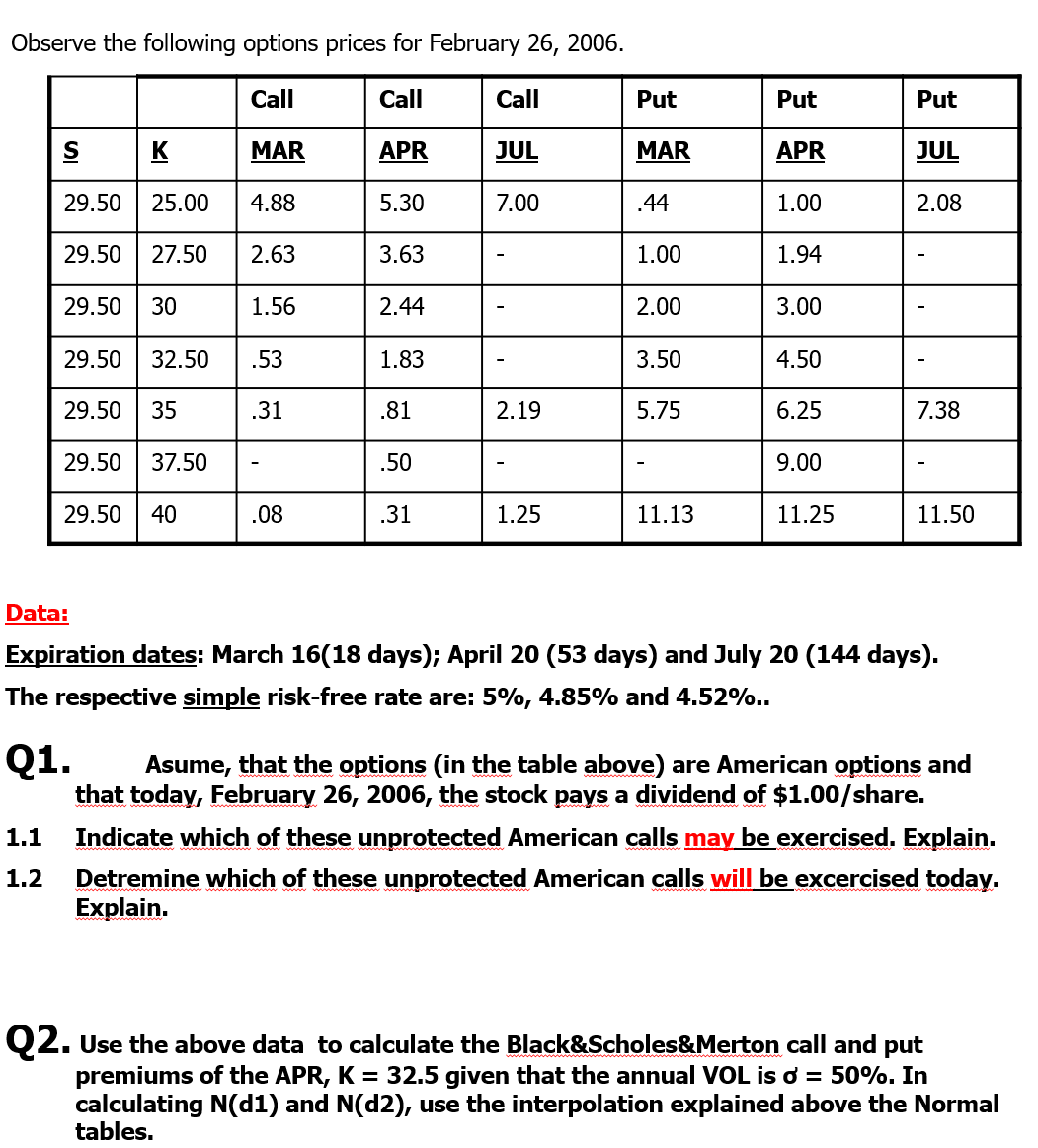

Observe the following options prices for February 26, 2006. Call Call SK MAR APR 29.50 25.00 4.88 5.30 29.50 27.50 2.63 3.63 29.50 30

