Answered step by step

Verified Expert Solution

Question

1 Approved Answer

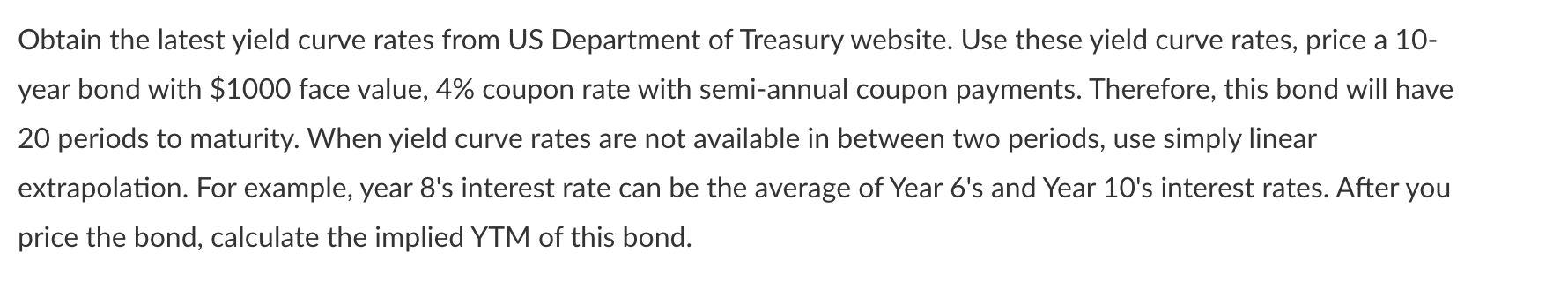

Obtain the latest yield curve rates from US Department of Treasury website. Use these yield curve rates, price a 10- year bond with $1000

Obtain the latest yield curve rates from US Department of Treasury website. Use these yield curve rates, price a 10- year bond with $1000 face value, 4% coupon rate with semi-annual coupon payments. Therefore, this bond will have 20 periods to maturity. When yield curve rates are not available in between two periods, use simply linear extrapolation. For example, year 8's interest rate can be the average of Year 6's and Year 10's interest rates. After you price the bond, calculate the implied YTM of this bond. Date 10/28/22 1 Mo 3.75 3 Mo 4.18 6 Mo 4.51 1 Yr 4.55 2 Yr 4.41 3 Yr 4.38 5 Yr 4.19 7 Yr 4.1 30 Yr 4.38 4.15 10 Yr 4.02 20 Yr

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To price the 10year bond and calculate the implied yield to maturity YTM we will use the provided yi...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started