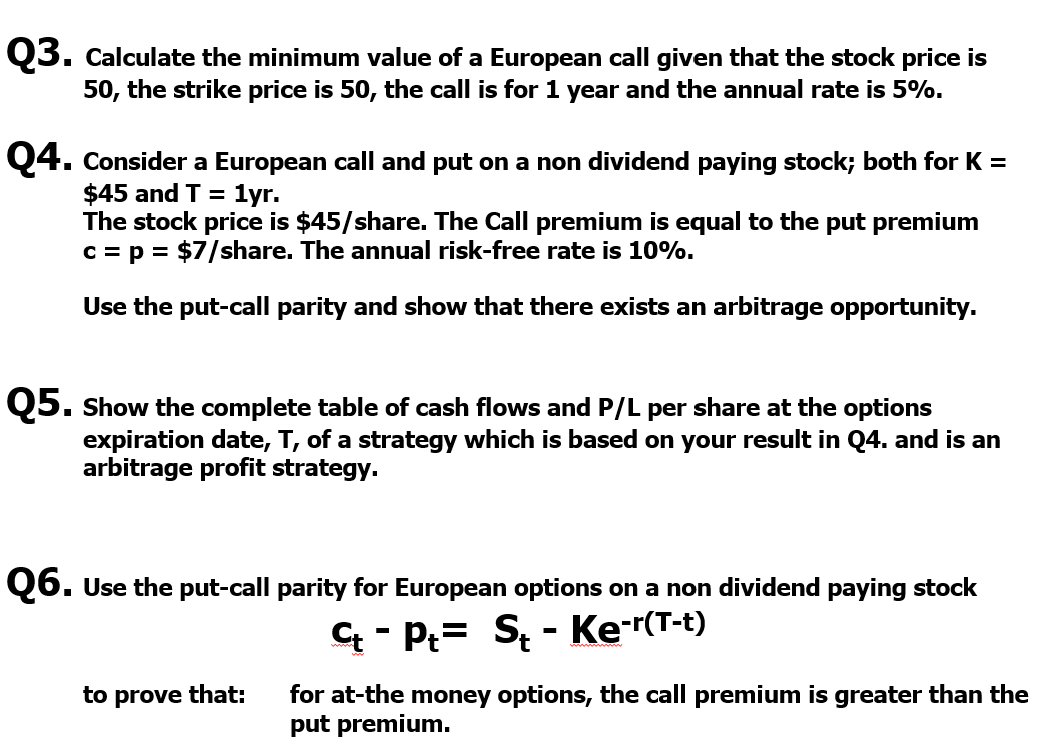

Observe the following options prices for February 26, 2006. Call Call SK MAR APR 29.50 25.00 4.88 5.30 29.50 27.50 2.63 3.63 29.50 30 29.50 32.50 29.50 35 29.50 37.50 29.50 40 1.56 .53 .31 .08 2.44 1.83 .81 .50 .31 Call JUL 7.00 2.19 1.25 Put MAR .44 1.00 2.00 3.50 5.75 11.13 Put APR 1.00 1.94 3.00 4.50 6.25 9.00 11.25 Put JUL 2.08 - 7.38 11.50 Data: Expiration dates: March 16(18 days); April 20 (53 days) and July 20 (144 days). The respective simple risk-free rate are: 5%, 4.85% and 4.52%.. Q1. Asume, that the options (in the table above) are American options and that today, February 26, 2006, the stock pays a dividend of $1.00/share. 1.1 Indicate which of these unprotected American calls may be exercised. Explain. 1.2 Detremine which of these unprotected American calls will be excercised today. Explain. Q2. Use the above data to calculate the Black&Scholes&Merton call and put premiums of the APR, K = 32.5 given that the annual VOL is d = 50%. In calculating N(d1) and N(d2), use the interpolation explained above the Normal tables. Q3. Calculate the minimum value of a European call given that the stock price is 50, the strike price is 50, the call is for 1 year and the annual rate is 5%. Q4. Consider a European call and put on a non dividend paying stock; both for K = $45 and T = 1yr. The stock price is $45/share. The Call premium is equal to the put premium c = p = $7/share. The annual risk-free rate is 10%. Use the put-call parity and show that there exists an arbitrage opportunity. Q5. Show the complete table of cash flows and P/L per share at the options expiration date, T, of a strategy which is based on your result in Q4. and is an arbitrage profit strategy. Q6. Use the put-call parity for European options on a non dividend paying stock Ct - Pt St - Ke-r(T-t) to prove that: for at-the money options, the call premium is greater than the put premium.

Step by Step Solution

★★★★★

3.42 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

Q11 The calls that may be exercised are the ones where the strike price is below the stock price plu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started